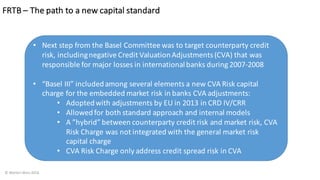

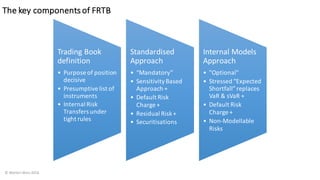

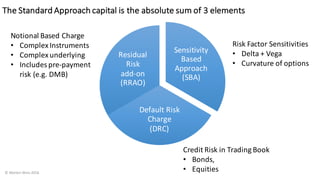

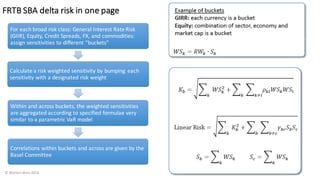

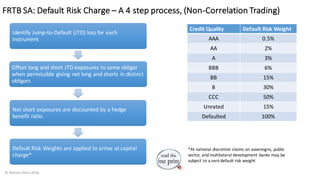

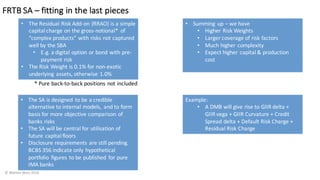

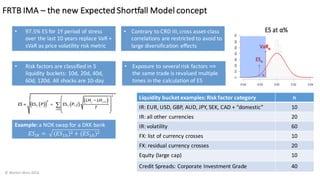

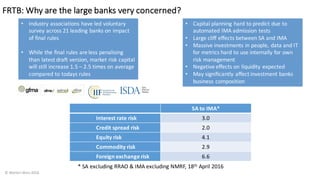

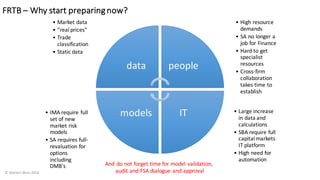

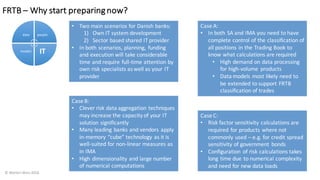

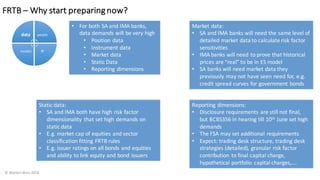

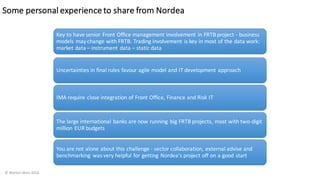

The document discusses the Fundamental Review of the Trading Book (FRTB), a regulatory framework introduced by the Basel Committee to address deficiencies in market risk capital requirements following the 2007-2008 financial crisis. It emphasizes the need for banks to start preparing for the FRTB due to its complexity and the significant increases in capital requirements expected under the new rules. Key components include the differentiation between the trading and banking book, new capital charge calculations, and the necessity for robust data and IT systems to support compliance.