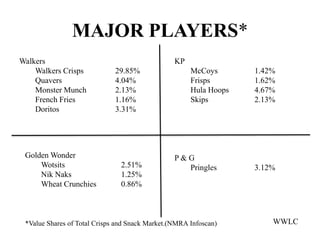

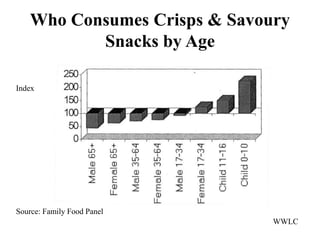

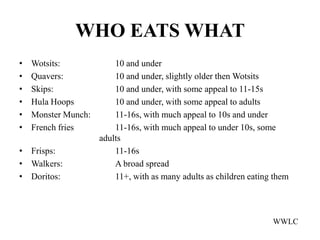

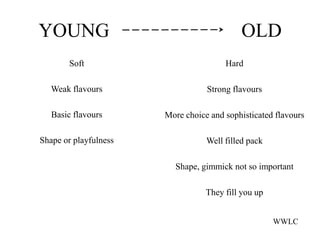

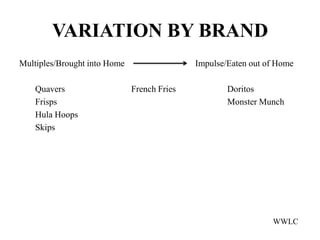

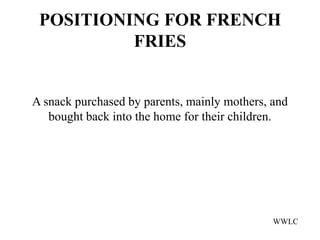

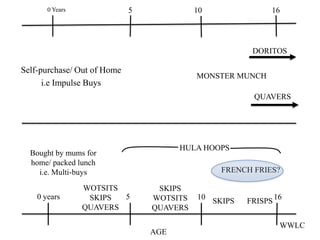

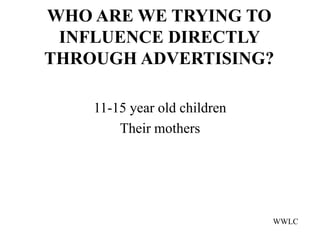

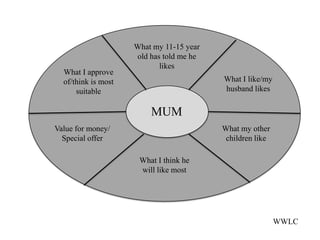

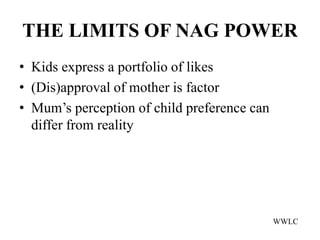

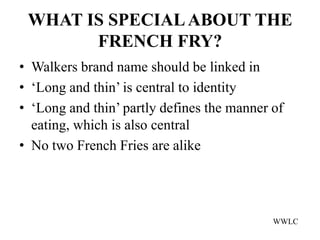

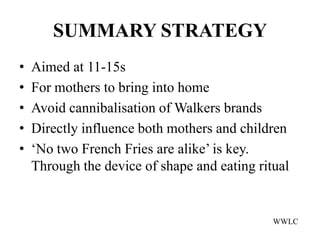

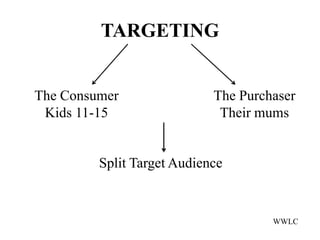

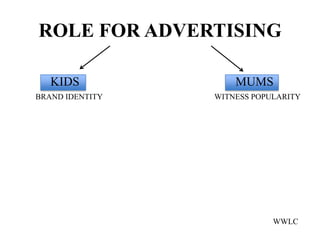

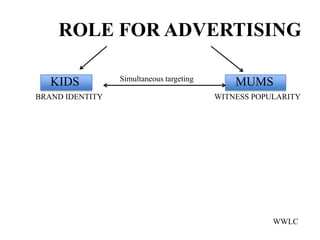

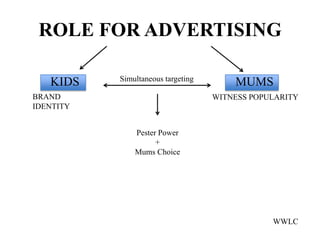

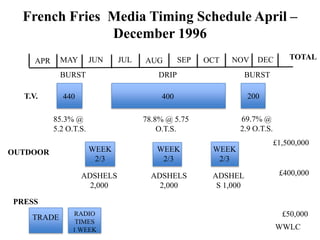

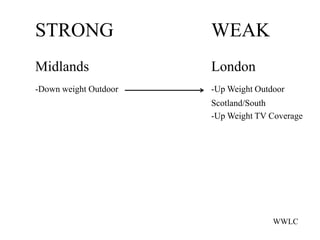

This document discusses marketing strategies for Walkers French Fries snack product. It analyzes the snack market, target demographics of 11-15 year olds and their mothers, and competitive brands. The strategy is to position French Fries as an at-home snack for kids, targeting both kids to build brand identity and mothers to influence purchase. A TV, outdoor, and print advertising campaign from April to December 1996 will launch nationally with heavier placement in midlands regions.