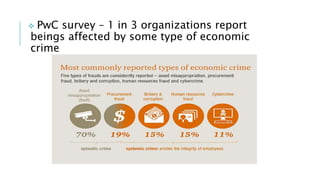

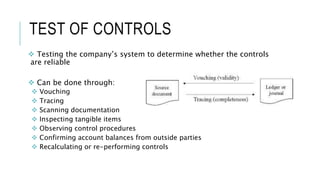

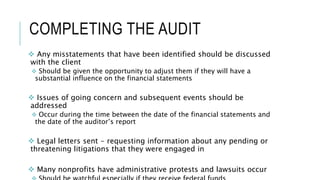

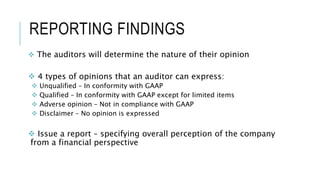

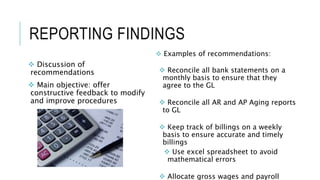

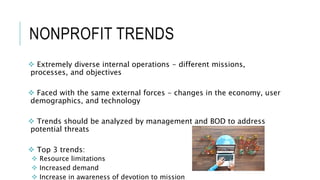

This document discusses external auditing of non-profit organizations. It provides an overview of the value of audits, accounting standards, audit procedures, and trends in non-profit financial reporting. Audits are important for non-profits to assure grantors and donors that the organization is financially sound and using funds appropriately. The audit process involves assessing risk, testing internal controls, collecting evidence during fieldwork, and issuing an opinion on whether the financial statements fairly represent the non-profit's financial position.