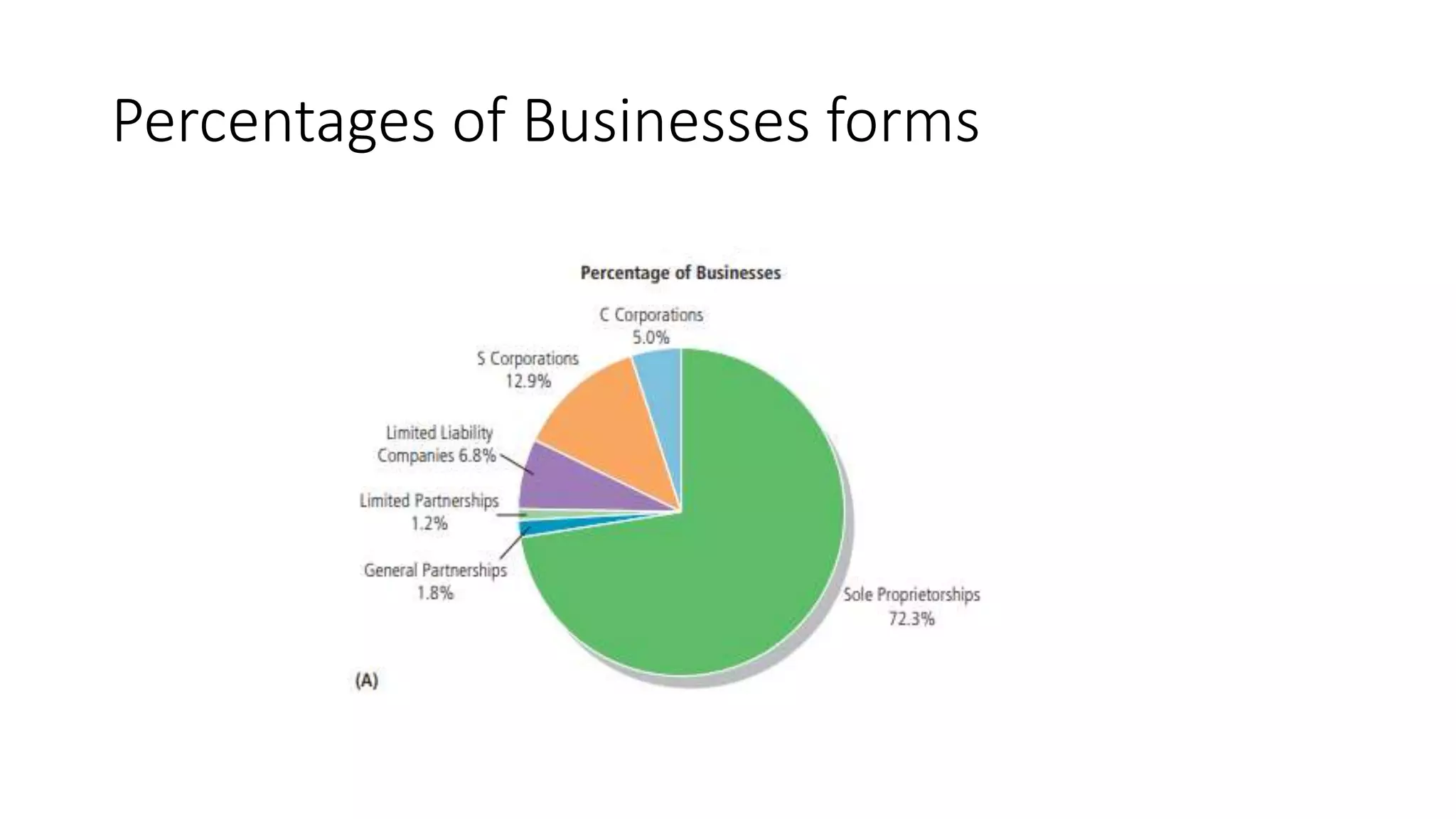

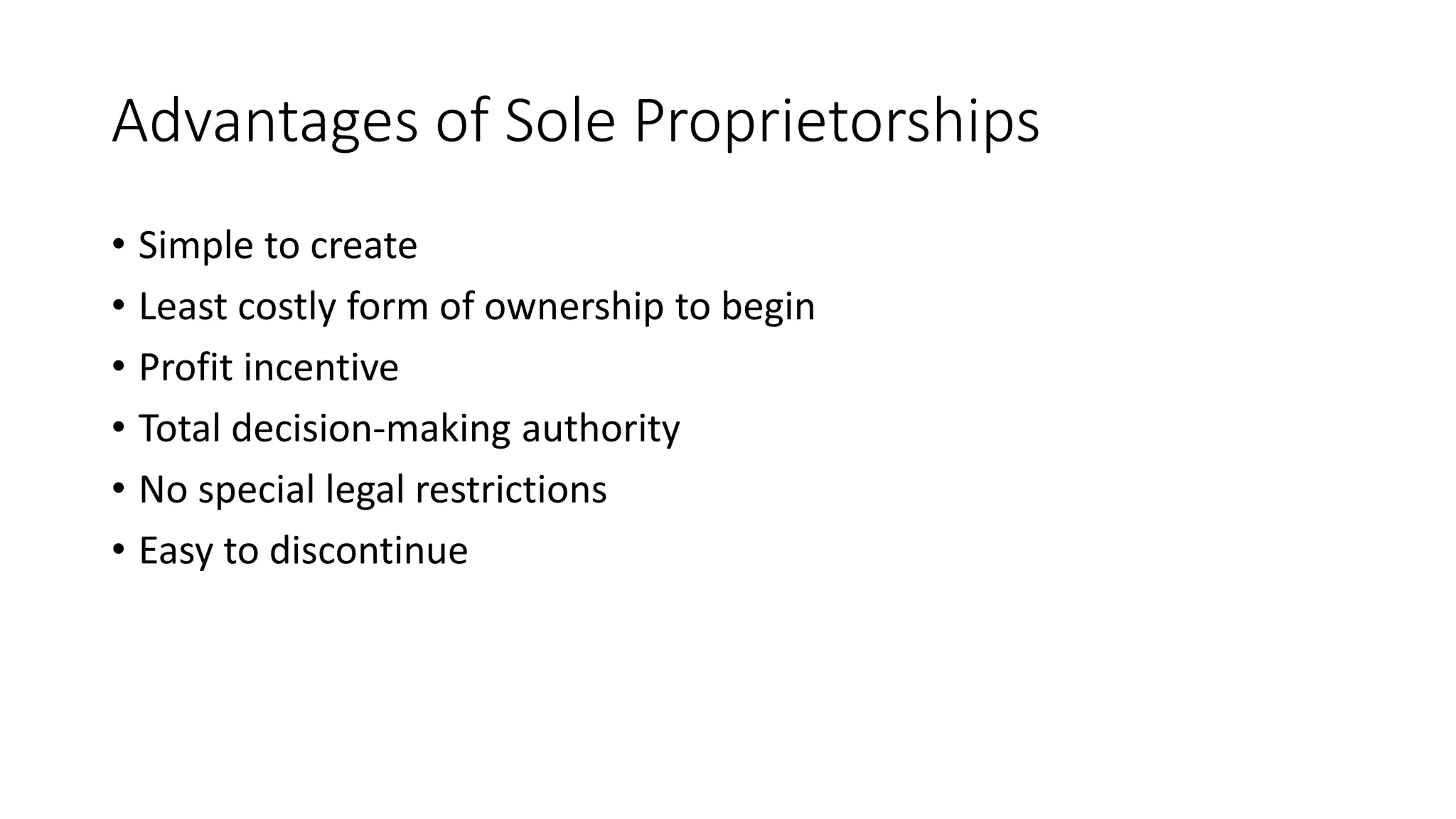

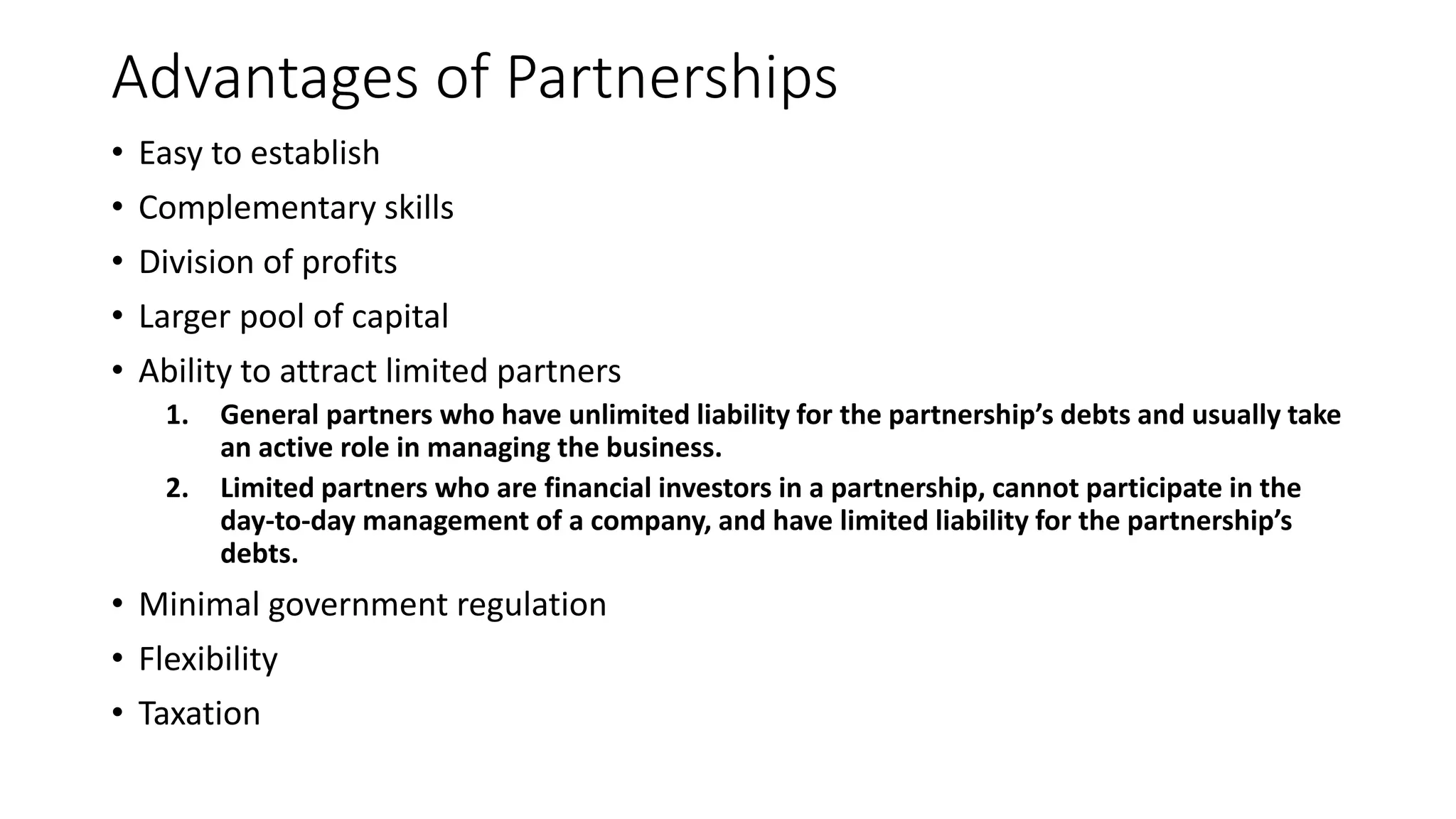

This document discusses different forms of business ownership including sole proprietorships, partnerships, and corporations. Sole proprietorships are the simplest form but provide unlimited liability. Partnerships allow for more capital and skills but at least one partner has unlimited liability. Corporations provide limited liability for shareholders but are more complex to establish. The best form depends on factors like tax implications, capital needs, control, and business goals.