Embed presentation

Download to read offline

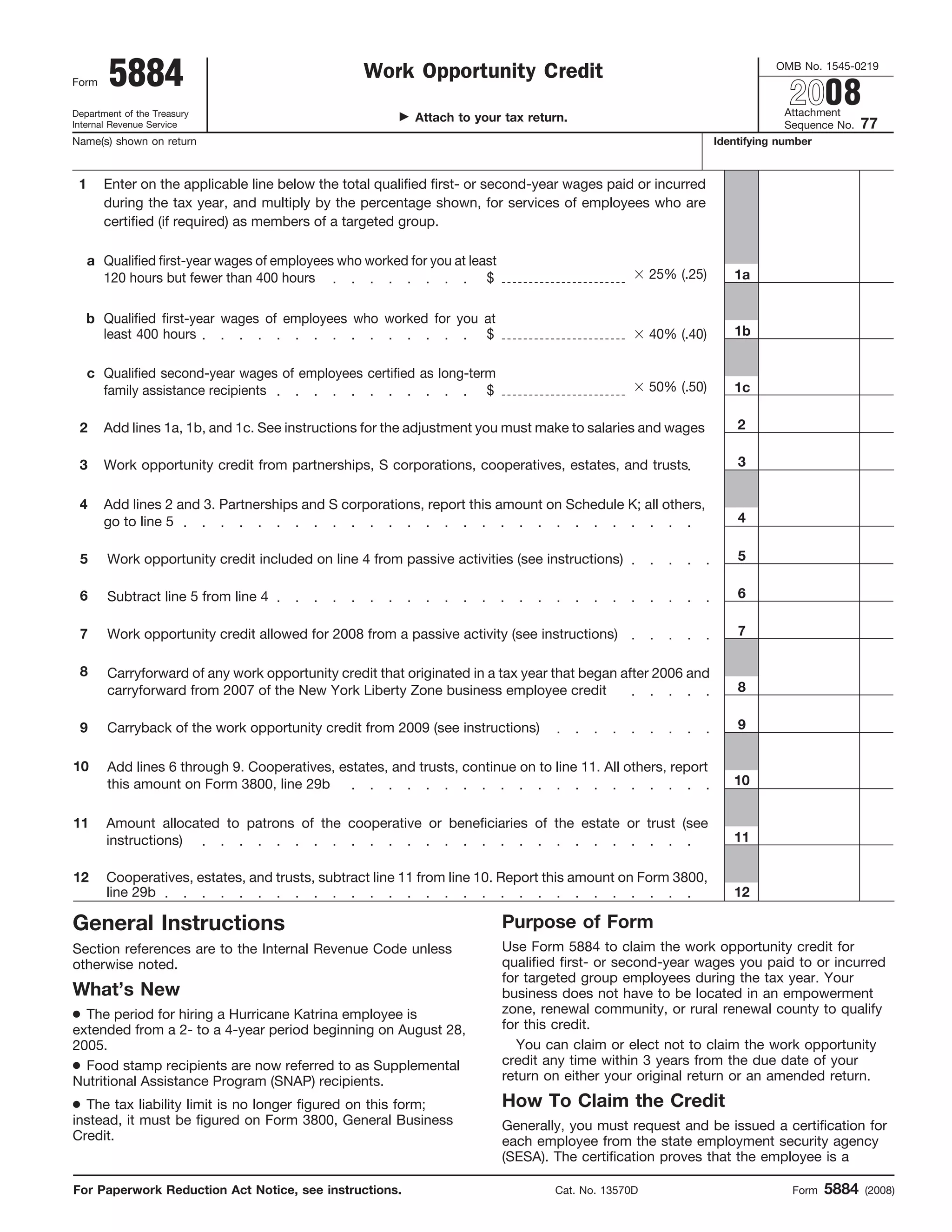

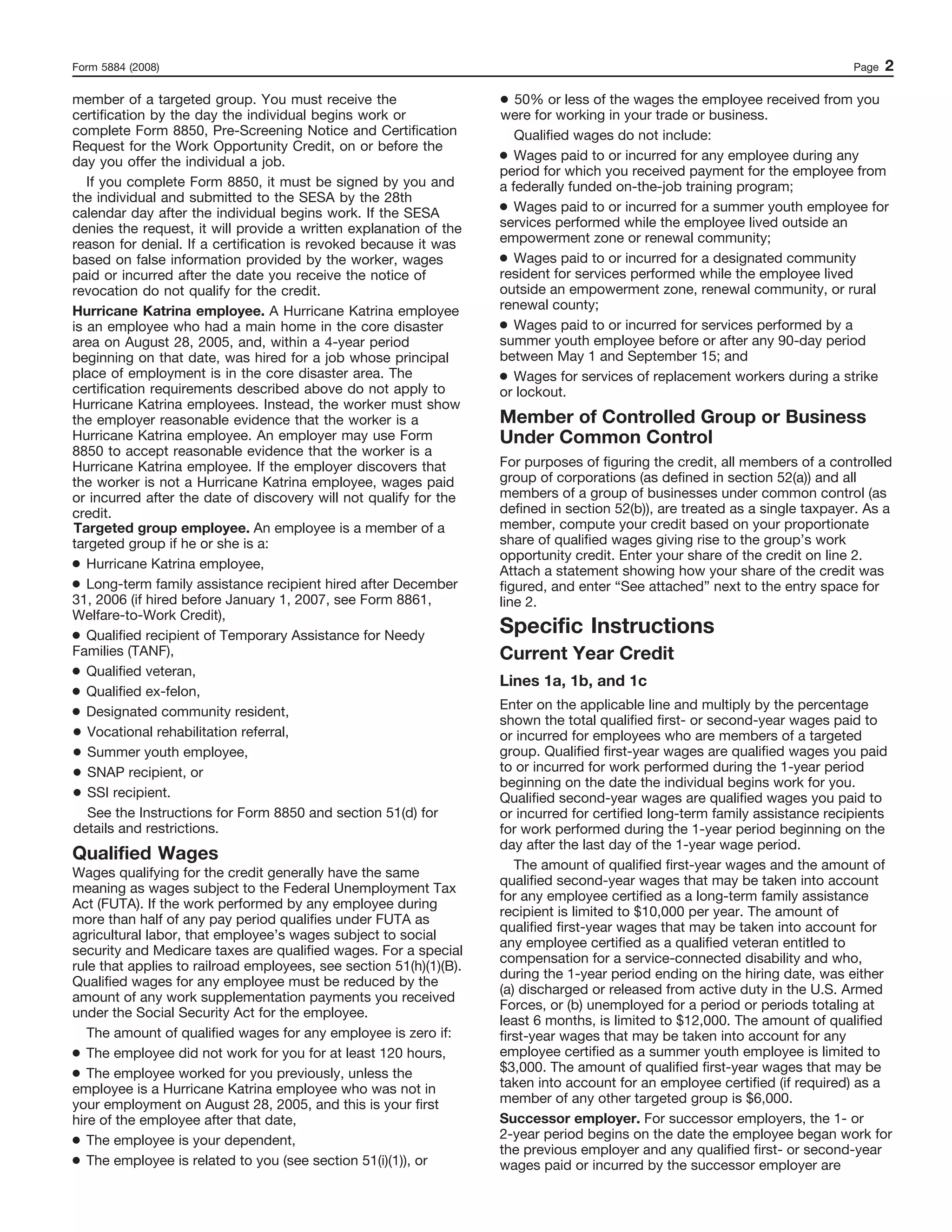

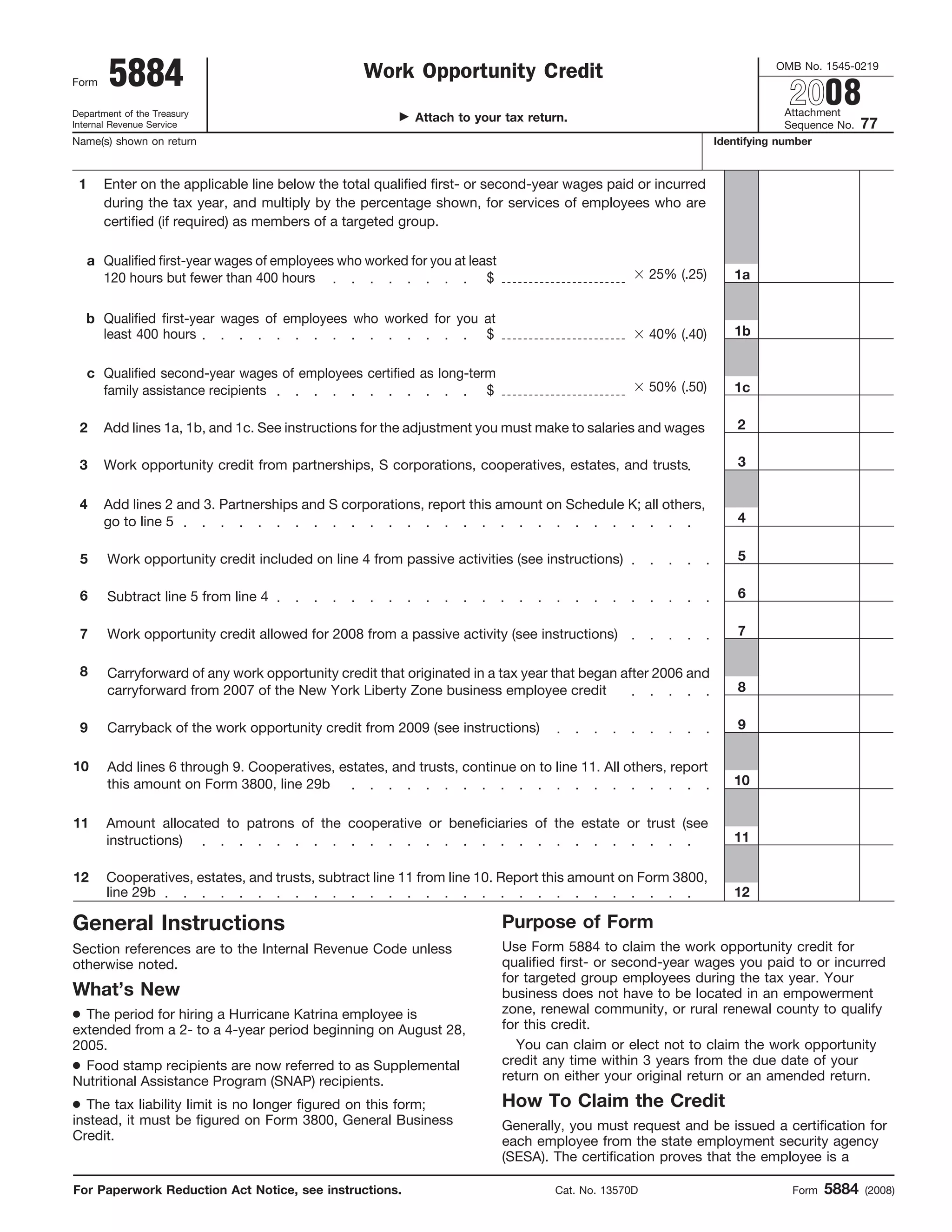

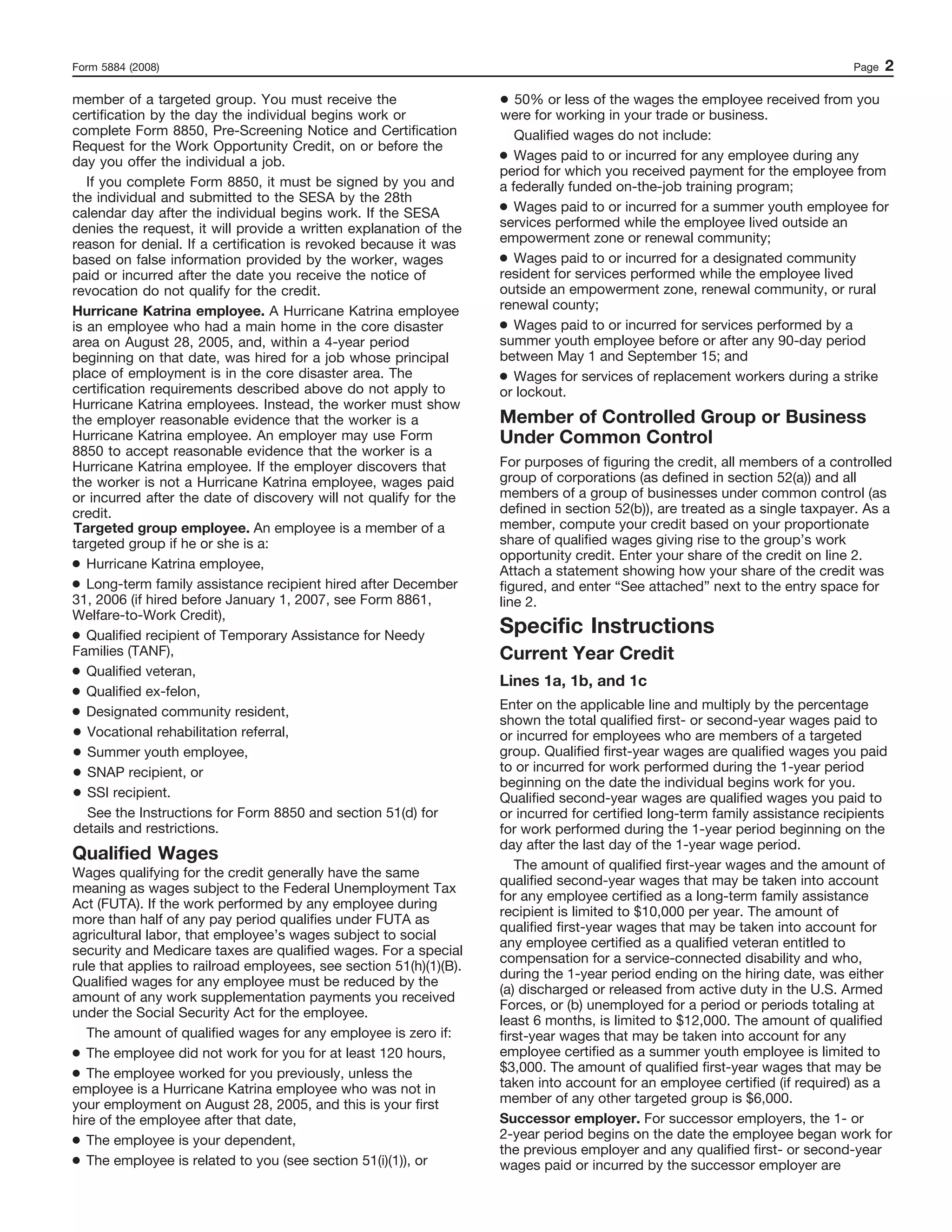

This 3-sentence summary provides the high-level information about the document: This IRS form is used to claim the Work Opportunity Tax Credit for qualified wages paid to targeted group employees. The form guides the taxpayer through calculating the credit amount based on first-year and second-year wages for different types of targeted employees. It also provides instructions on how to carry forward or back unused portions of the credit to other tax years.