Embed presentation

Download to read offline

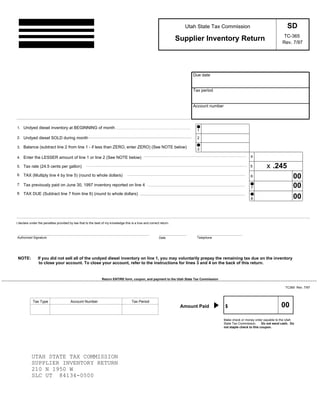

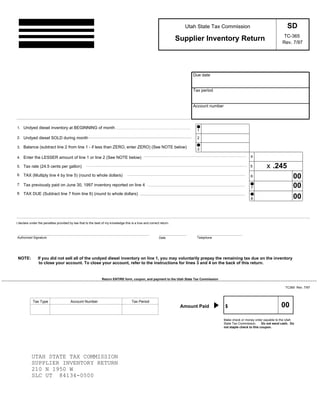

This document is a supplier inventory return form from the Utah State Tax Commission. It requires suppliers of undyed diesel to report their beginning and ending inventory, gallons sold, and calculate tax due at 24.5 cents per gallon. Line items include beginning inventory, gallons sold, taxable gallons (lesser of beginning inventory or gallons sold), tax rate, tax due, previously paid tax, and tax amount owed. Examples are given to show calculations if previously paid tax or prepaying remaining tax to close the account.