This document discusses various types of exchange rate exposure that firms face:

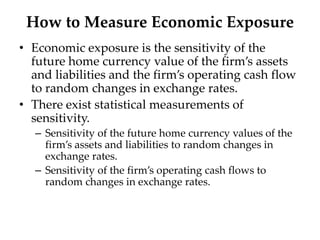

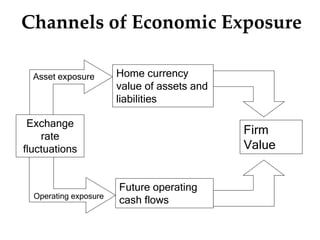

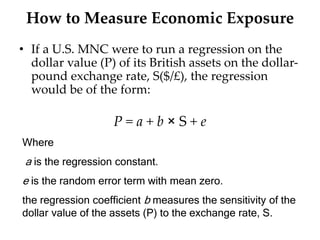

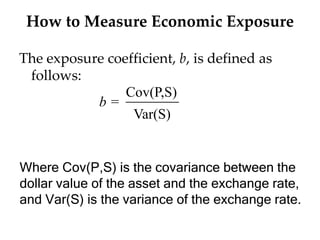

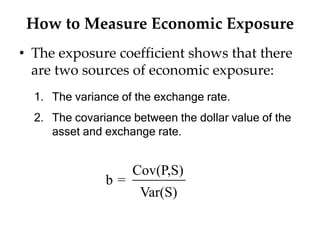

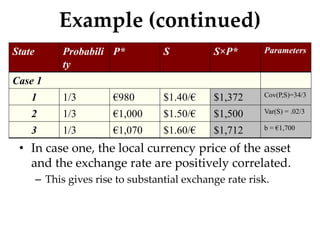

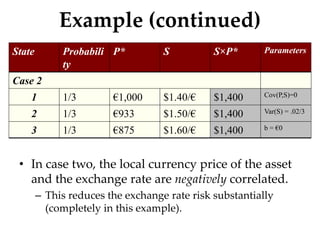

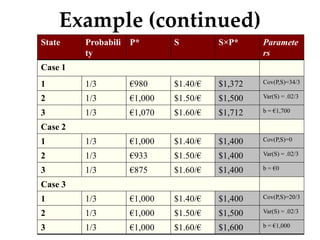

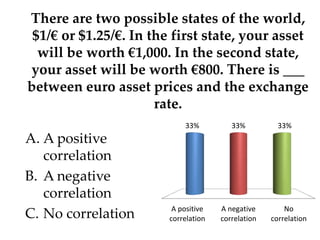

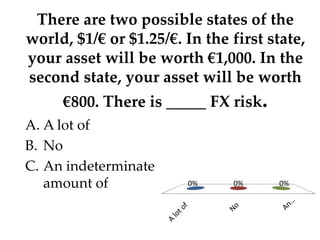

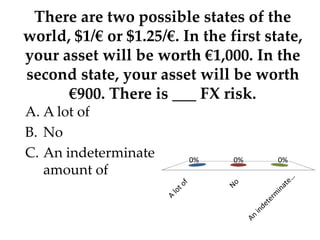

1. Economic exposure is how changes in exchange rates can affect the competitive position and value of domestic firms through international competition, even if they do not directly import or export.

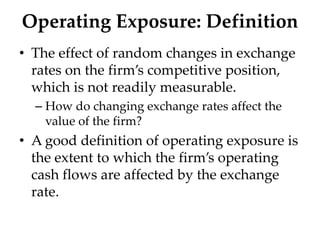

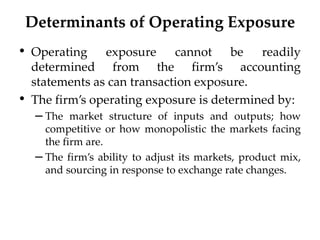

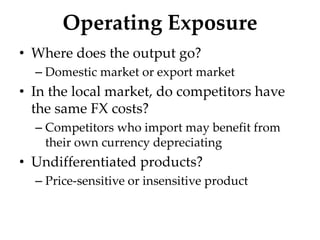

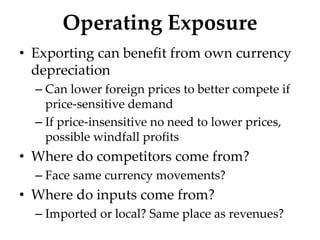

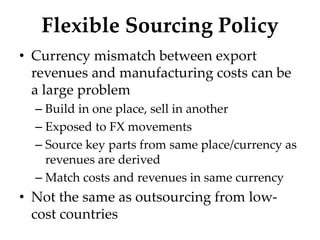

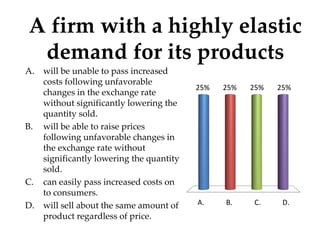

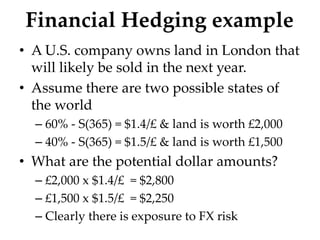

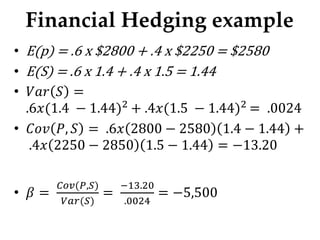

2. Operating exposure is how exchange rate changes affect a firm's operating cash flows through factors like input costs, ability to adjust prices, and market competitiveness. It is harder to measure than transaction exposure.

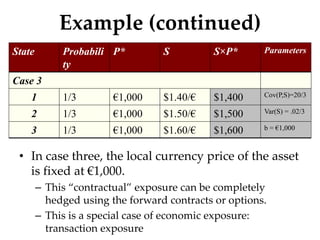

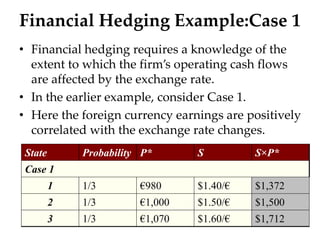

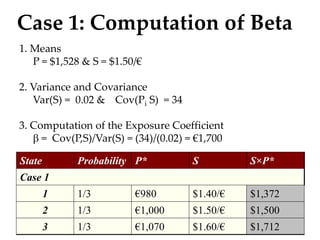

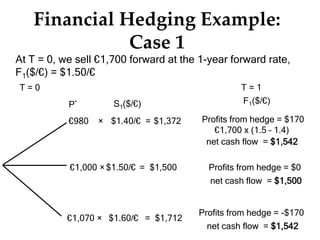

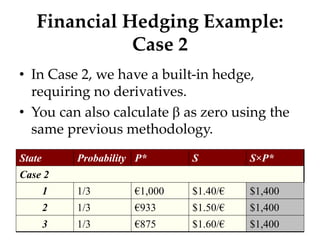

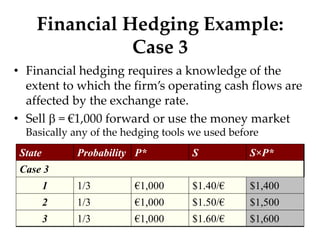

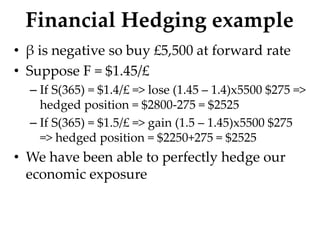

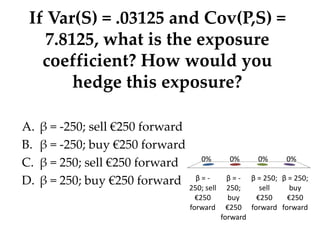

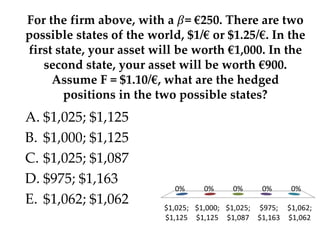

3. Financial tools like hedging contracts can help manage operating and economic exposure by offsetting the effects of exchange rate movements on a firm's foreign currency cash flows and the value of its foreign assets and liabilities. The effectiveness of hedging depends on