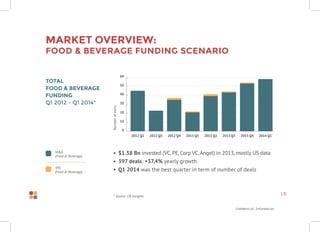

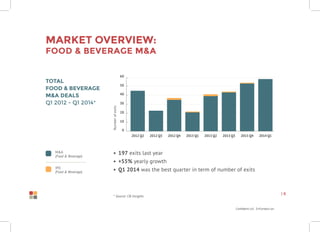

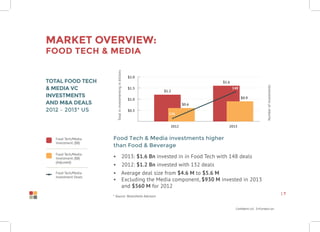

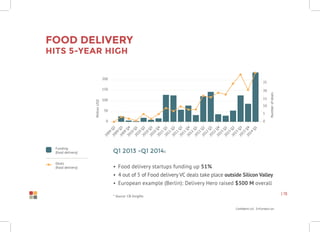

The document discusses recent trends in food technology (foodtech) startups and investments from 2012 to mid-2014. There has been a large increase in funding and M&A activity for foodtech companies, which are innovating in areas like food delivery, ecommerce marketplaces, and restaurant services. Big companies are also entering this space through acquisitions and releasing new APIs to engage with startups. The future of foodtech is predicted to involve more open innovation between startups and large firms, as well as new technologies like food 3D printing and drone delivery.