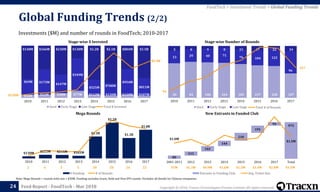

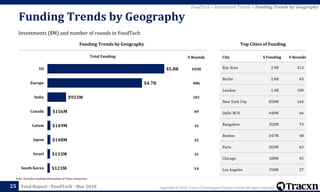

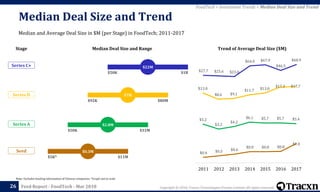

The document provides an overview of the global foodtech sector, including investment trends, key markets, notable companies, and recent news. It summarizes that the sector has seen $12.5 billion in total funding, with online food delivery and recipe box companies receiving significant investment. The top markets are identified as online food delivery platforms, recipe boxes, restaurant point-of-sale solutions, and on-demand food delivery. Notable global companies discussed include Delivery Hero, HelloFresh, Blue Apron, DoorDash, and Zomato.

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

FJ Labs

154

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > FJ Labs

People

Investments

[Minicorn] Zume Pizza (2015, Mountain View, $99.4M, Series C)

Pizza chain that use robotics for preparation

[Editor's Pick] Zesty (2013, San Francisco, $20.9M, Series A)

Curation and delivery of dietician-prescribed healthy meals in SF

[Editor's Pick] Flaviar (2012, New York City, $8.8M, Series A)

Spirit Tasting Service, curated monthly sample delivery

FoodTech Notable Portfolio

[Unicorn] Uber (2009, San Francisco, $22.5B, Series G)

Mobile app that connects passengers with vehicle drivers for hire

[Unicorn] Palantir (2004, Palo Alto, $2.8B, Series J)

Intelligence products to Augment Human Driven Analysis

[Unicorn] Farfetch (2008, London, $709M, Series G)

Curated fashion boutique marketplace

[Unicorn] Dropbox (2007, San Francisco, $607M, Series C)

Cloud-based file sharing and synchronization software

[Unicorn] Zenefits (2013, San Francisco, $584M, Series C)

SaaS HR Platform for SMBs

[Unicorn] Wish Shopping (2011, San Francisco, $579M, Series F)

Mobile Social Shopping App

[Unicorn] Stripe (2010, San Francisco, $511M, Series D)

Web & Mobile Payments for Developers

[Unicorn] FanDuel (2009, New York City, $416M, Series E)

Fantasy sports gaming company

[Unicorn] Klarna (2005, Stockholm, $336M, Series D)

Provides purchase financing and late payment options.

[Unicorn] BlaBlaCar (2006, Paris, $336M, Series D)

Long Distance Ride Sharing

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Jose Marin

Co-Founder

Fabrice Grinda

Co-Founder

Geographical Spread Stage of Entry

Mar 2018

Delivery Hero Selects NewVoiceMedia As Contact Center

Partner to Transform Global Customer Experience,

Business Wire

Feb 2018

Rocket Internet shifts $242m of Delivery Hero shares,

Global Corporate Venturing

Feb 2018

Delivery Hero beats expectations with €544 million in

revenue for 2017, Tech.eu

Jan 2018

Takeaway.com says merger with Delivery Hero an option,

Reuters

Jan 2018

Delivery Hero gets 1% stake in Ola for selling Foodpanda

India, Indiatimes

Dec 2017

Delivery Hero sees proceeds of $429 million from capital

increase, Reuters

Dec 2017

Delivery Hero to place $810 million worth of shares,

Reuters

Nov 2017

Germany's Delivery Hero third-quarter revenue jumps 60

percent, Reuters

Nov 2017

Food Delivery App Otlob to be acquired by German

Delivery Hero, Egypt Today

Delivery Hero

(2011, Berlin, $1.8B)

IPO - Jun 2017

11

3

1

2

1

2012 2013 2014 2015 2016 2017

Follow On New Investments

6

-

1

-

8

Undisclosed

Series C+

Series B

Series A

Seed9

5

1

-

-

US

Europe

Canada](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-154-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

New Crop Capital

155

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > New Crop Capital

Investments

[Editor's Pick] Memphis Meats (2015, San Francisco, $22M,

Series A)

Develops lab cultured meat

[Editor's Pick] SuperMeat (2015, Tel Aviv, $3M, Seed)

Biotech company developing technology to produce lab cultured meat

[Editor's Pick] Sunfed Limited (2015, Auckland, $1.2M, Seed)

Yellow pea based meat alternative

[Editor's Pick] New Wave Foods (2015, San Francisco, $250k,

Seed)

Producer of cultured shrimps in lab from red algae

[Editor's Pick] Purple Carrot (2014, Boston, Seed)

Online platform to purchase plant-based meal kits

FoodTech Notable Portfolio

Top Exits Recent News on Fund & Portfolio

Geographical Spread Stage of Entry

Mar 2018

Bill Gates and Richard Branson are betting lab-grown

meat might be the food of the future, CNBC

Feb 2018

Singapore’s Sirius Venture backs $3m round in Israeli

food-tech startup SuperMeat, Deal Street Asia

Jan 2018

Tyson Foods Invests in Cultured Meat with Stake in

Memphis Meats, GlobeNewswire

Sep 2017

Torch passed to new president and CEO at SunFed, The

Produce News

Aug 2017

Branson and Gates back lab-grown “clean meat”

innovators, Food Ingredients First

Feb 2017

Miyoko’s Kitchen Receives Growth Equity Investment

from JMK Consumer Growth Partners, Business Wire

Nov 2016

Lab-made meat startup Memphis Meats hopes to grow a

Thanksgiving turkey, TechCrunch

Jul 2016

Truly Sustainable Seafood: New Wave Foods Secures Seed

Investments from Efficient Capacity and New Crop

Capital, My Social Good News

None

1

3

2

2012 2013 2014 2015 2016 2017

Follow On New Investments

2

-

-

-

6

Undisclosed

Series C+

Series B

Series A

Seed5

1

1

1

-

US

Israel

New Zealand](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-155-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

High-Tech Grunderfonds

156

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > High-Tech Grunderfonds

Investments

[Soonicorn] Heliatek (2006, Dresden, $117M, Series D)

Manufactures organic solar films.

[Soonicorn] Windeln (2010, Munich, $72.7M, Public)

Online Baby Shop in Germany

[Soonicorn] Mister Spex (2007, Berlin, $69.6M, Series E)

Online eye-wear retailer

[Soonicorn] Outfittery (2012, Berlin, $59.8M, Series D)

Curated shopping service for men’s clothing

[Soonicorn] JUNIQE (2014, Berlin, $22.2M, Series B)

Online marketplace for independent designers

[Minicorn] Immunic Therapeutics (2016, Martinsried,

$35.9M, Series A)

German, clinical-stage immunotherapy biotech developing small

molecule immunomodulators for auto-immune diseases

[Minicorn] Fazua (2011, Munich, $11.2M, Series B)

Developer of e-bike drive system

[Minicorn] NFON (2009, Munich, $5.3M, Series B)

Cloud telephony services provider

[Minicorn] Inventorum (2012, Berlin, $5.1M, Series A)

Business Management suite

[Minicorn] contentbird (2012, Berlin, $2.5M, Seed)

Content marketing workflow platform

[Minicorn] Thermosome (2014, Munich, $2.2M, Series A)

Developing thermosensitive drug-loaded nanocarriers to treat cancer.

[Minicorn] Bitwala (2013, Utrecht, $890k, Seed)

Bill payment via bitcoins

[Minicorn] Loopline Systems (2014, Berlin, Series A)

SaaS based solution for managing performance reviews

Other Notable Portfolio

Top Exits Recent News on Fund & Portfolio

Geographical Spread Stage of Entry

NoneNone

4

1 1

2012 2013 2014 2015 2016 2017

Follow On New Investments

-

-

-

-

6

Undisclosed

Series C+

Series B

Series A

Seed6

-

-

-

-

Europe](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-156-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

500 Startups

202

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > 500 Startups

People

Investments

[Soonicorn] E la Carte (2008, Palo Alto, $52.5M, Series C)

SaaS-based restaurant management solution through tablets

[Minicorn] Winc (2011, Los Angeles, $30.6M, Series B)

Wine retailer

[Minicorn] Fooda (2011, Chicago, $24.6M, Series C)

Online curated food catering service for businesses

[Minicorn] Fooda (2011, Chicago, $24.6M, Series C)

Online curated food catering service for businesses

[Minicorn] Chewse (2011, San Francisco, $15M, Series B)

Online marketplace for corporate catering and events

[Minicorn] Saucey (2013, Los Angeles, $10.2M, Series A)

Online marketplace of alcoholic beverages

[Minicorn] Qraved (2013, Jakarta, $9.3M, Series B)

Restaurant information and booking

[Minicorn] Bizimply (2011, Dublin, $2.3M, Series A)

Attendence managment solution

[Minicorn] PlateJoy (2013, San Francisco, $1.7M, Seed)

Do-it-yourself meal kits

[Minicorn] truBrain (2013, Los Angeles, $750k, Seed)

Brain Nutrition Shipped Monthly

[Minicorn] Tableapp (2013, Ampang, $78k, Series A)

Online reservation booking at restaurants

[Editor's Pick] Zesty (2013, San Francisco, $20.9M, Series A)

Curation and delivery of dietician-prescribed healthy meals in SF

[Editor's Pick] SimplyCook (2012, London, $3.7M, Series A)

Recipe- kit based grocery delivery

[Editor's Pick] Grain (2014, Singapore, $1.7M, Series A)

Delivers fresh healthy meals

FoodTech Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Dave McClure

Founder, Partner

Geographical Spread Stage of Entry

Sep 2017 Fooda Brings In $12.5 Million, NewsCenter

Jun 2017

Human cloud firm Sprig shuts down; raising money

become more difficult, Staffing Industry Analysts

May 2017

Sprig is Bay Area's latest meal deliverer to bite the dust,

The Business Journals

Mar 2017

E la Carte Launches New Payment Terminal That

Supports Apple Pay, PYMNTS

Jan 2017

Meal-Delivery Service Sprig Cooks Up A Bigger Menu And

New Delivery Plan, Fast Company

Jan 2017

Demand Food Delivery Service Sprig Has Raised

$45 Million / modaride.com, modaride.com

Sep 2016

The Past, Present, and Future of On-Demand [Podcast],

Greylock Partners

Aug 2016

ZeroCater raises $4.1 million to keep office workers well-

fed in the U.S., TechCrunch

Jul 2016

Sprig pauses food delivery service in Chicago, lays off

seven people, TechCrunch

May 2016

Square Acquires Fastbite To Add Cheap, Fast Meals To

Caviar, TechCrunch

None

2 1 2 3

1

3

7 6

8 14

4

2012 2013 2014 2015 2016 2017

Follow On New Investments

16

-

1

13

40

Undisclosed

Series C+

Series B

Series A

Seed44

7

6

4

2

US

Latam

SEA

Europe

China](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-202-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

SOSV

203

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > SOSV

People

Investments

[Minicorn] Perfect Day (2014, San Francisco, $26.7M, Series A)

Produces milk substitute through yeast fermentation

[Editor's Pick] Memphis Meats (2015, San Francisco, $22M,

Series A)

Develops lab cultured meat

[Editor's Pick] Clara Foods (2014, San Francisco, $1.8M, Seed)

Develops egg white substitute synthesized in lab

[Editor's Pick] New Wave Foods (2015, San Francisco, $250k,

Seed)

Producer of cultured shrimps in lab from red algae

FoodTech Notable Portfolio

[Soonicorn] Leap Motion (2010, San Francisco, $94.1M, Series C)

Making motion control software and hardware

[Soonicorn] Getaround (2009, San Francisco, $86.3M, Series C)

Peer-to-peer carsharing marketplace

[Soonicorn] Breather (2012, Montreal, $73M, Series C)

On-demand Private Room Reservation

[Soonicorn] Formlabs (2011, Somerville, $55.8M, Series B)

High-resolution desktop 3D printing

[Soonicorn] WithMe (2016, Las Vegas, $32.8M, Series B)

Designer, builder and lease provider of short-term omnichannel retail

stores

[Minicorn] Yoyowallet (2013, London, $31.5M, Series B)

QR code based mobile payment service provider & consumer behavior

analysis

[Minicorn] JUMP Bikes (2010, Brooklyn, $17M, Series A)

Bicycle rental platform

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Sean O’Sullivan

Founder & Managing

Partner

Geographical Spread Stage of Entry

Mar 2018

Bill Gates and Richard Branson are betting lab-grown

meat might be the food of the future, CNBC

Mar 2018

Perfect Day gets $24.7 million and a new patent, Biofuels

Digest

Mar 2018

Hamilton Beach, Bartesian Enter Into Exclusive Multi-

Year Agreement, Reuters

Feb 2018

Perfect Day On Its Way to Bringing Animal-Free Dairy to

Store Shelves, PR Newswire

Jan 2018

Tyson Foods Invests in Cultured Meat with Stake in

Memphis Meats, GlobeNewswire

Aug 2017

Branson and Gates back lab-grown “clean meat”

innovators, Food Ingredients First

Feb 2017

FreshSurety Wins ITEXPO's IDEA Showcase, Technology

Marketing Corporation

Nov 2016

Lab-made meat startup Memphis Meats hopes to grow a

Thanksgiving turkey, TechCrunch

Jul 2016

Truly Sustainable Seafood: New Wave Foods Secures Seed

Investments from Efficient Capacity and New Crop

Capital, My Social Good News

None

1 11

1

2

2012 2013 2014 2015 2016 2017

Follow On New Investments

28

-

-

-

5

Undisclosed

Series C+

Series B

Series A

Seed22

5

3

3

-

US

China

Europe

Canada](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-203-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - FoodTech - Mar 2018

Y Combinator

204

Portfolio in FoodTech | Exits | Funds Link | Website | LinkedIn | Twitter

FoodTech > Investors > Y Combinator

People

Investments

[Unicorn] DoorDash (2013, Palo Alto, $722M, Series D)

On-demand food delivery marketplace

[Soonicorn] Soylent (2013, Los Angeles, $74.5M, Series B)

Meal replacement product that provides all the essential nutrients in a

serving

[Soonicorn] E la Carte (2008, Palo Alto, $52.5M, Series C)

SaaS-based restaurant management solution through tablets

[Soonicorn] ZeroCater (2009, San Francisco, $5.6M, Series A)

Food Catering for Office

[Minicorn] Gobble (2010, Palo Alto, $27.1M, Series B)

Subscription based recipe kit delivery service

[Minicorn] PlateJoy (2013, San Francisco, $1.7M, Seed)

Do-it-yourself meal kits

[Editor's Pick] Zesty (2013, San Francisco, $20.9M, Series A)

Curation and delivery of dietician-prescribed healthy meals in SF

[Editor's Pick] Tovala (2015, Chicago, $14.6M, Series A)

Smart Appliance manufacturer and food subscription service

[Editor's Pick] Flaviar (2012, New York City, $8.8M, Series A)

Spirit Tasting Service, curated monthly sample delivery

[Editor's Pick] Dah Makan (2014, Kuala Lumpur, $4.2M, Series A)

Healthy lunchboxes delivered

[Editor's Pick] Nutrigene (2016, Mountain View, $120k, Seed)

Manufactures consumer device to dispense vitamin drink from pods

[Editor's Pick] Trackin (2014, San Jose, $120k, Seed)

Ordering managment and delivery tracking software

FoodTech Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Michael Seibel

CEO

Geographical Spread Stage of Entry

Mar 2018

Restaurant Revolution Technologies partners with

DoorDash, MeatPoultry.com

Mar 2018 El Pollo Loco Partners With DoorDash, Reuters

Mar 2018

Doordash Secures $535 Million In Funding From

Softbank, Sequoia, And GIC To Expand Its On-Demand

Platform, Reuters

Feb 2018

In-N-Out Files Lawsuit Against Food Delivery Startup

DoorDash, TechCrunch

Jan 2018

Doordash Repurposes Its Tech To Fight Hunger, Industry

Buzz

Jan 2018

DoorDash Launches In The Kansas City Area, Offers Door-

To-Door Delivery From More Than 1,500 Restaurants, PR

Newswire

Dec 2017

SoftBank is negotiating an investment in DoorDash that

could reach $300 million, Recode

Nov 2017

DoorDash has hired ex Twitter and Groupon execs to

spearhead big expansion plans, Business Insider

Nov 2017 Portillo’s announces first delivery service, BizTimes

Oct 2017

DoorDash opens Silicon Valley home for 'virtual'

restaurants, Reuters

None

1 2 1 21

6

8

4 3 1

2012 2013 2014 2015 2016 2017

Follow On New Investments

2

-

-

1

31

Undisclosed

Series C+

Series B

Series A

Seed31

1

1

1

-

US

Israel

SEA

Canada](https://image.slidesharecdn.com/finalfoodtechlonglist1522328597539-180403094813/85/Tracxn-Food-Tech-Startup-Landscape-204-320.jpg)