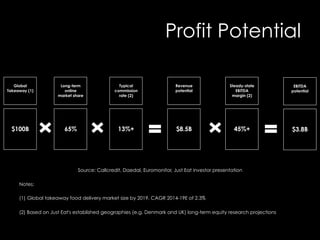

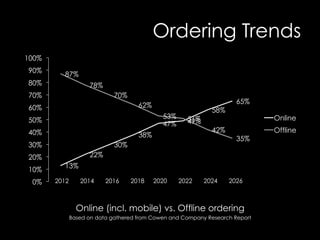

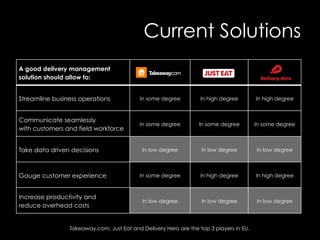

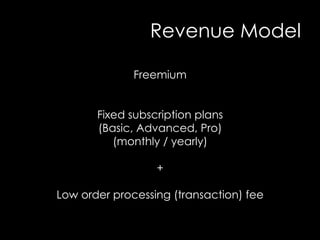

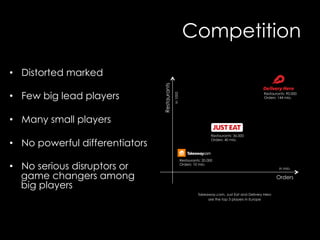

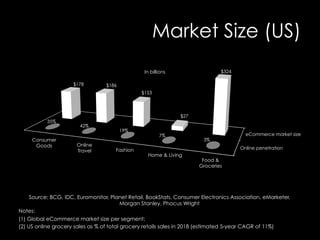

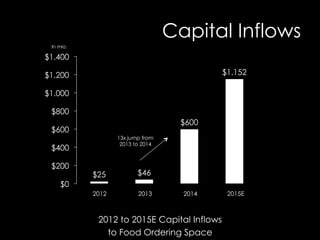

The document presents a pitch deck for an e-food solution company called e-takeaway. It summarizes that the online food delivery market is growing rapidly but still has low penetration rates, presenting a major business opportunity. E-takeaway aims to be the "Shopify" platform for the food industry by providing a cloud-based SaaS product that allows restaurants and grocery stores to better manage online ordering and delivery. Their solution analyzes data to help businesses make decisions, provides customer feedback tools, and streamlines operations with features like online ordering and menu management. They plan to generate revenue through freemium subscription plans and low transaction fees. The pitch deck argues this is an attractive market with room for growth and disruption,