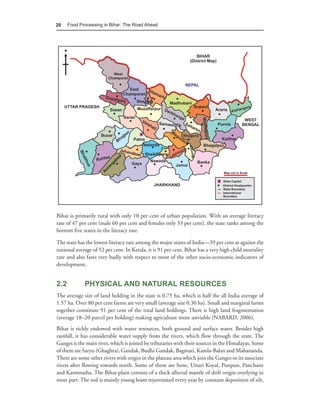

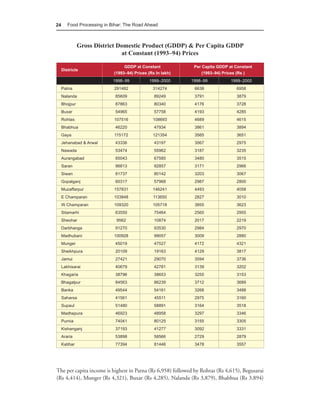

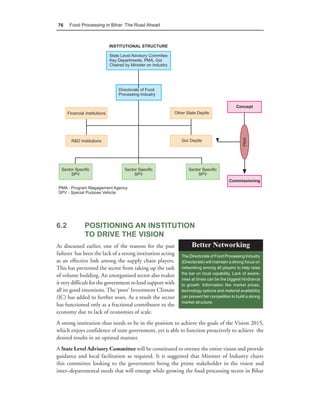

This document discusses the opportunities for food processing in the state of Bihar, India. It notes that while India's overall economy is growing, the agriculture sector has been lagging and its share of GDP is declining. Bihar in particular has good conditions for agriculture but its potential remains untapped. The document advocates developing the food processing industry in Bihar as a way to add value to agricultural output, boost economic growth, and improve food security. It analyzes the current status and potential of various food processing sub-sectors and outlines a vision and action plan to develop food processing clusters and infrastructure over the short and long term.