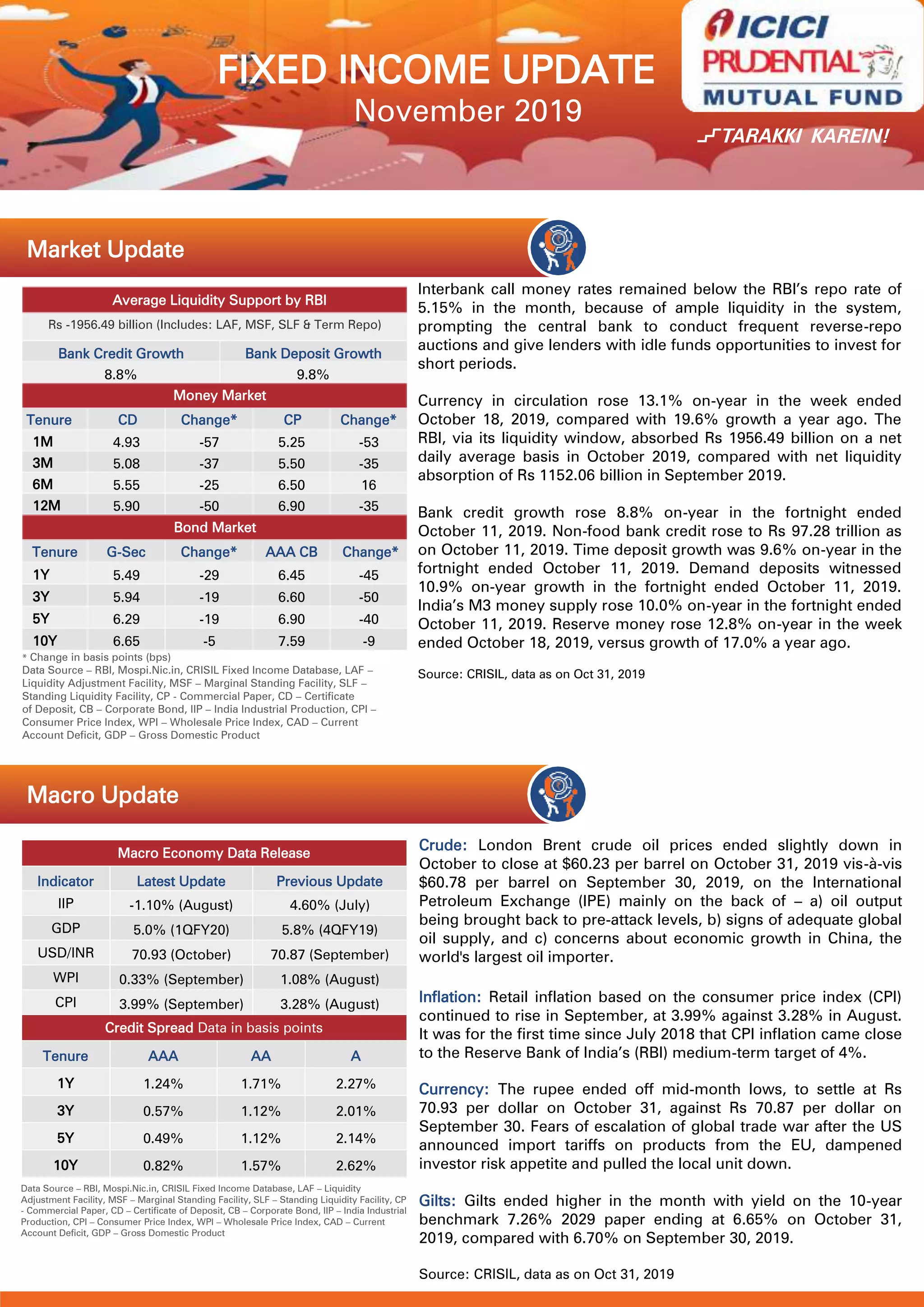

In November 2019, interbank call money rates remained below the RBI’s repo rate due to ample liquidity, while bank credit growth slowed to 8.8% year-on-year. Retail inflation based on CPI rose to 3.99% in September, approaching the RBI’s target, and the rupee settled at Rs 70.93 per dollar. Recommendations for investors include a focus on short to medium duration accrued-based debt schemes to capitalize on favorable risk-adjusted returns.