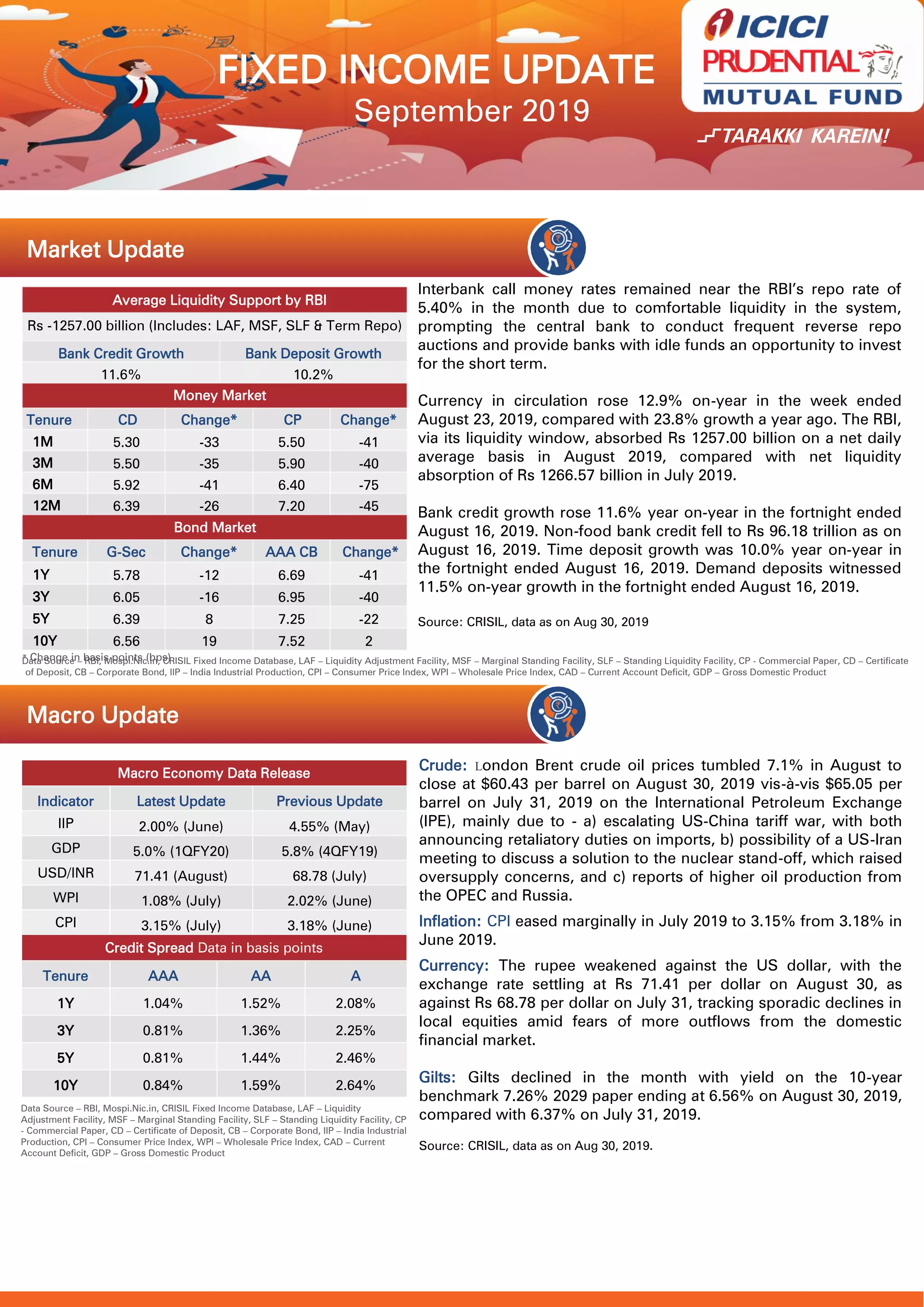

The document provides a market and macroeconomic update for September 2019. Interbank lending rates remained near the RBI's repo rate of 5.40% due to ample liquidity in the system. Currency in circulation and bank credit growth increased year-over-year in August, while deposit growth was moderate. Government bond yields declined over the month but increased toward the end due to slowing growth concerns.