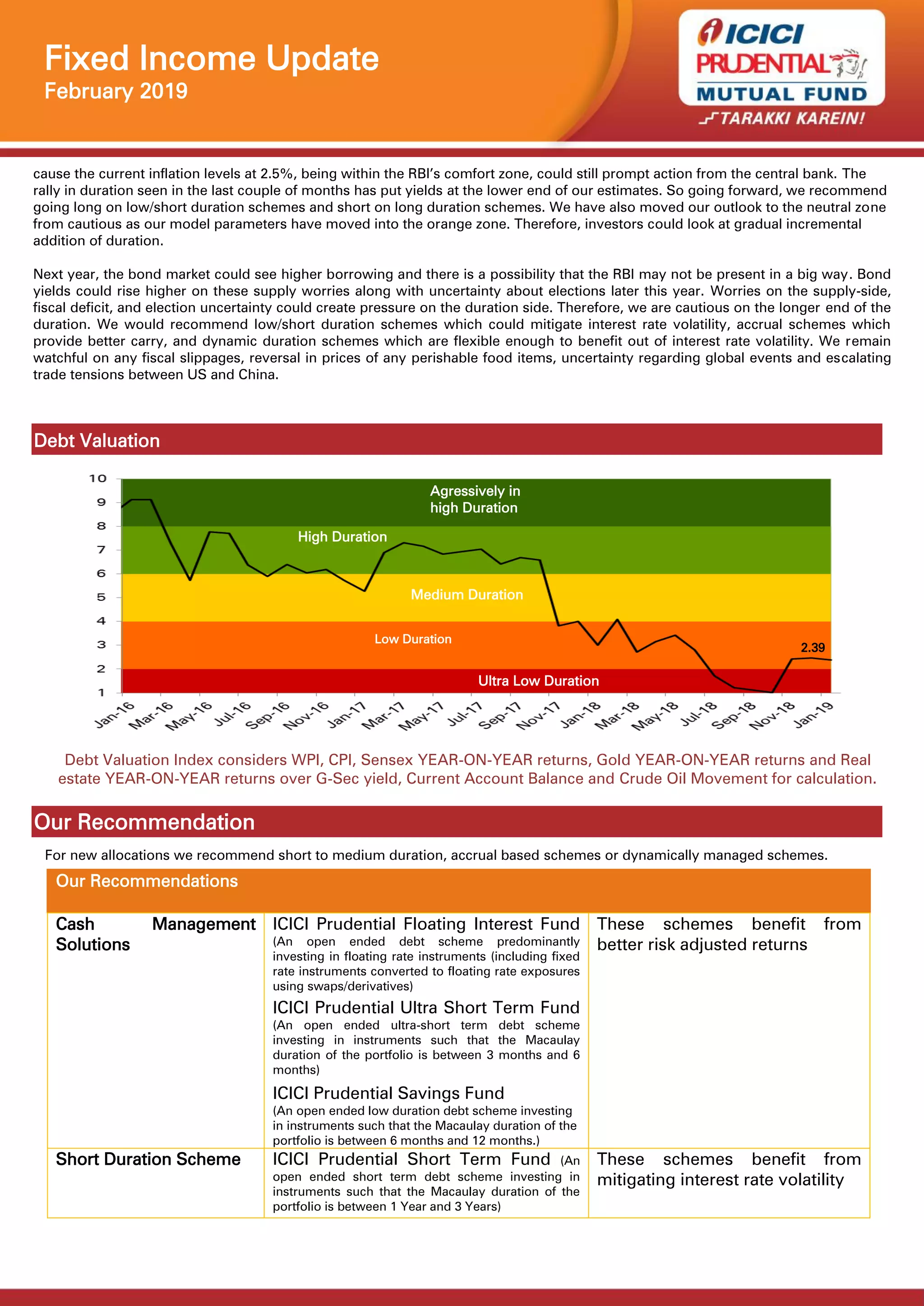

The Fixed Income Update for February 2019 highlights a 14.5% bank credit growth and a decline in consumer price index-based inflation to 2.19%, alongside a significant liquidity injection by the RBI. Market sentiments were influenced by fluctuating oil prices and upcoming elections, with recommendations leaning towards short to medium duration debt schemes to mitigate interest rate volatility. The document expresses caution regarding longer duration investments due to potential fiscal slippages and uncertainty in the bond market.