- The RBI kept key policy rates unchanged, including keeping the repo rate at 4%.

- Inflation increased in June 2020 to 6.09% due to rising food and fuel prices.

- Economic activity has remained fragile both domestically and globally, though equity markets have rebounded.

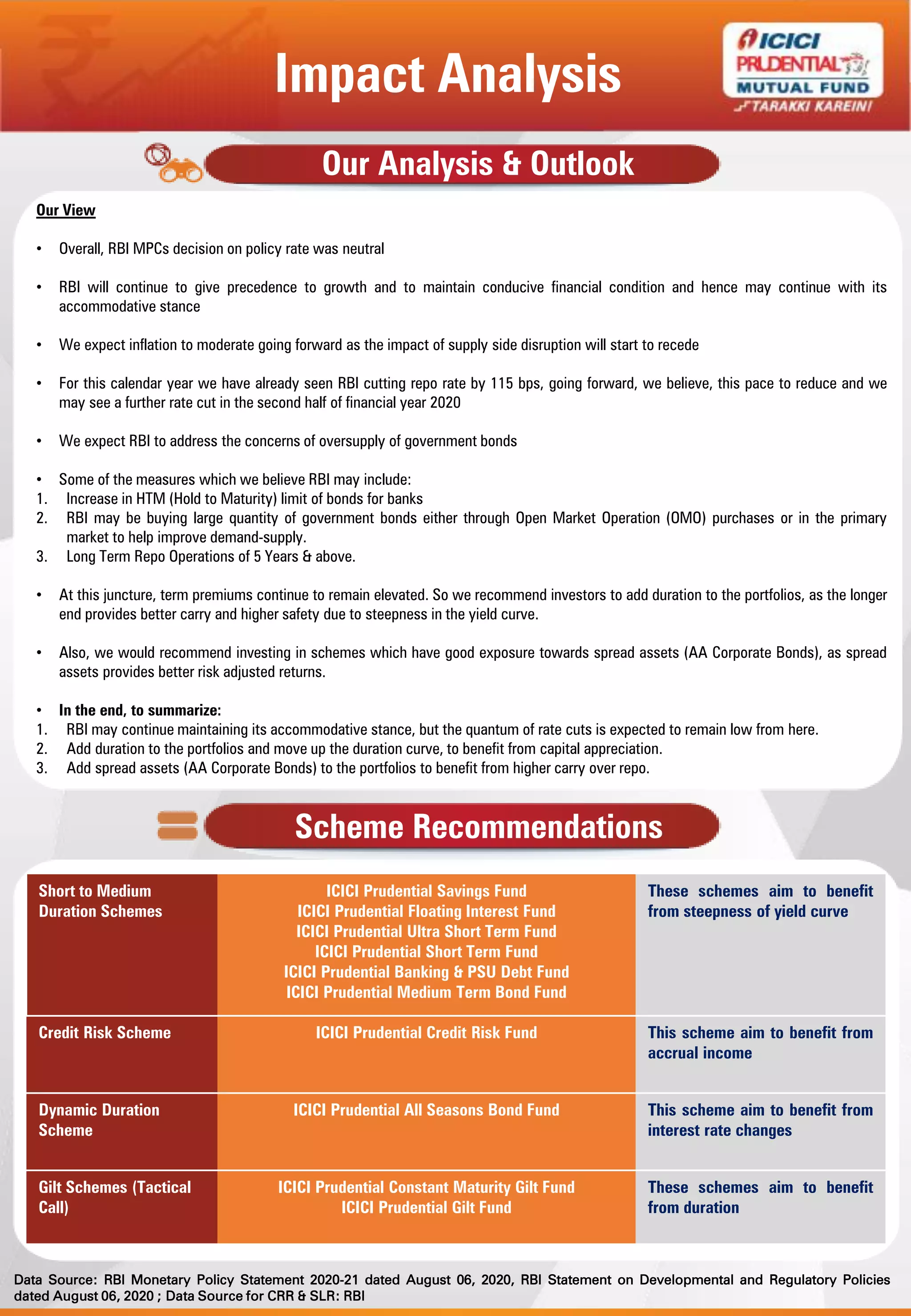

- RBI is likely to continue its accommodative stance to support growth but may reduce the pace of rate cuts. It is also expected to address the oversupply of government bonds through measures like increasing banks' bond holding limits.