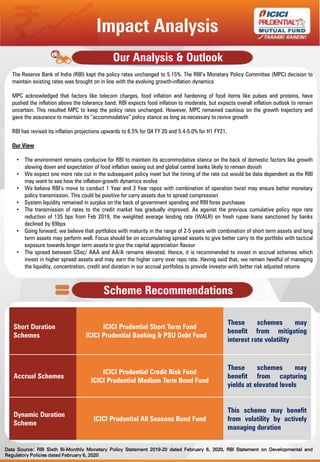

The Reserve Bank of India (RBI) kept the policy rates unchanged to 5.15%. While inflation has risen above the tolerance band due to factors like food and telecom prices, RBI expects food inflation to moderate. RBI has revised its inflation projections upwards but expects the overall inflation outlook to remain uncertain. RBI remains cautious on the growth trajectory and will maintain its accommodative policy stance as long as needed to revive growth. Transmission of rates to credit markets has improved with banks lowering lending rates. RBI's liquidity measures and operation twist have helped ensure better monetary policy transmission. Going forward, portfolios focusing on accrual and spread across shorter and longer duration assets may perform well.