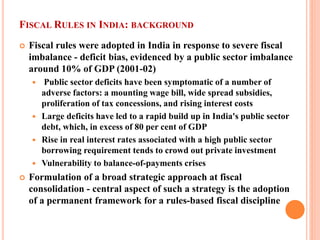

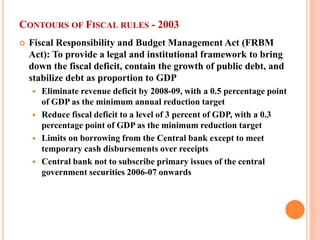

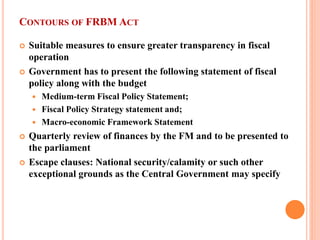

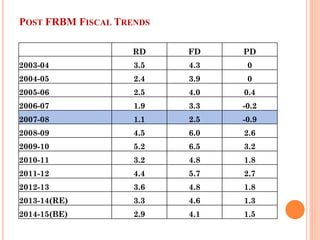

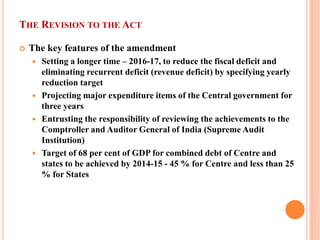

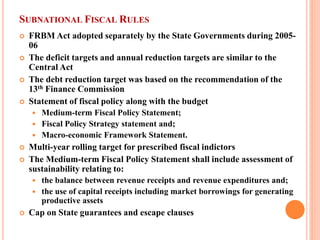

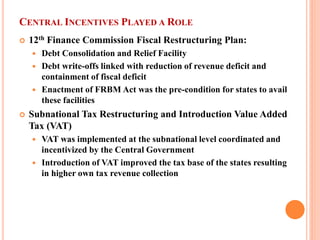

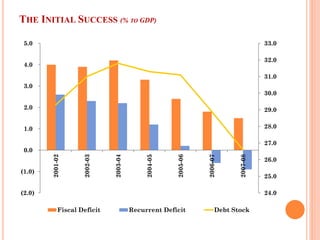

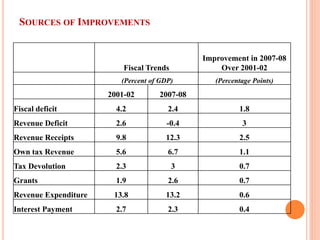

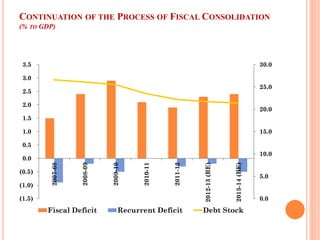

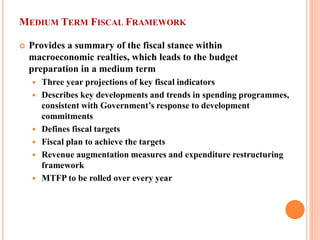

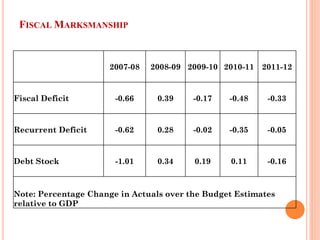

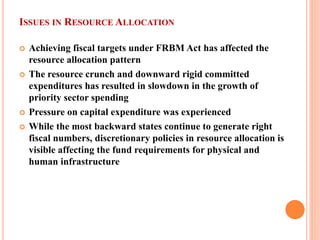

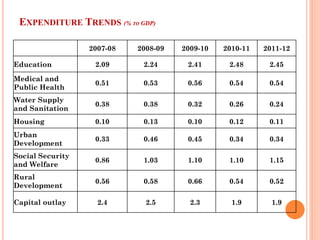

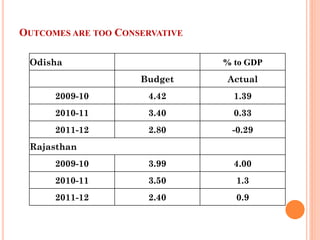

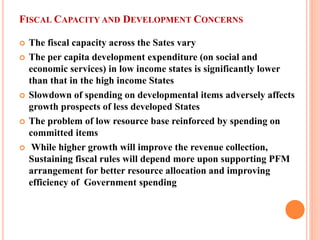

This document discusses the need for public financial management (PFM) reforms to sustain fiscal rules at the sub-national level in India. It provides background on India adopting fiscal rules in 2003 through the Fiscal Responsibility and Budget Management Act to address high fiscal deficits. While fiscal deficits and debt levels improved initially, challenges remain around balancing fiscal targets with resource allocation needs, as expenditure on social and economic services varies significantly between low and high income states. Ongoing reforms aim to strengthen fiscal transparency, medium-term planning, and coordination between central and state governments.