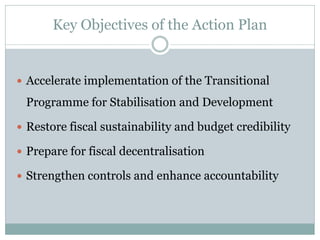

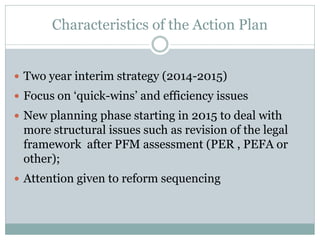

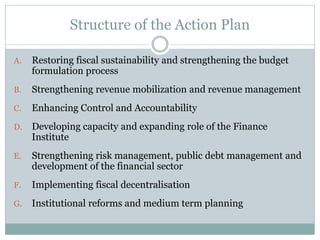

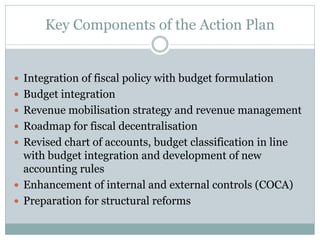

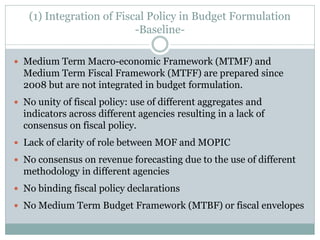

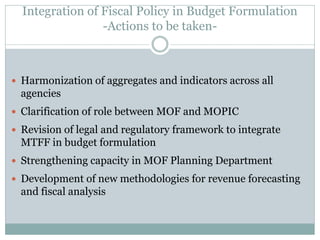

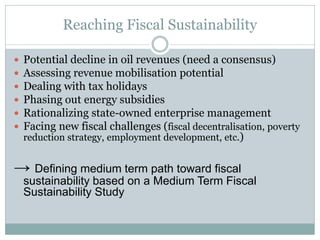

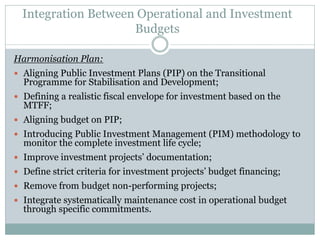

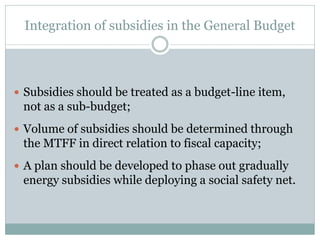

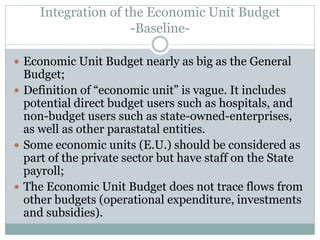

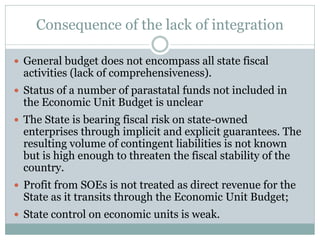

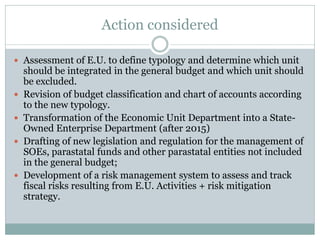

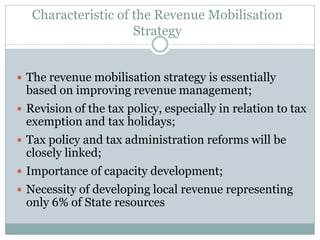

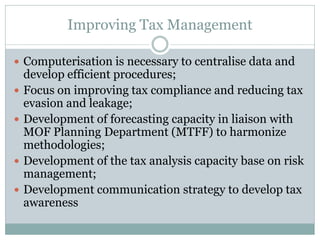

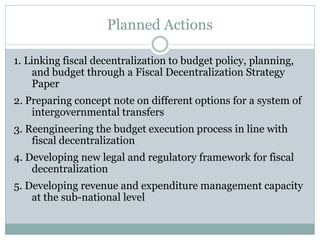

This document summarizes the key points from a government-development partners roundtable on public finance management reforms. It outlines an action plan with the following objectives: 1) restore fiscal sustainability and budget credibility, 2) prepare for fiscal decentralization, and 3) strengthen controls and accountability. The action plan focuses on quick wins for 2014-2015, with a new planning phase in 2015 to address more structural issues. Key areas of focus include integrating fiscal policy with budgeting, strengthening revenue collection, enhancing budget integration, and developing a roadmap for fiscal decentralization. The document concludes by noting the need to plan reforms beyond 2015 based on a public finance assessment.