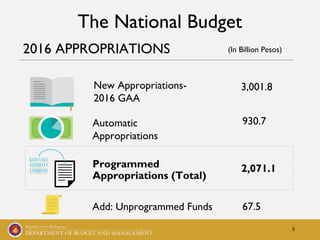

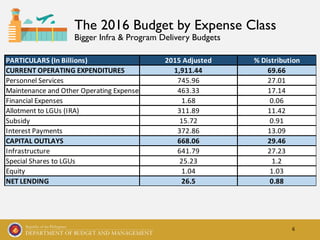

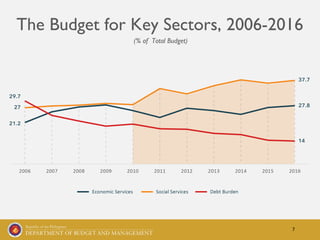

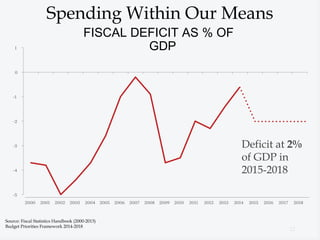

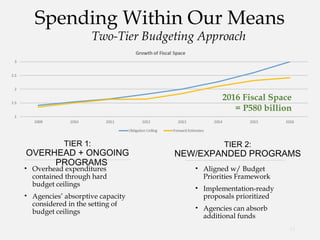

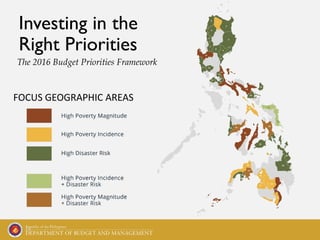

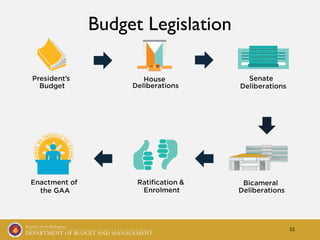

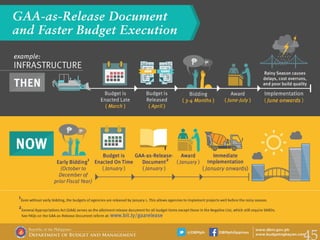

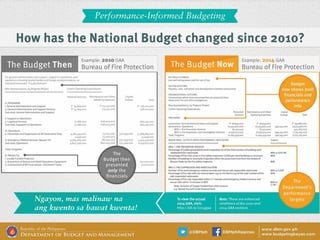

The document discusses the national budget of the Philippines and the Department of Budget and Management's (DBM) role in its preparation and oversight. It notes that DBM is mandated to promote efficient use of government resources to achieve socioeconomic goals. It then provides details on the composition and funding amounts of the 2016 national budget, emphasizing spending on infrastructure and program delivery while keeping a fiscal deficit below 2% of GDP. It outlines DBM's budgeting process and priorities of spending within means on key sectors and priority geographic areas in a transparent manner.