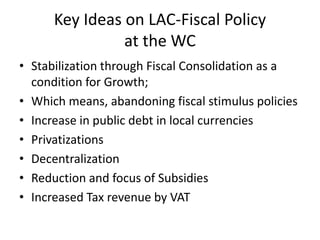

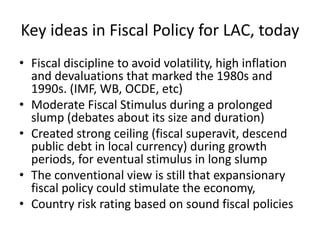

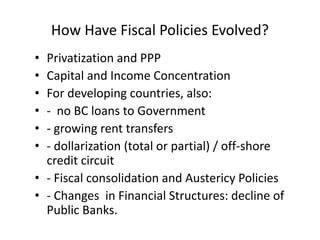

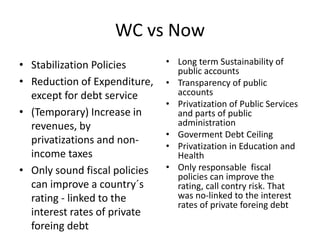

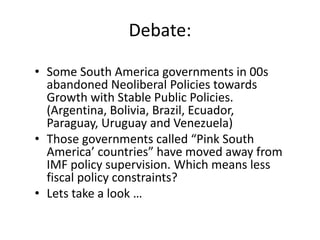

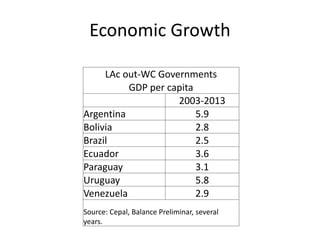

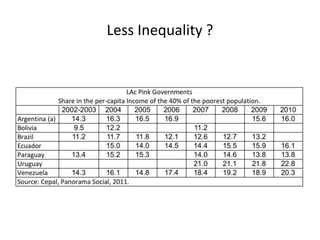

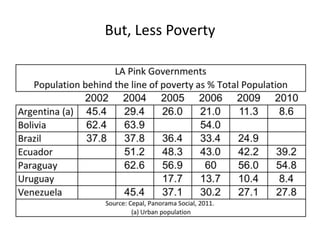

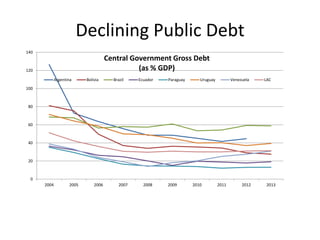

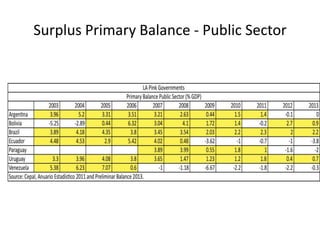

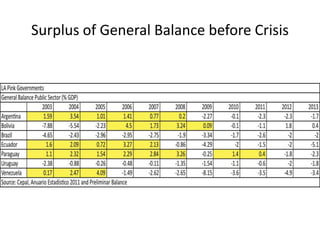

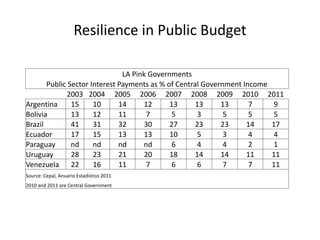

This document discusses fiscal policy in Latin American countries. It notes that international institutions traditionally advocated fiscal consolidation through austerity measures. However, some South American governments in the 2000s abandoned neoliberal policies in favor of growth with stable public policies. Data shows that these "Pink" countries experienced higher economic growth and declining public debt compared to other Latin American nations, though inequality remained an issue. While these governments had more autonomy, international credit markets still imposed conditions that limited their fiscal policy sovereignty.