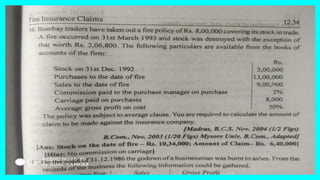

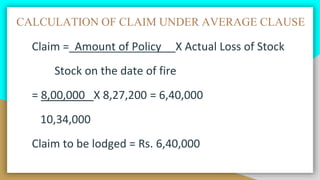

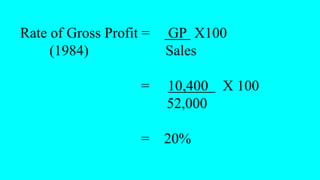

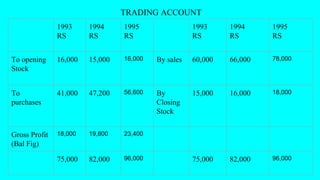

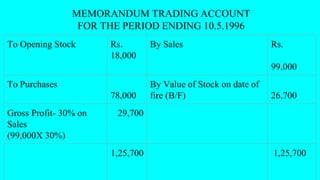

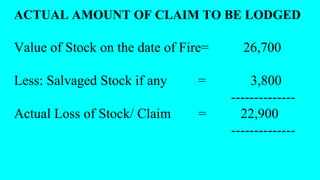

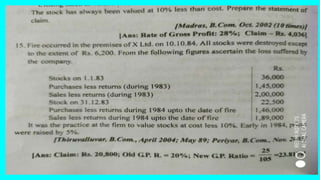

The document discusses fire insurance calculations involving the average clause and details various trading accounts over multiple years, outlining opening stock, purchases, sales, gross profit, and claim calculations due to fire losses. It provides examples of how to compute actual losses of stock and the claims that can be lodged based on policy amounts and stock values at the time of fire. Figures and percentages are used throughout to illustrate the calculations needed to determine claims and gross profit rates.