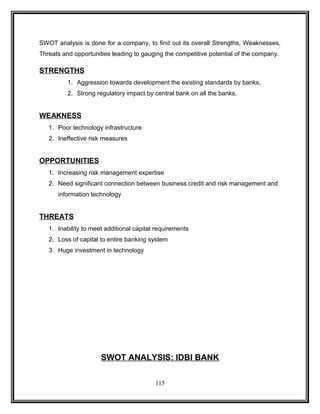

This document is a project study report submitted for a Master's degree. It examines customer awareness of retail banking products at IDBI Bank. The report includes an introduction, background on the organization, research methodology, analysis and findings from surveys conducted, as well as conclusions and recommendations. It discusses nationalizing India's banking sector in 1969 and the liberalization of the 1990s that increased competition. The report aims to analyze customer satisfaction with IDBI Bank's products and services and identify opportunities to improve awareness of their wealth management offerings.