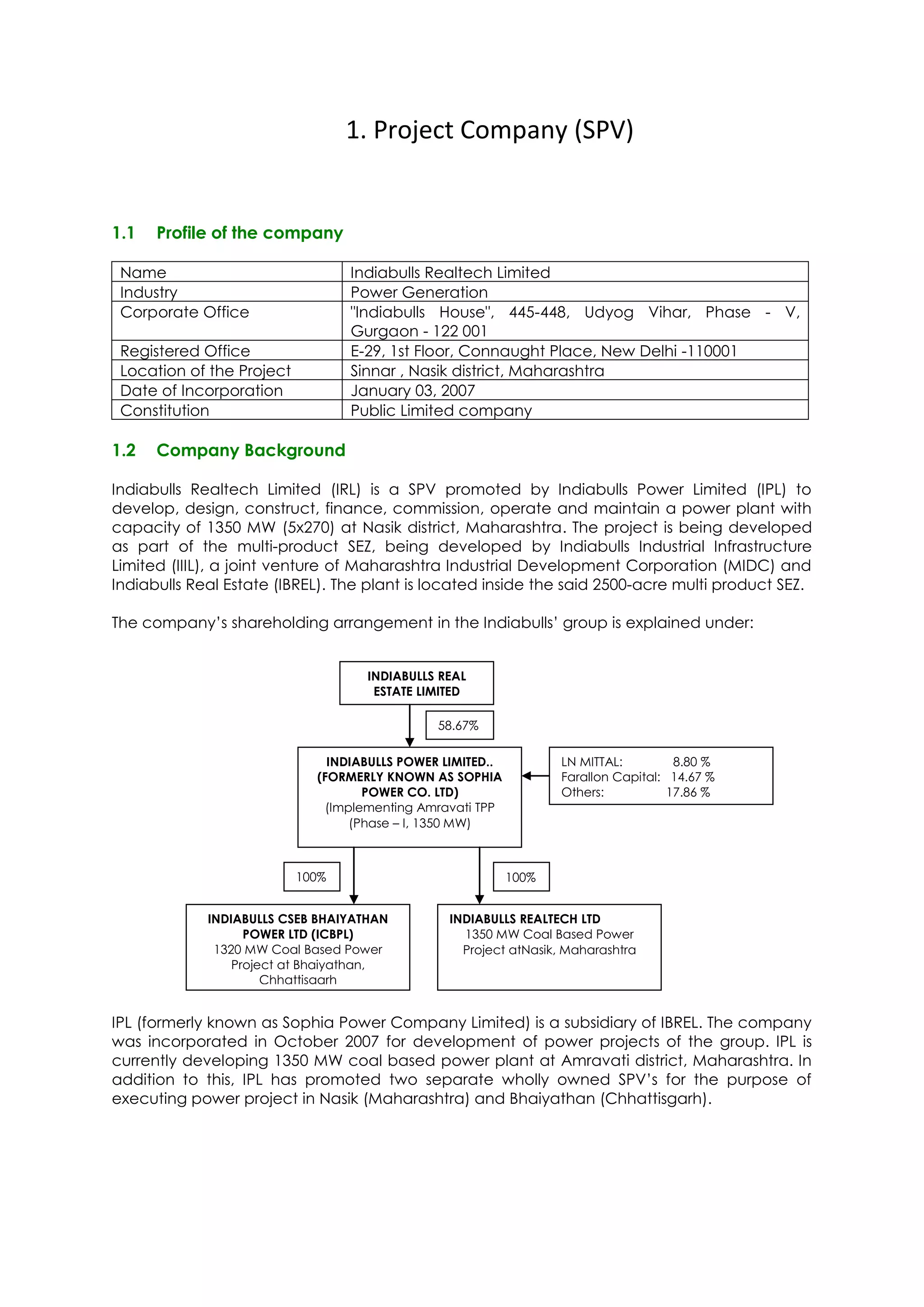

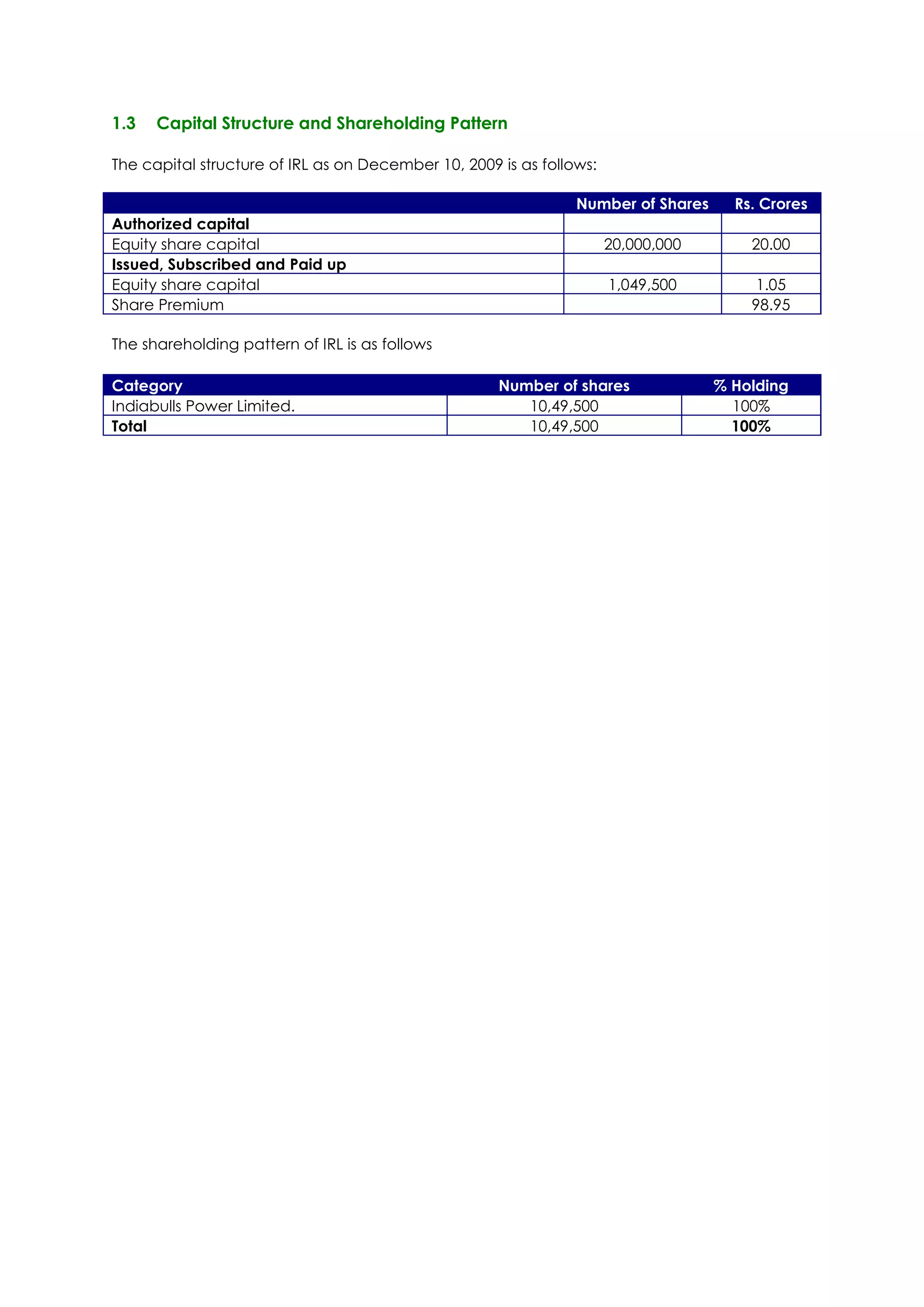

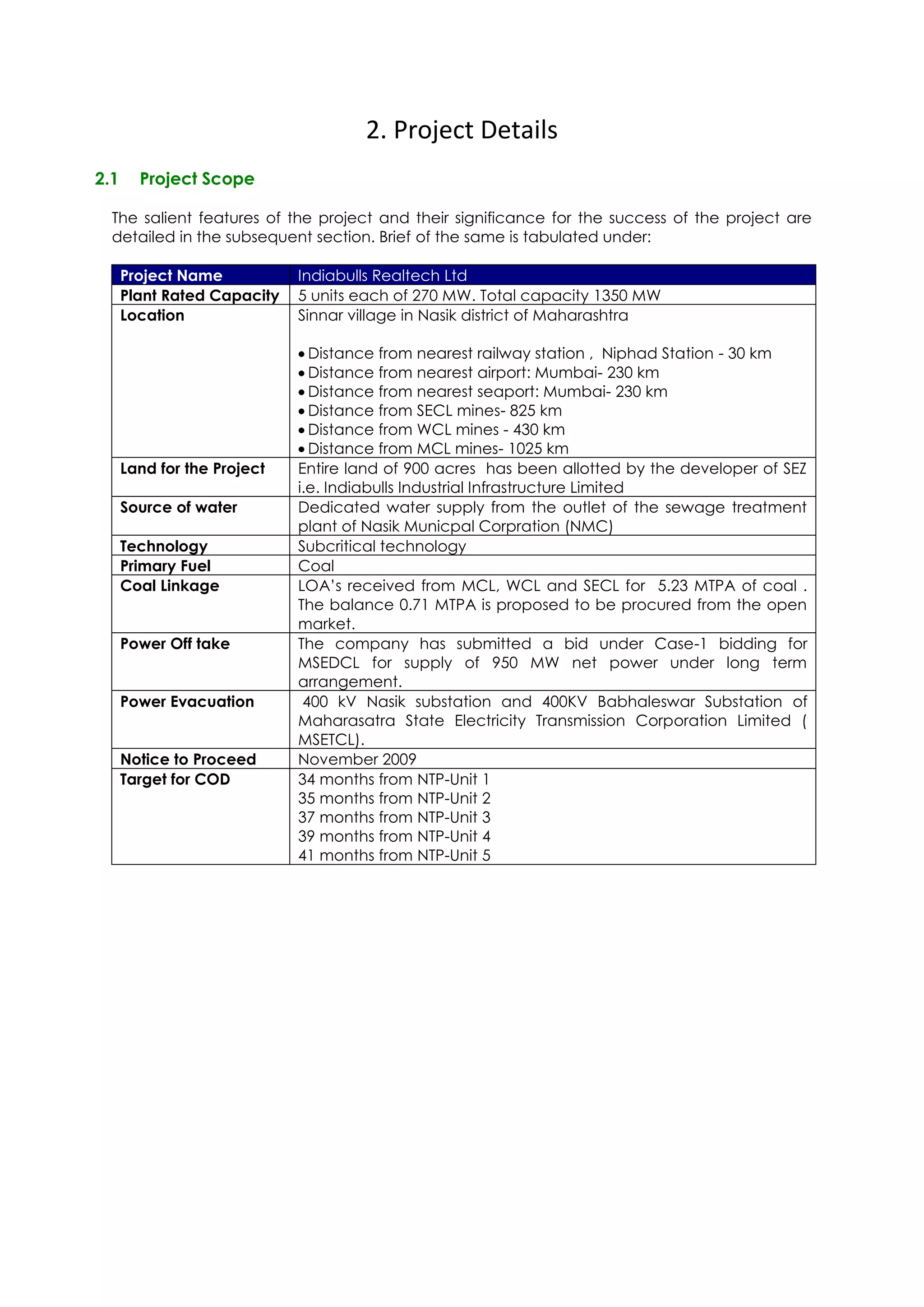

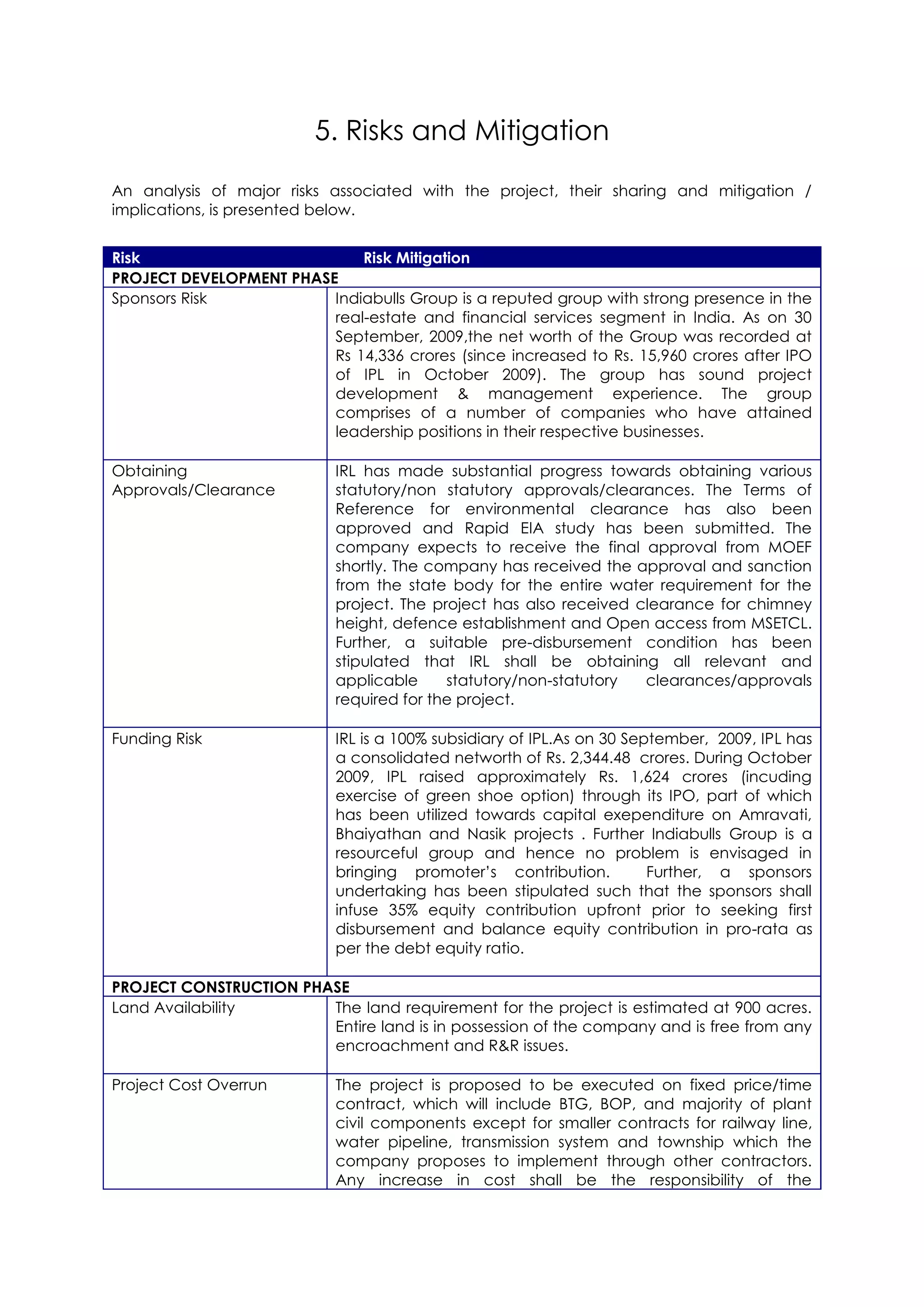

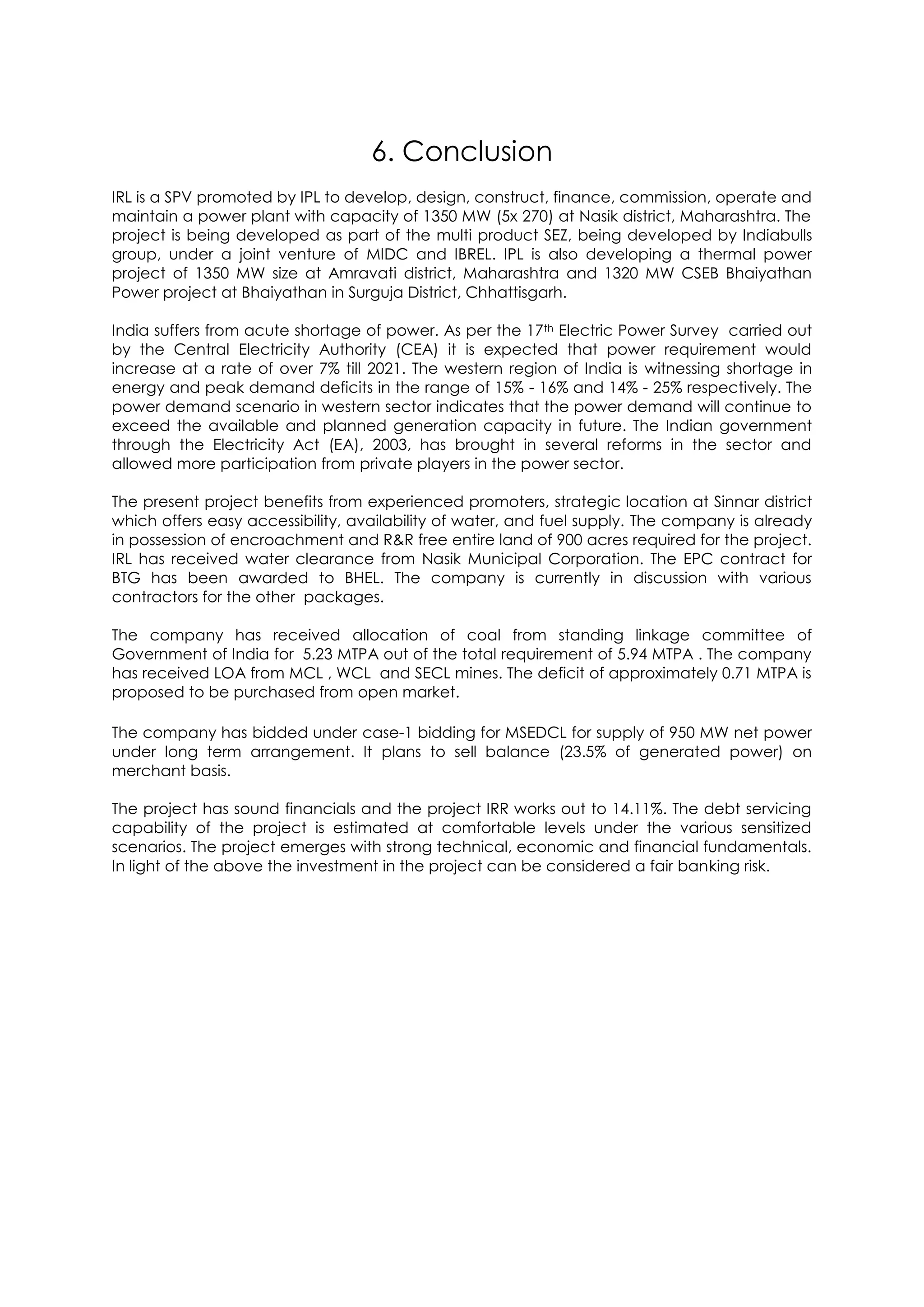

The document provides details of a proposed 1350 MW thermal power project in Nasik, Maharashtra by Indiabulls Realtech Limited. Key details include:

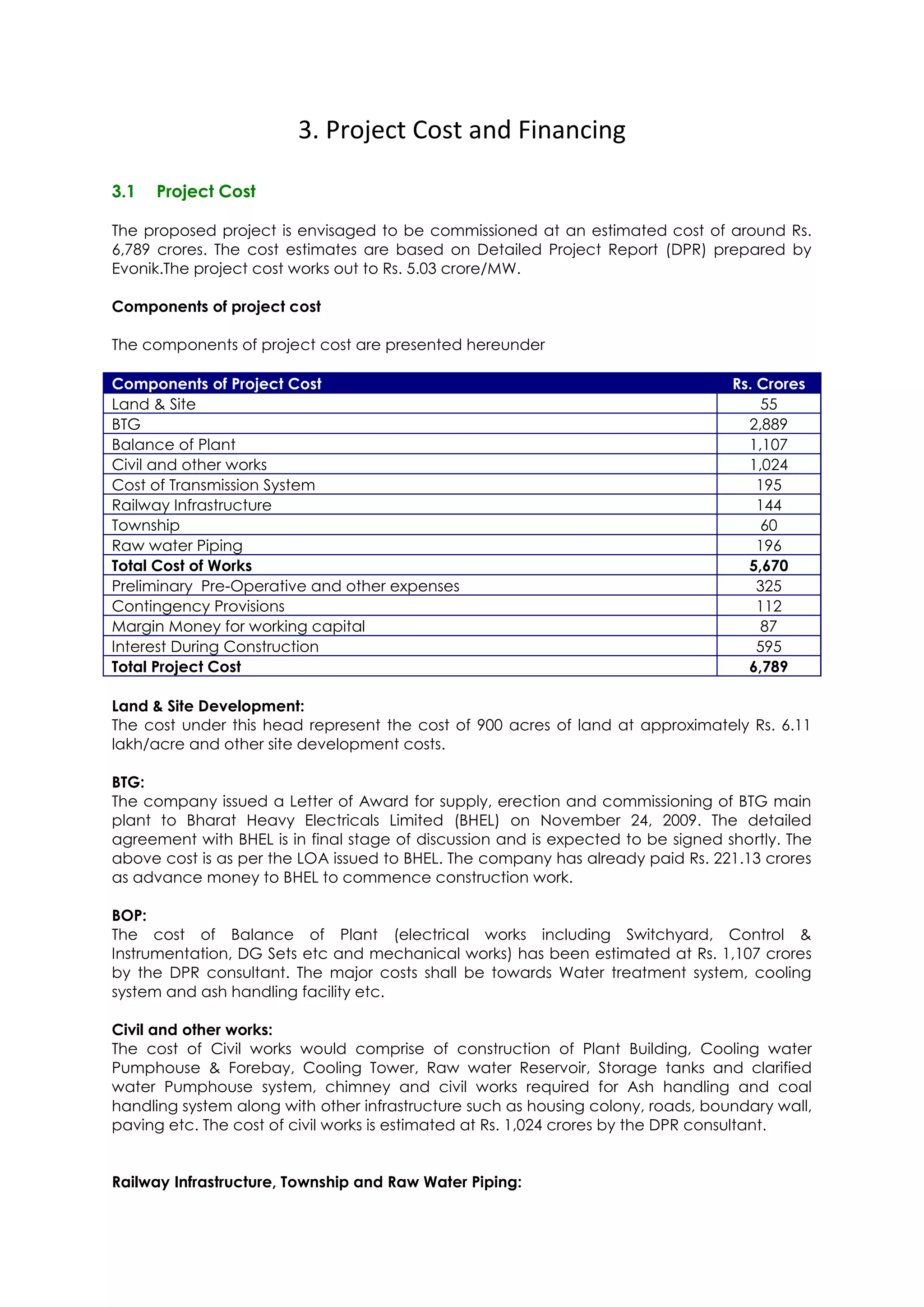

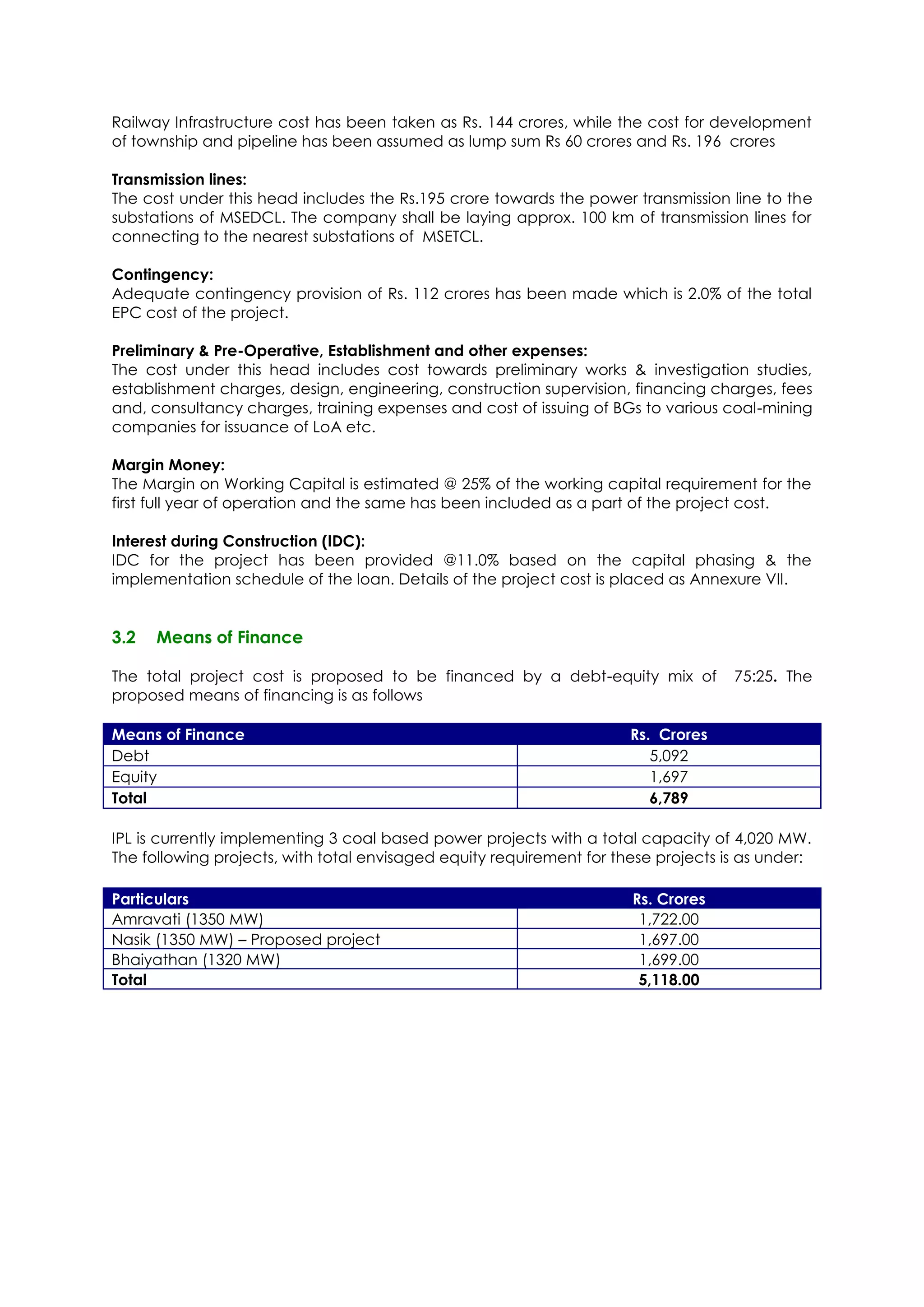

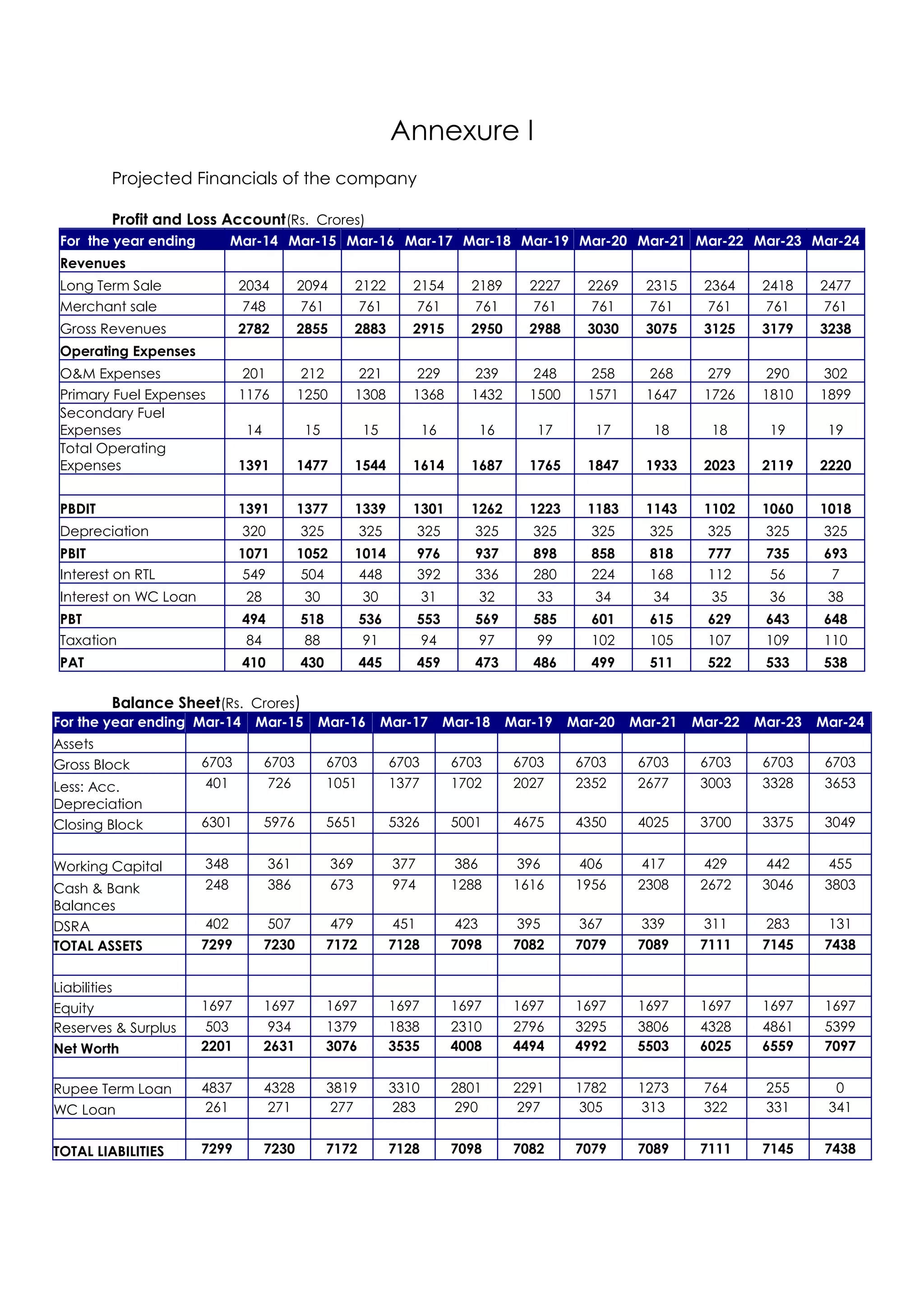

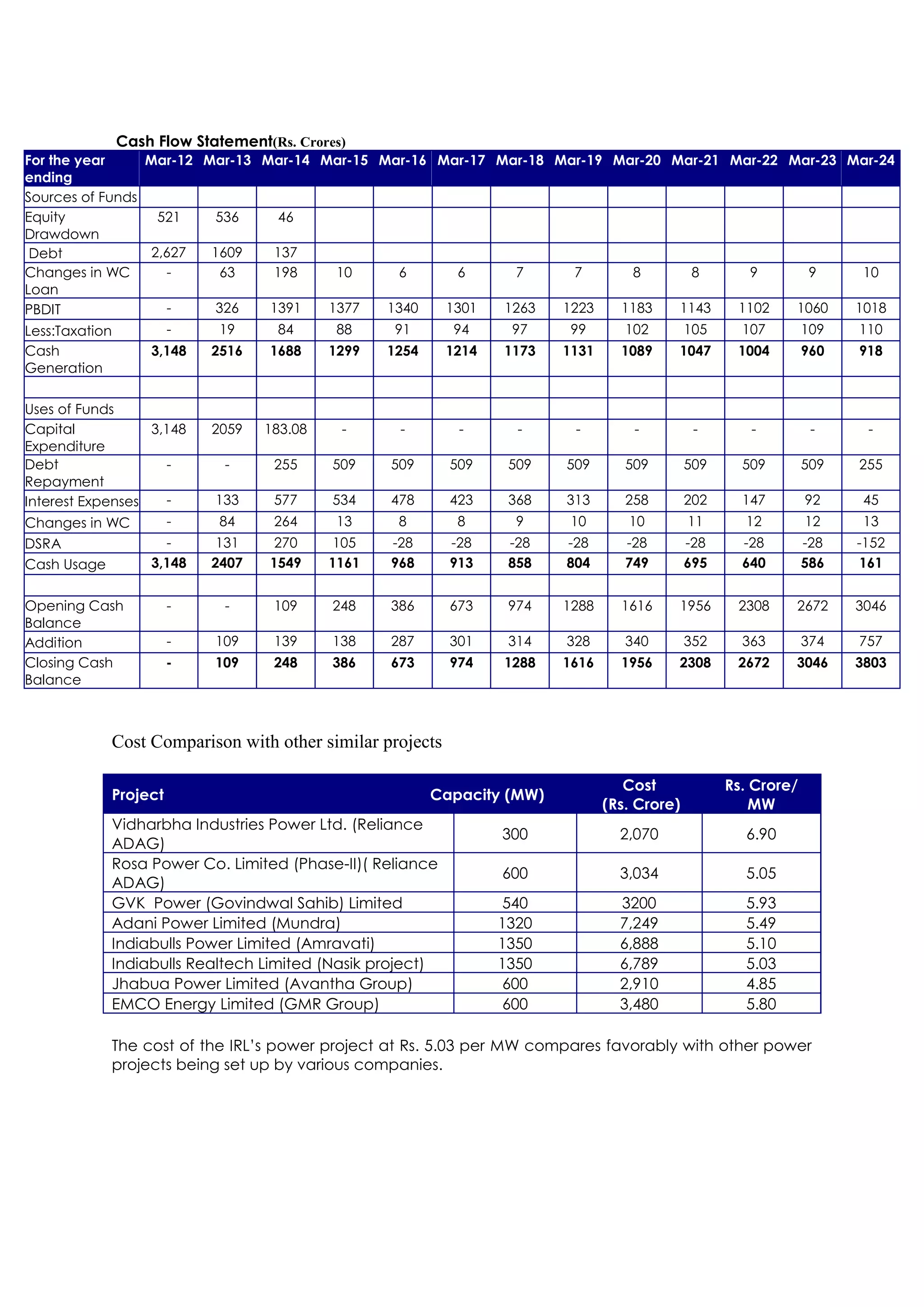

- Total project cost is estimated at Rs. 6,789 crores to be financed through a debt-equity ratio of 75:25.

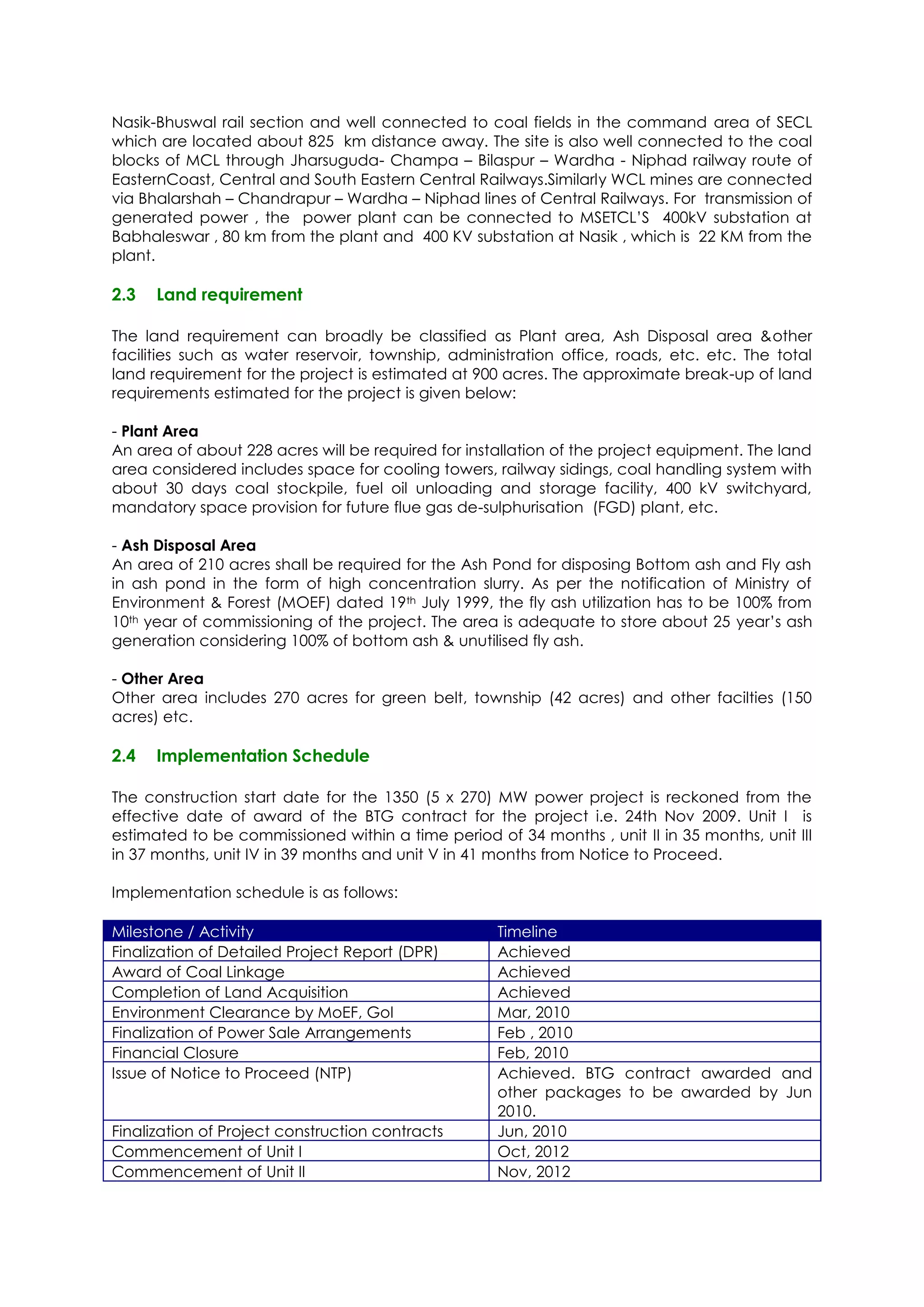

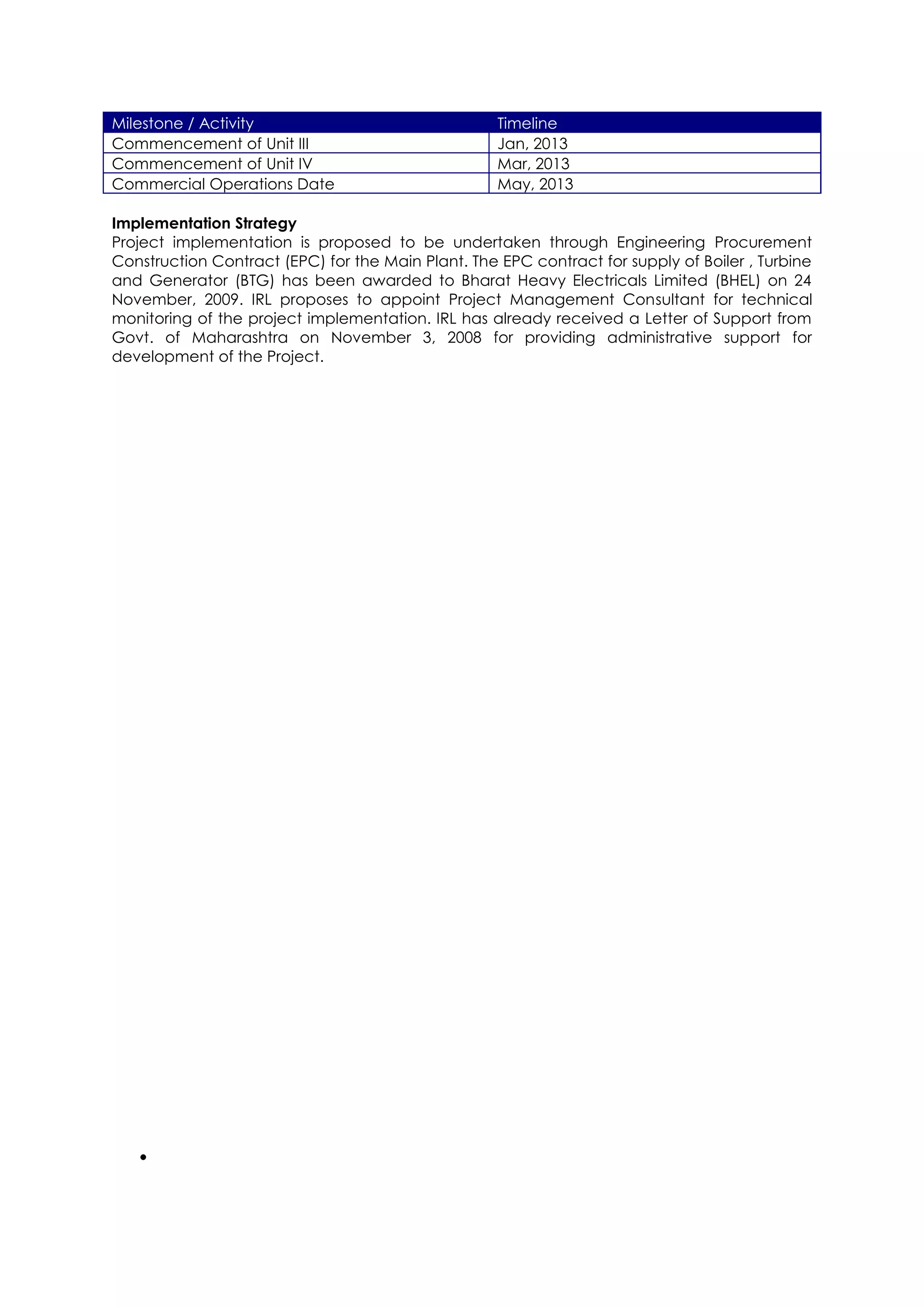

- The project involves setting up 5 units of 270 MW capacity each and is expected to be commissioned in phases over 41 months from the notice to proceed date.

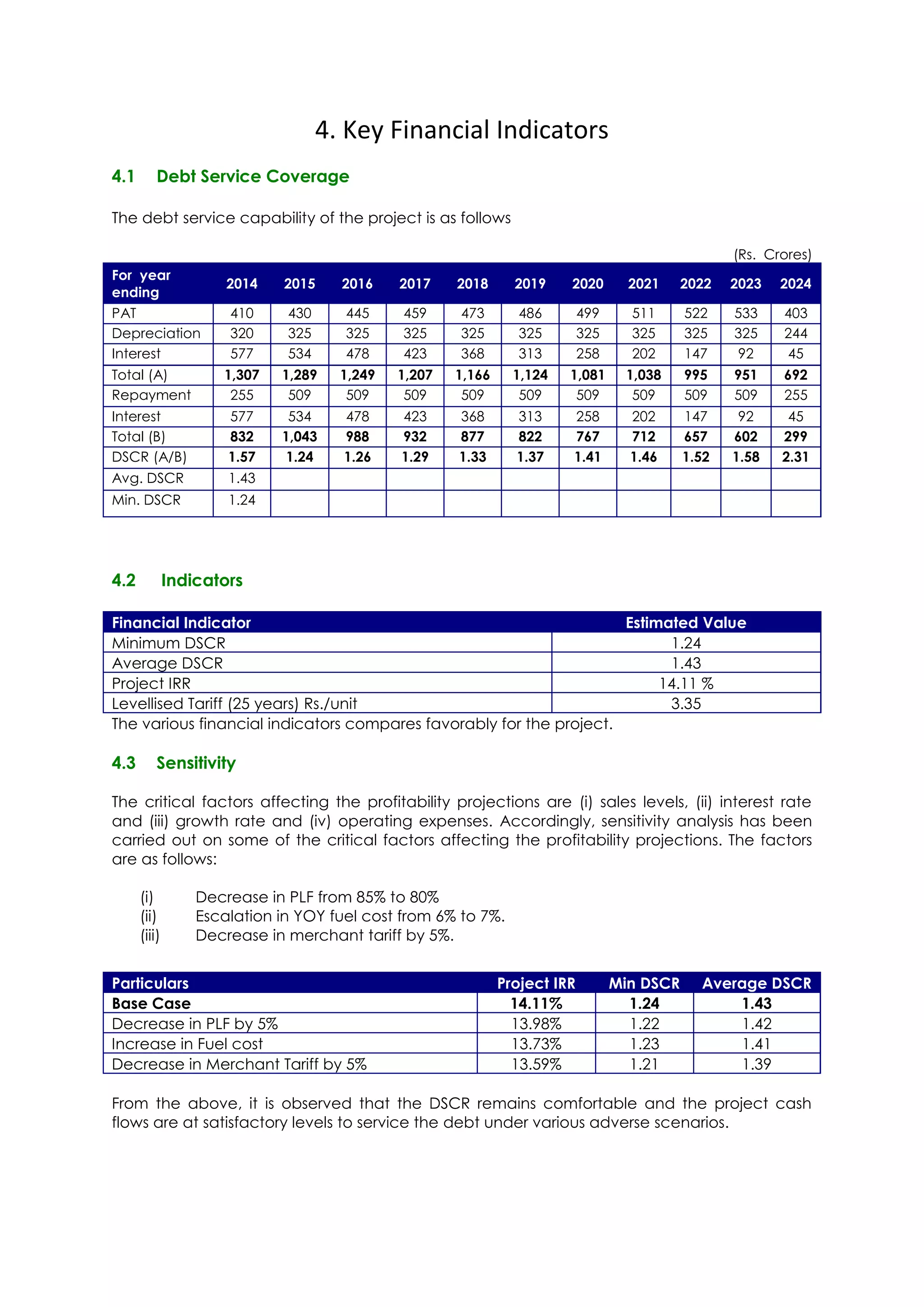

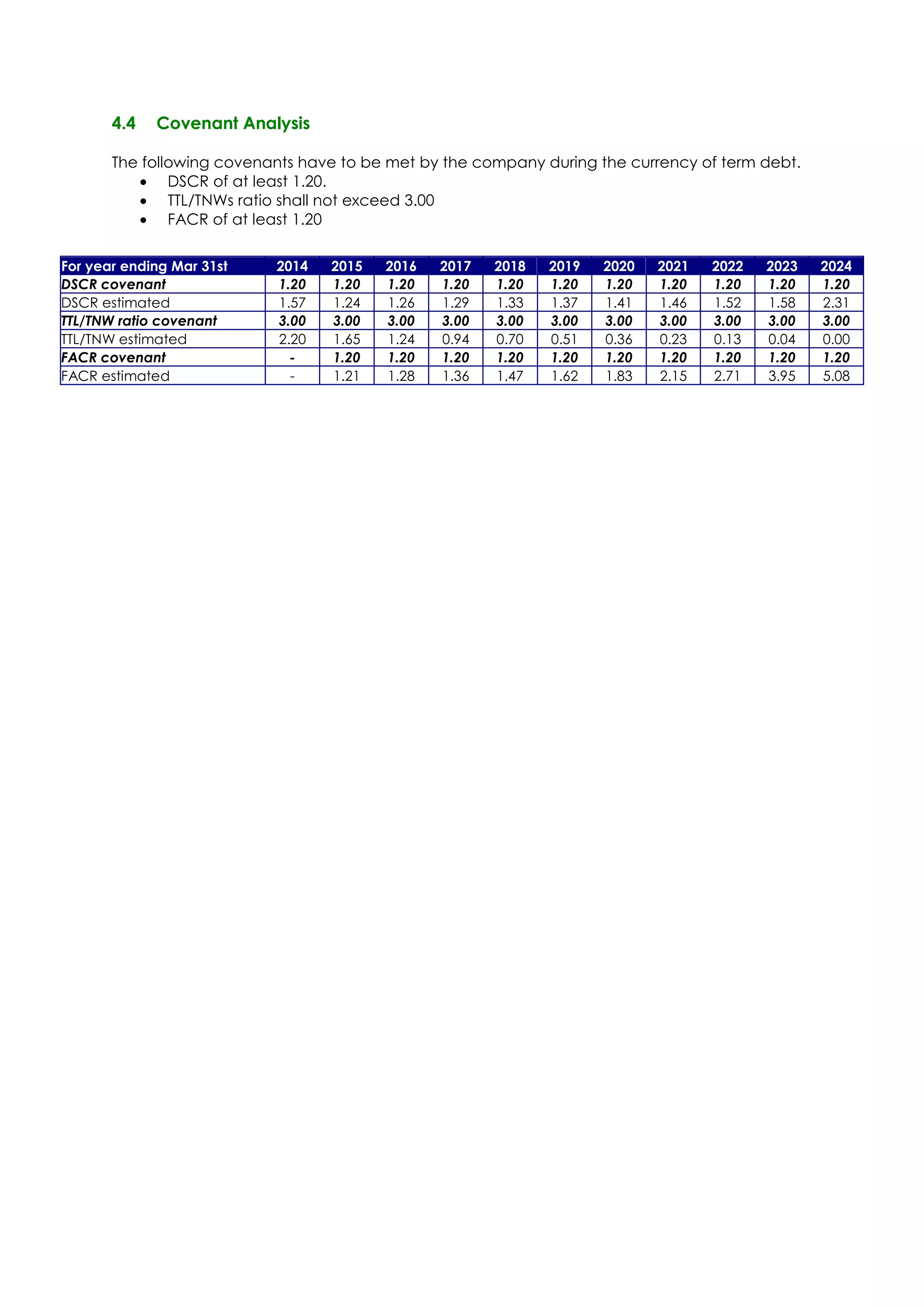

- Key financial indicators like the debt service coverage ratio are positive and the project is expected to be a viable investment.