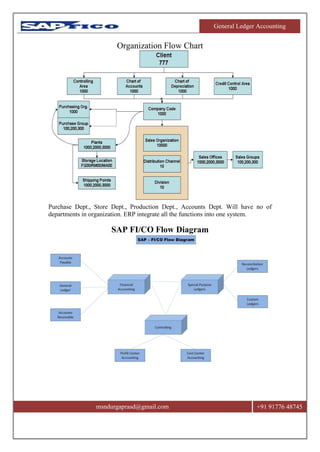

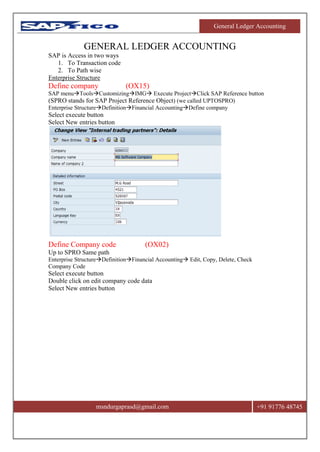

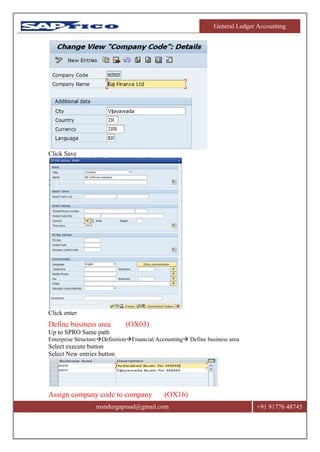

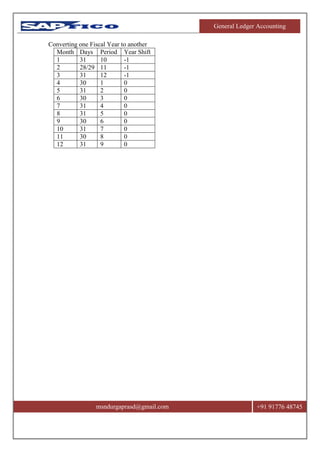

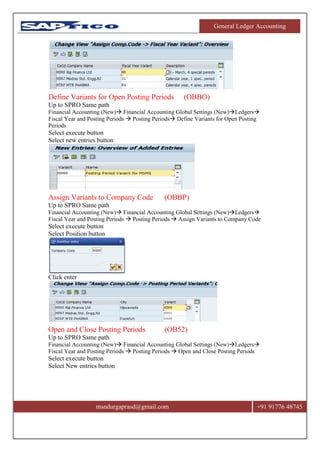

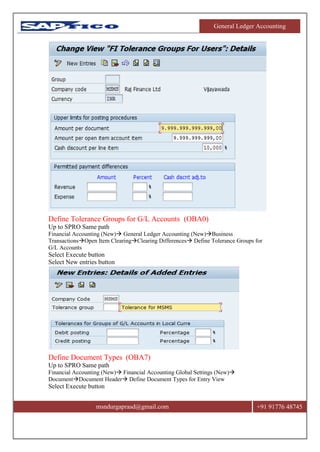

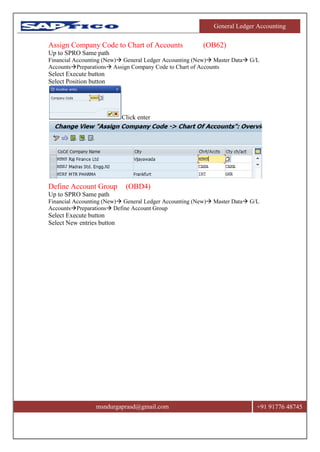

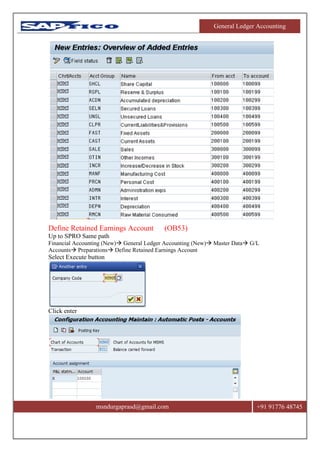

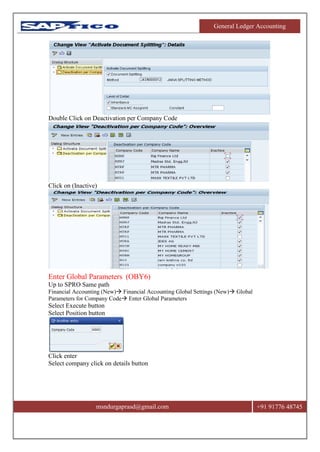

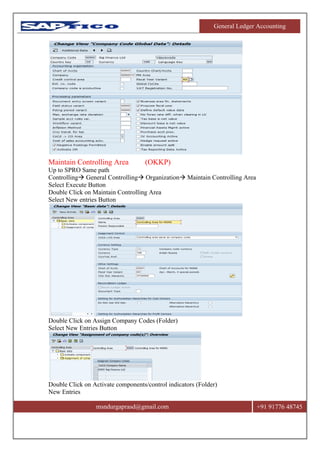

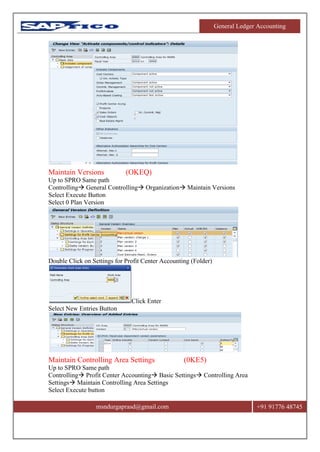

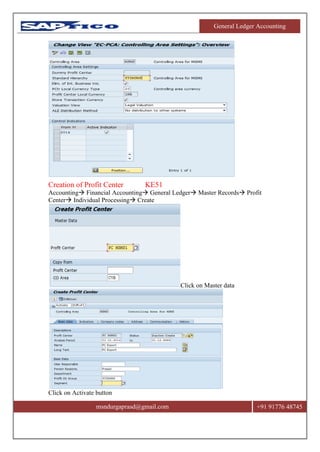

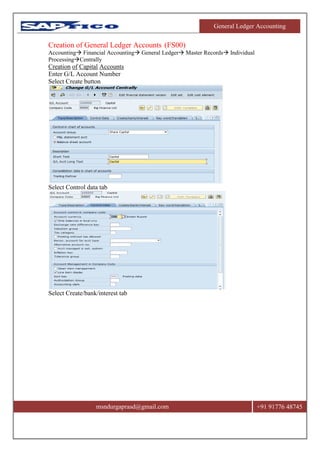

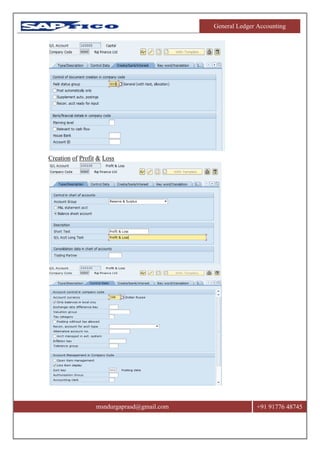

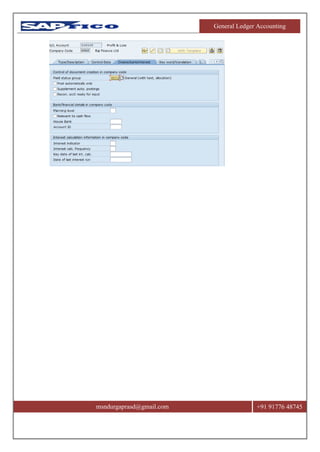

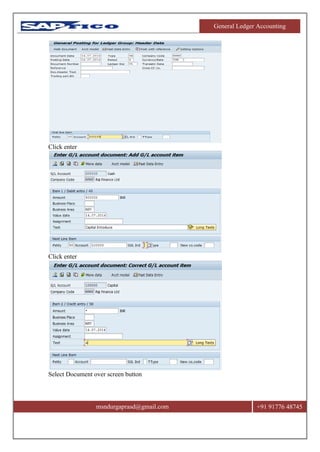

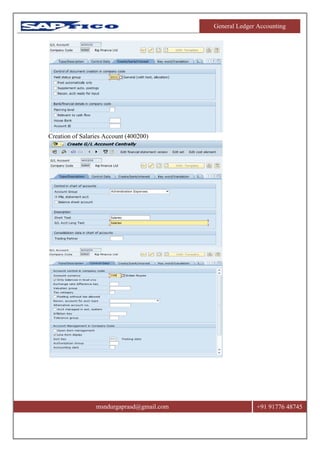

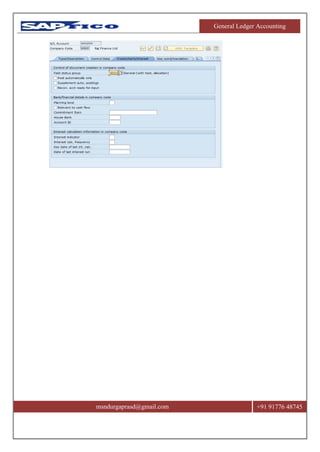

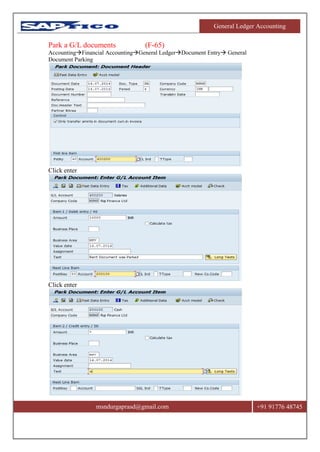

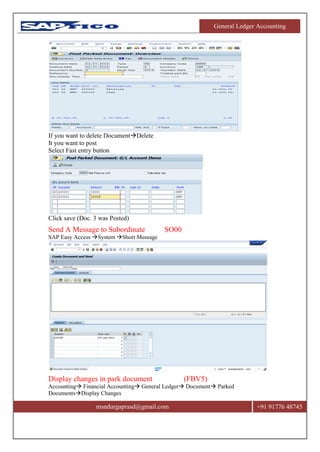

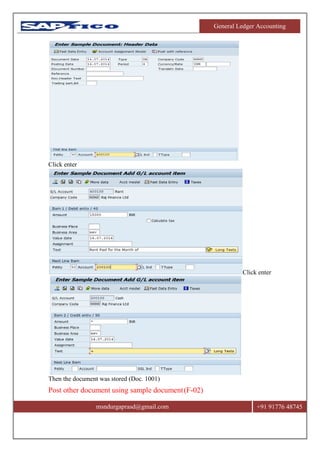

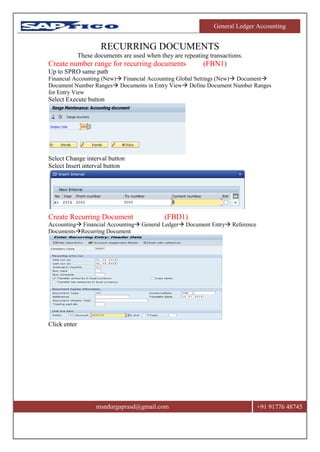

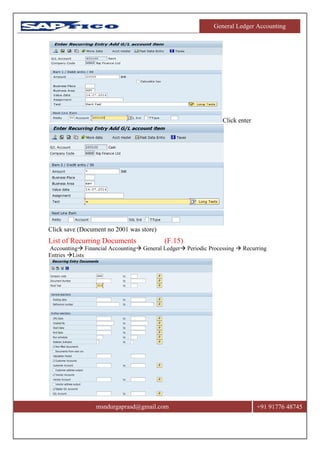

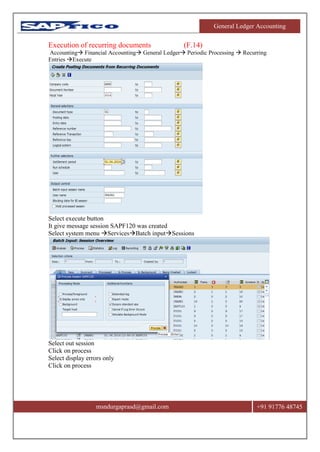

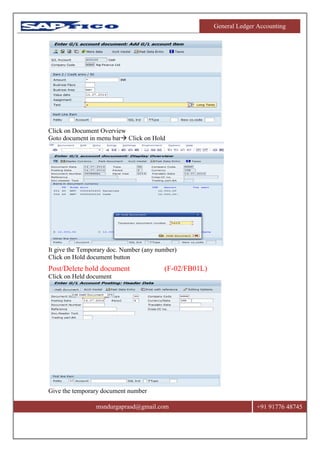

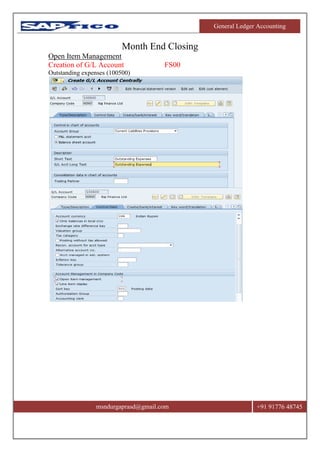

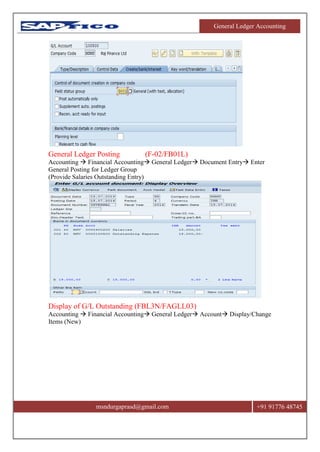

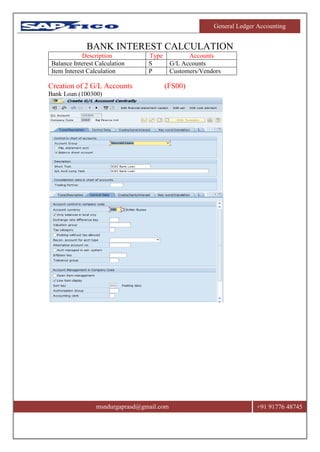

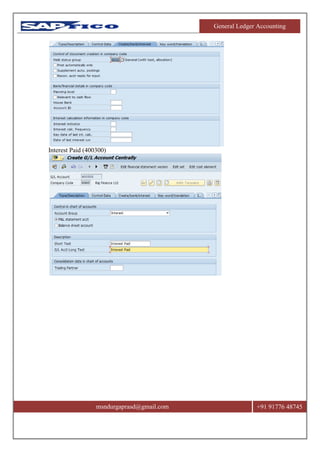

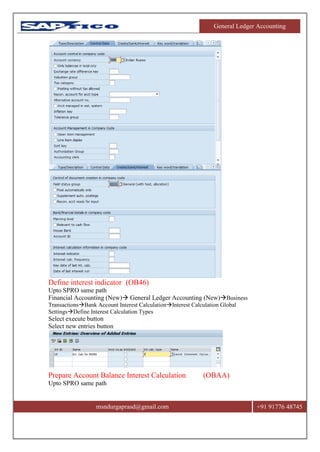

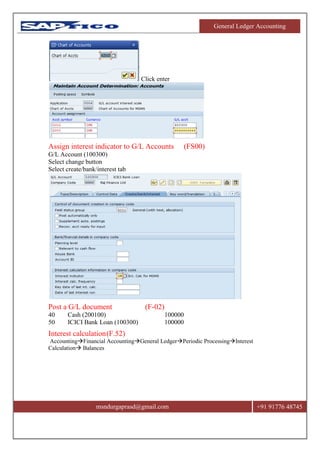

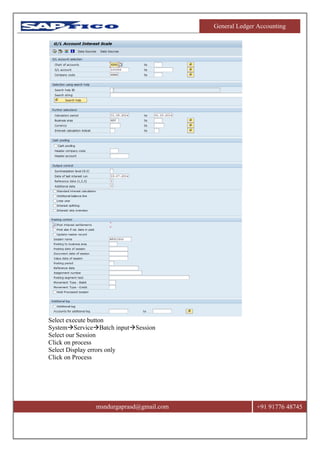

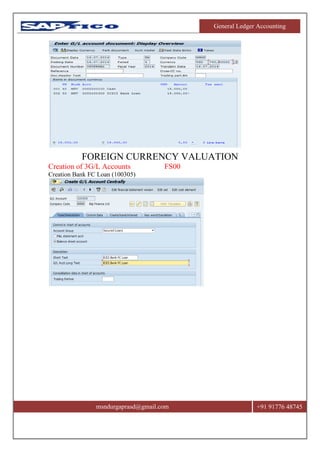

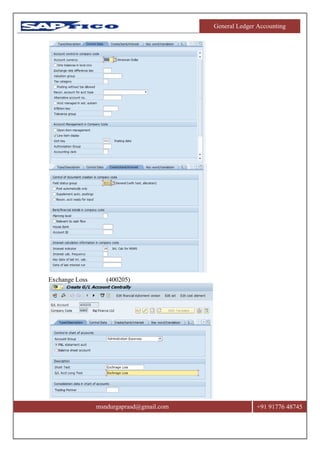

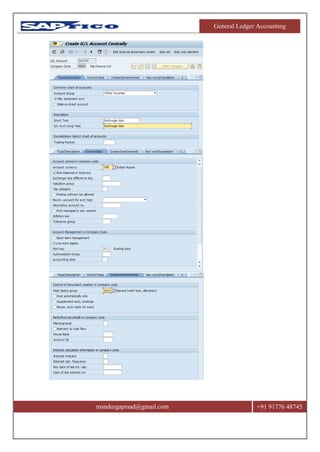

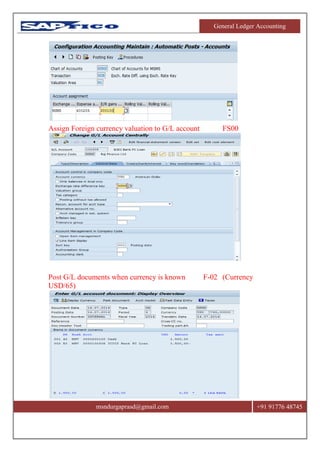

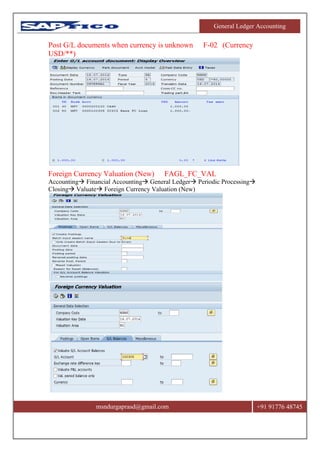

This document provides instructions for customizing and configuring SAP FI/CO modules for general ledger accounting. It includes steps for defining the company and business area, maintaining the fiscal year variant and assigning it to the company code, customizing the chart of accounts, and posting journal entries. The purpose is to integrate the general ledger with other SAP modules like controlling and enable financial reporting.