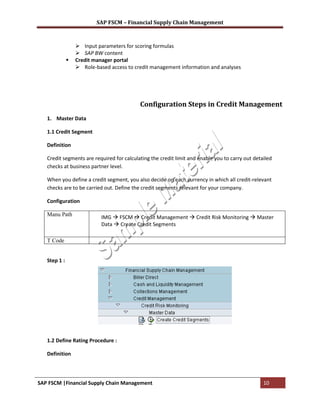

This document provides an overview of SAP Financial Supply Chain Management (FSCM) and its key components. SAP FSCM includes modules for credit management, biller direct, dispute management, and collection management. It aims to optimize financial processes like accounts receivable, credit risk assessment, billing and payments. The document outlines the functionality of each FSCM module and provides configuration steps for setting up credit management, including defining credit segments, rating procedures, customer groups and formulas.