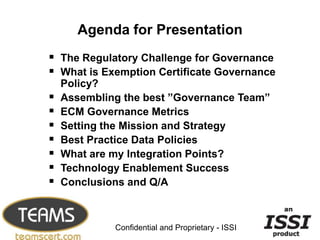

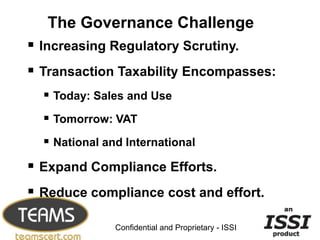

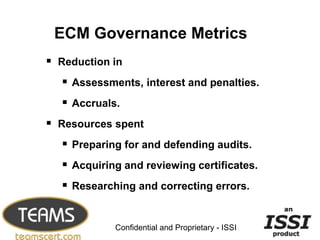

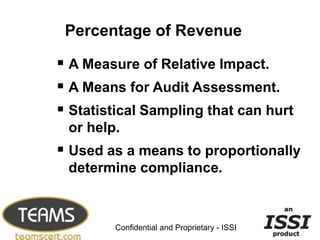

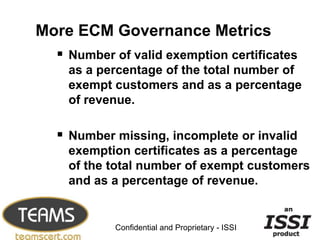

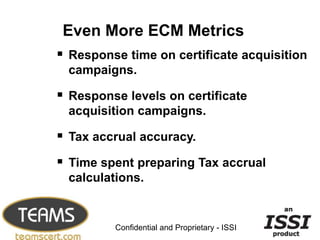

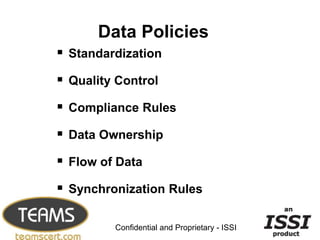

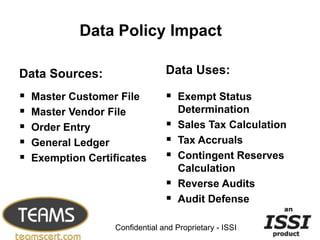

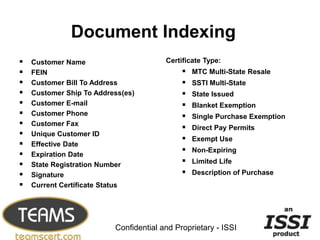

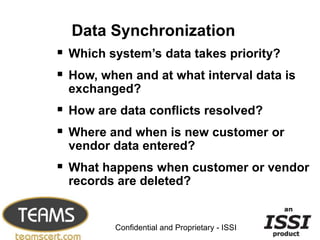

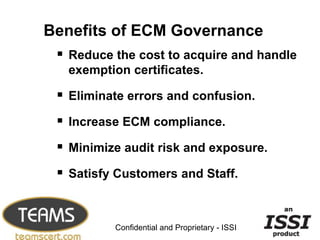

This document is a presentation by ISSI from October 2012 about corporate governance for exemption certificates. It discusses the regulatory challenges around governance, assembling a governance team, setting metrics and policies for electronic certificate management, and how technology can enable governance success. It provides an overview of best practices for exemption certificate governance through electronic certificate management.