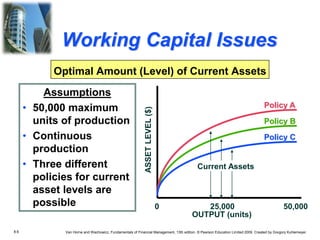

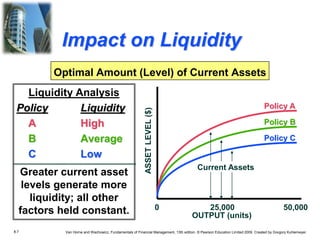

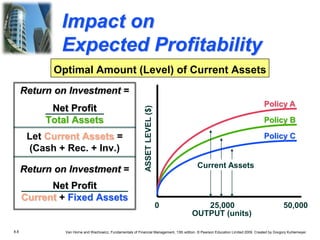

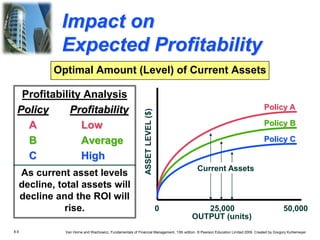

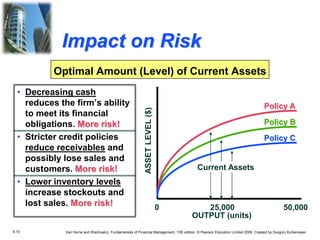

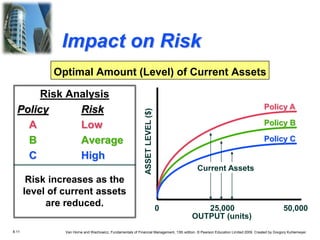

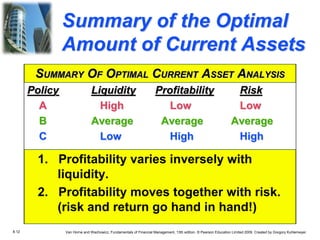

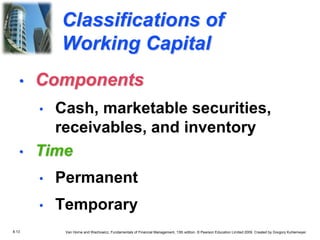

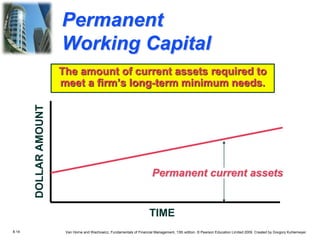

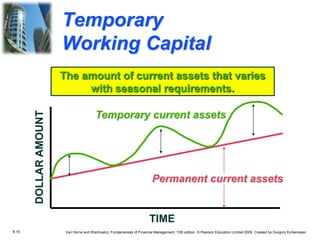

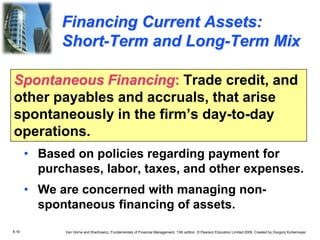

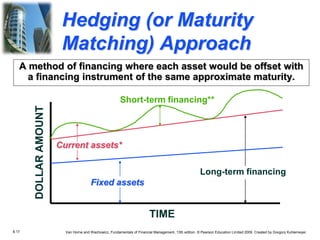

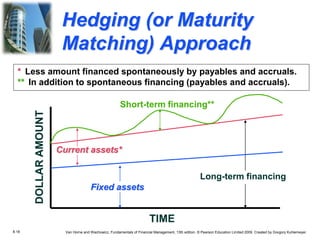

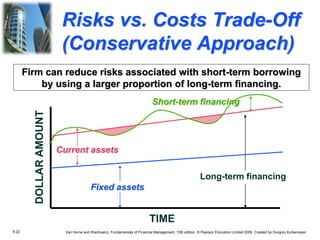

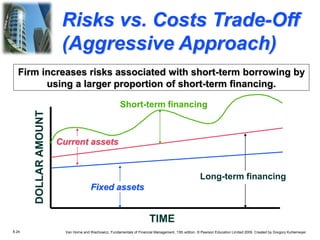

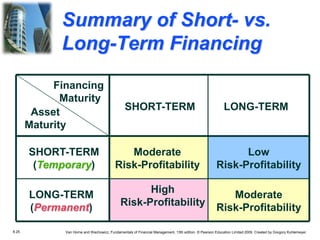

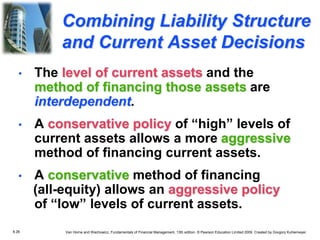

This document provides an overview of working capital management concepts from the 13th edition of Van Horne and Wachowicz's Fundamentals of Financial Management textbook. It discusses key topics such as determining the optimal level of current assets, classifying working capital, and approaches to financing current assets, including hedging and short- versus long-term financing. The document also examines trade-offs between liquidity, profitability and risk across different current asset and financing policies.