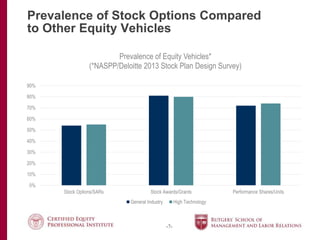

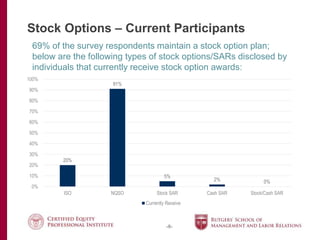

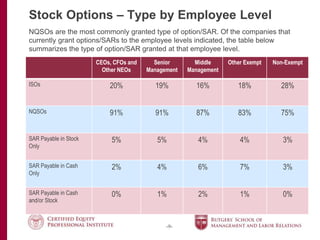

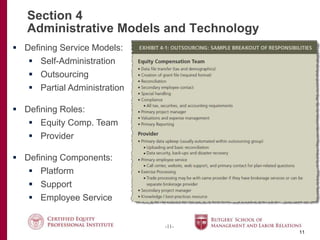

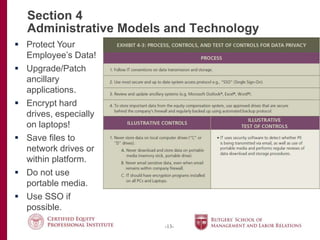

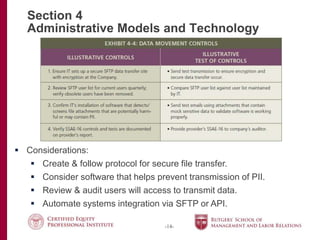

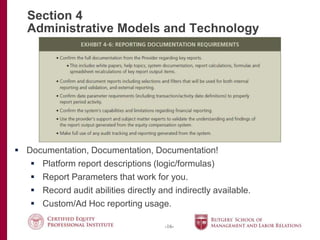

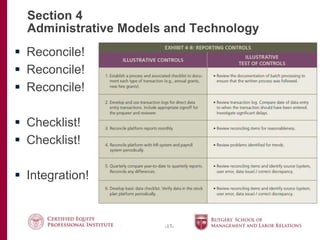

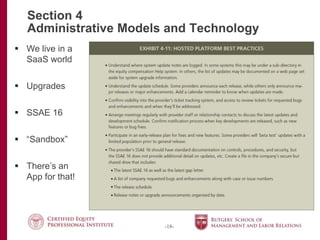

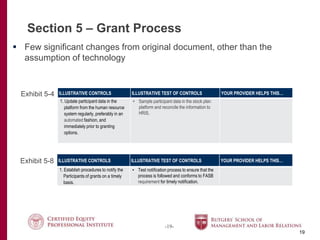

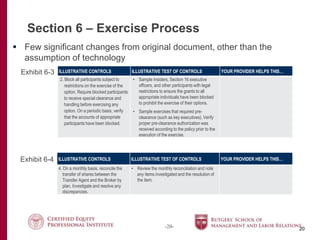

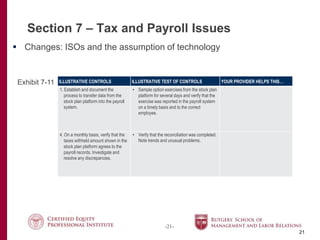

The document provides an overview of the GPS stock options project, focusing on administrative models and technology for managing non-qualified and incentive stock options granted to U.S. employees of publicly traded companies. It discusses the evolution of stock options usage from 2004 to 2016, administrative protocols for grant and exercise processes, and emphasizes the importance of secure data management and reconciliation procedures. Contact information for key speakers involved in the project is also included.