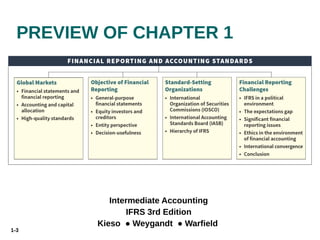

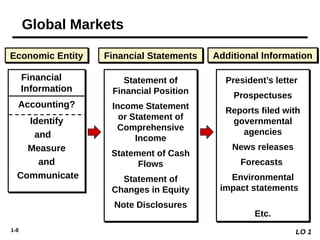

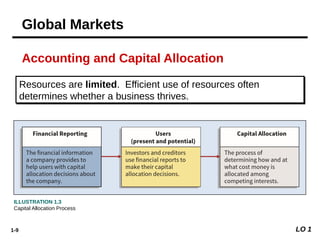

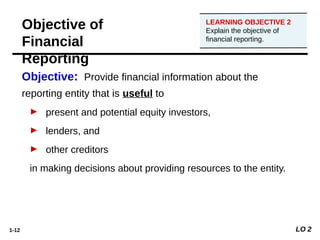

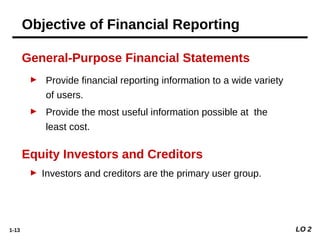

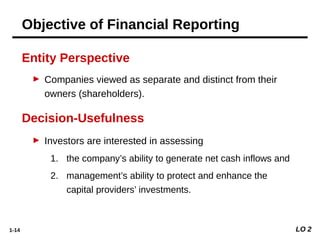

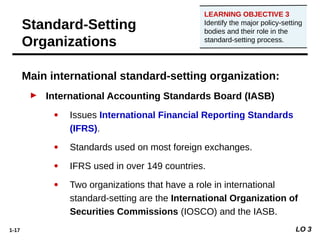

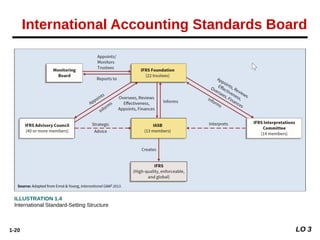

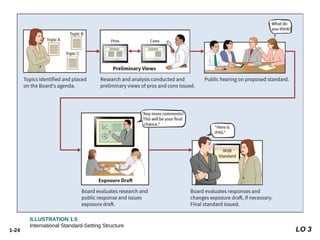

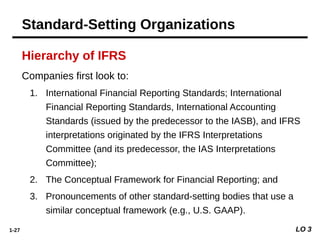

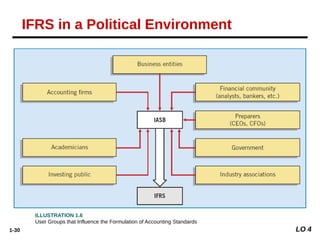

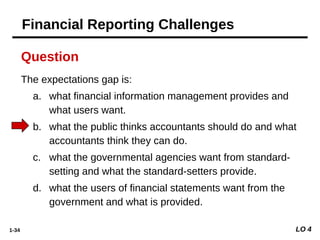

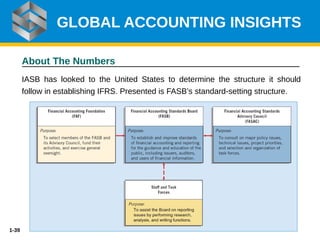

The document discusses the significance of global financial markets and their connection to financial reporting, emphasizing the need for high-quality international accounting standards. It outlines the objectives of financial reporting, identifies major standard-setting bodies like the IASB, and addresses challenges in financial reporting including political influences and the expectations gap. Additionally, it compares IFRS and U.S. GAAP, noting similarities and differences in their standard-setting processes.