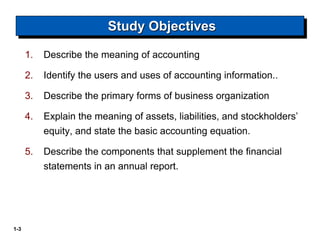

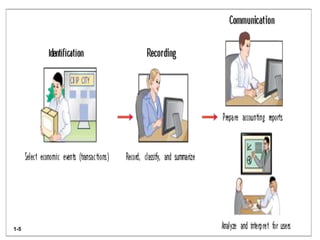

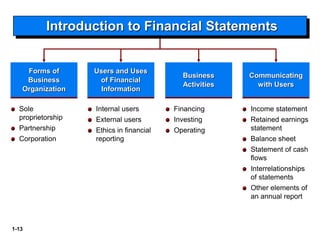

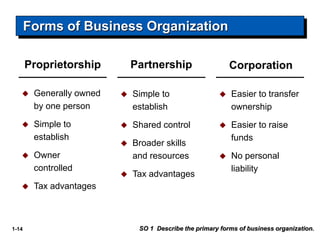

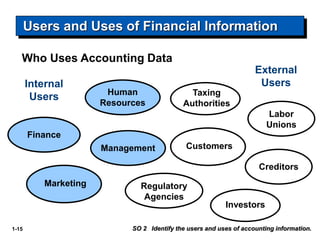

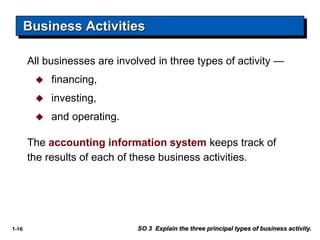

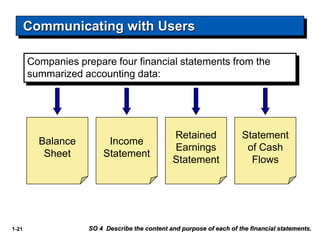

The document provides an introduction to financial accounting. It defines accounting and describes the four main branches: financial accounting, managerial accounting, auditing, and tax accounting. It identifies the main users and uses of accounting information, both internal and external. It also describes the three primary forms of business organization - proprietorship, partnership, and corporation - and explains the basic accounting equation relating assets, liabilities, and owner's equity.