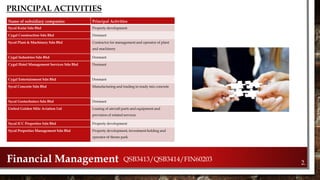

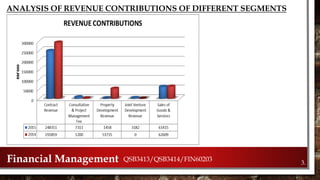

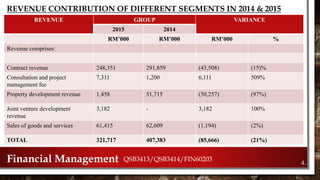

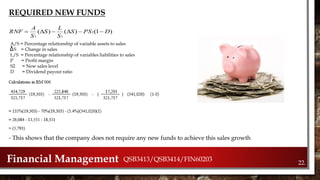

Sycal Venture Berhad is a public construction and property development company established in 1980. It has core businesses in construction/infrastructure, property development, and hotels/resorts. It has several subsidiary companies involved in these businesses. In 2015, its revenue decreased 21% year-over-year due to declines in contract revenue and property development revenue. However, it remains profitable through diversification across business segments.