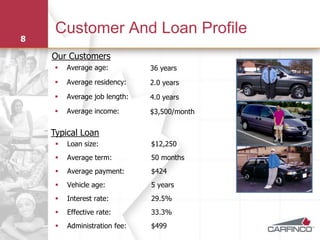

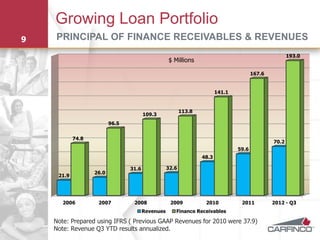

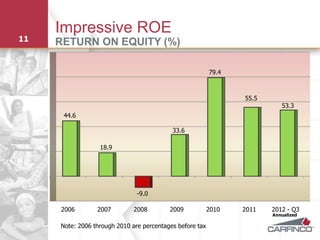

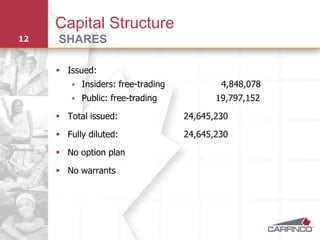

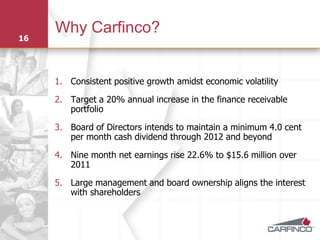

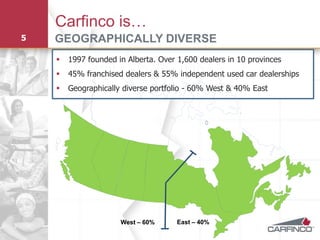

Carfinco Financial Group Inc. is a uniquely positioned auto finance company that has delivered consistent 20% annual growth. It provides financing to "non-prime" credit customers through over 1,600 dealer partnerships across Canada. Carfinco has refined credit risk management practices and vertically integrated operations that have supported strong and growing financial returns, including impressive annual returns on equity of over 50%. The leadership team emphasizes continued growth and maintaining dividend payments.

![Canadian Non-prime Market

7 BEACON SCORE AS A % OF THE CANADIAN CREDIT MARKET

70%

58% 61%

60%

50%

40% 36%

30%

20%

11% 11%

7%

10% 5% 5%

4%

2%

0%

No Score 000 - 619 [D] 620 - 649 [C] 650 - 679 [B] 680 - 719 [A] 720 - 999 [A+]

Canadian Market Carfinco Portfolio](https://image.slidesharecdn.com/carfincomar13presentation-130312133820-phpapp02/85/Carfinco-mar13presentation-7-320.jpg)