This document provides background information on Sycal Ventures Berhad, a public construction company listed on Bursa Malaysia. It discusses the company's establishment in 1980, core businesses in construction, property development, and hotels/resorts. It also lists the company's major shareholders and key management personnel.

![7

[Grab your

reader’s

attention

witha great

quote from

the

documentor

use this

space to

emphasize a

keypoint.To

place this

textbox

anywhere on

the page,

justdrag it.]

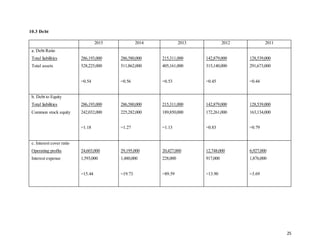

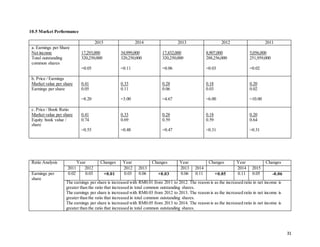

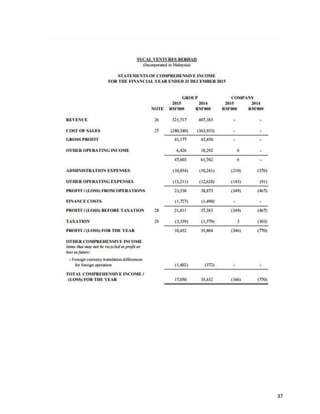

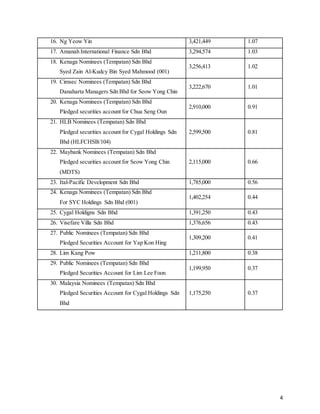

3.0 ANALYSIS OF THE REVENUE CONTRIBUTIONS OF DIFFERENT SEGMENTS

Figure 1.1 showing each segments of revenue of the company in 2014 and 2015.

Table 1.1: Revenue contribution of different segments in 2014 & 2015.

*(Retrieved from Annual Report 2015)

REVENUE

GROUP VARIANCE

2015 2014

RM'000 RM'000 RM'000 %

Revenue comprises:

Contract revenue 248,351 291,859 (43,508) (15%)

Consultation and project management

fee 7,311 1,200 6,111 509%

Property development revenue 1,458 51,715 (50,257) (97%)

Joint venture development revenue 3,182 - 3,182 100%

Sales of goods and services 61,415 62,609 (1,194) (2%)

TOTAL 321,717 407,383 -85,666 (21%)

RM](https://image.slidesharecdn.com/fm-final-assignment-completed-161205140451/85/Financial-Analysis-Report-for-Sycal-Ventures-Berhad-11-320.jpg)