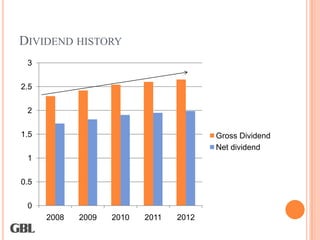

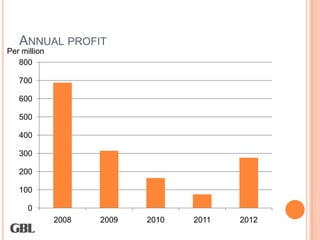

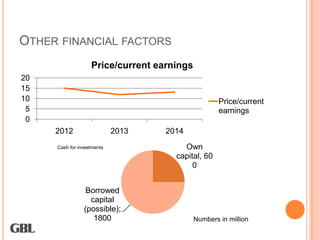

This financial report analyzes Belgian holding company GBL. It discusses GBL's stock price evolution, dividend history showing steady increases, and annual profit trending upward since 2008. The report concludes GBL is a good investment due to its constant dividend growth, revitalized profits, ample cash for new investments, and positive price-to-earnings ratio.