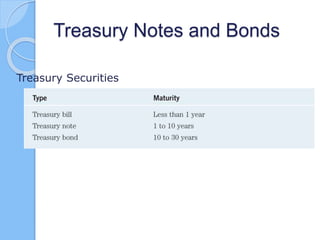

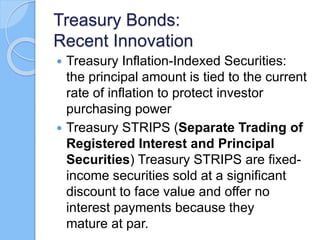

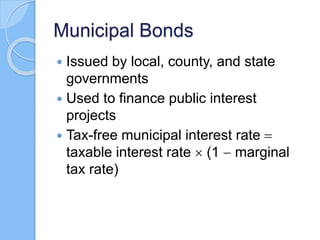

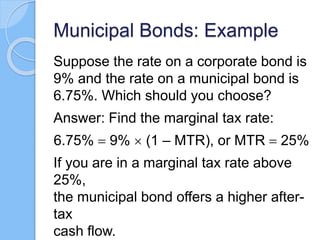

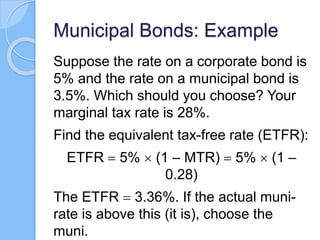

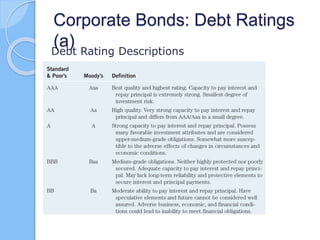

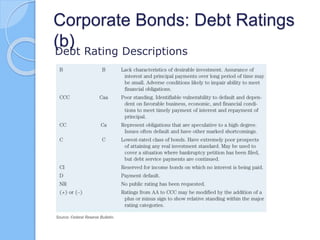

The document provides an overview of the bond market, explaining bonds as debt securities and detailing various types, including government, municipal, and corporate bonds. It highlights attributes such as interest rates, tax implications for municipal bonds, and investment risks associated with different bond types. Additionally, it discusses the pricing of bonds and the concept of financial guarantees to mitigate risk.