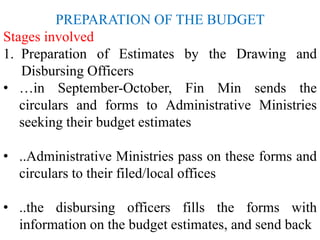

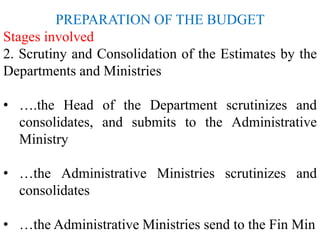

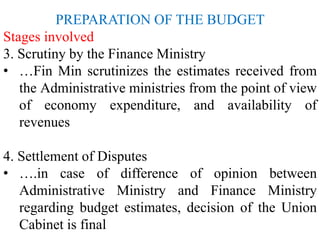

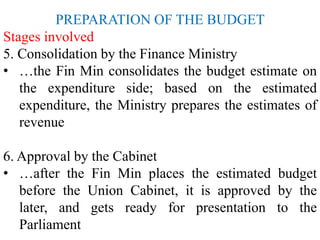

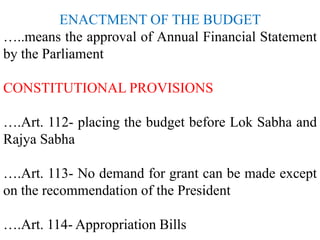

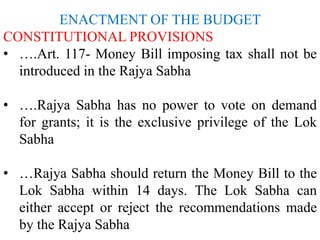

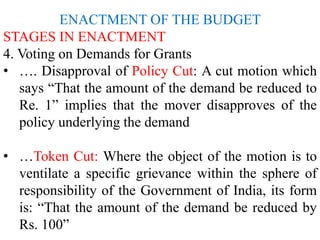

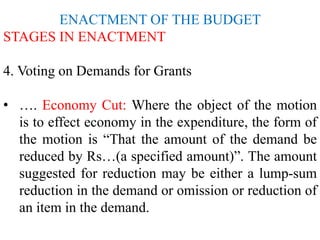

The document discusses the budget process in India, which involves 4 stages: preparation, enactment, execution, and parliamentary control. It outlines the key agencies and stages involved in the preparation of the budget, including the formulation of estimates by various ministries and departments. It then explains the constitutional provisions and stages for enactment, including presentation to Parliament, general discussion, scrutiny by committees, and voting on demands for grants. Finally, it discusses how the budget is executed once passed, through allocation of funds to ministries and departments for approved projects and auditing of accounts.