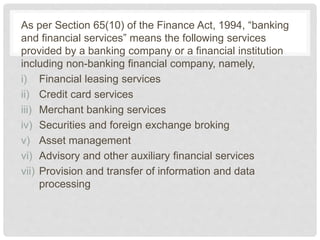

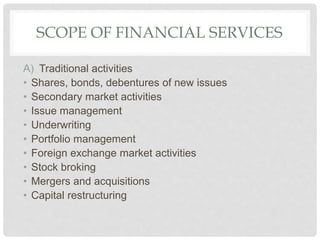

This document provides an introduction to finance and financial services. It discusses that finance is concerned with resource allocation and management. It notes some key features of finance including investment and profitability opportunities. It also outlines several sub-categories and functions of finance. The document then describes various financial services such as those provided by banks, investment banks, and insurance companies. It discusses the scope and features of financial services and management. Finally, it outlines some objectives and activities of financial managers.