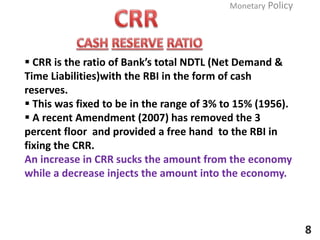

This document discusses monetary policy in India. It defines monetary policy as the central government's policy with respect to the quantity of money in the economy, interest rates, and exchange rates, as executed by the Reserve Bank of India. The objectives of monetary policy are maintaining price stability, ensuring adequate credit flows to support growth, rapid economic growth, full employment, and equal income distribution. The methods used to achieve these objectives include both qualitative methods like directing lending to priority sectors, and quantitative methods like required reserve ratios, statutory liquidity ratios, and repo and reverse repo rates which the central bank uses to control money flows.