The document presents a budget variance report for Peyton Approved, analyzing variances between actual results and budgeted figures for direct materials and labor. Key findings include favorable variances in direct materials efficiency and cost/price but unfavorable labor efficiency variance attributed to potential poor training. Recommendations for improvement include enhancing employee training and seeking quality raw material suppliers at lower costs.

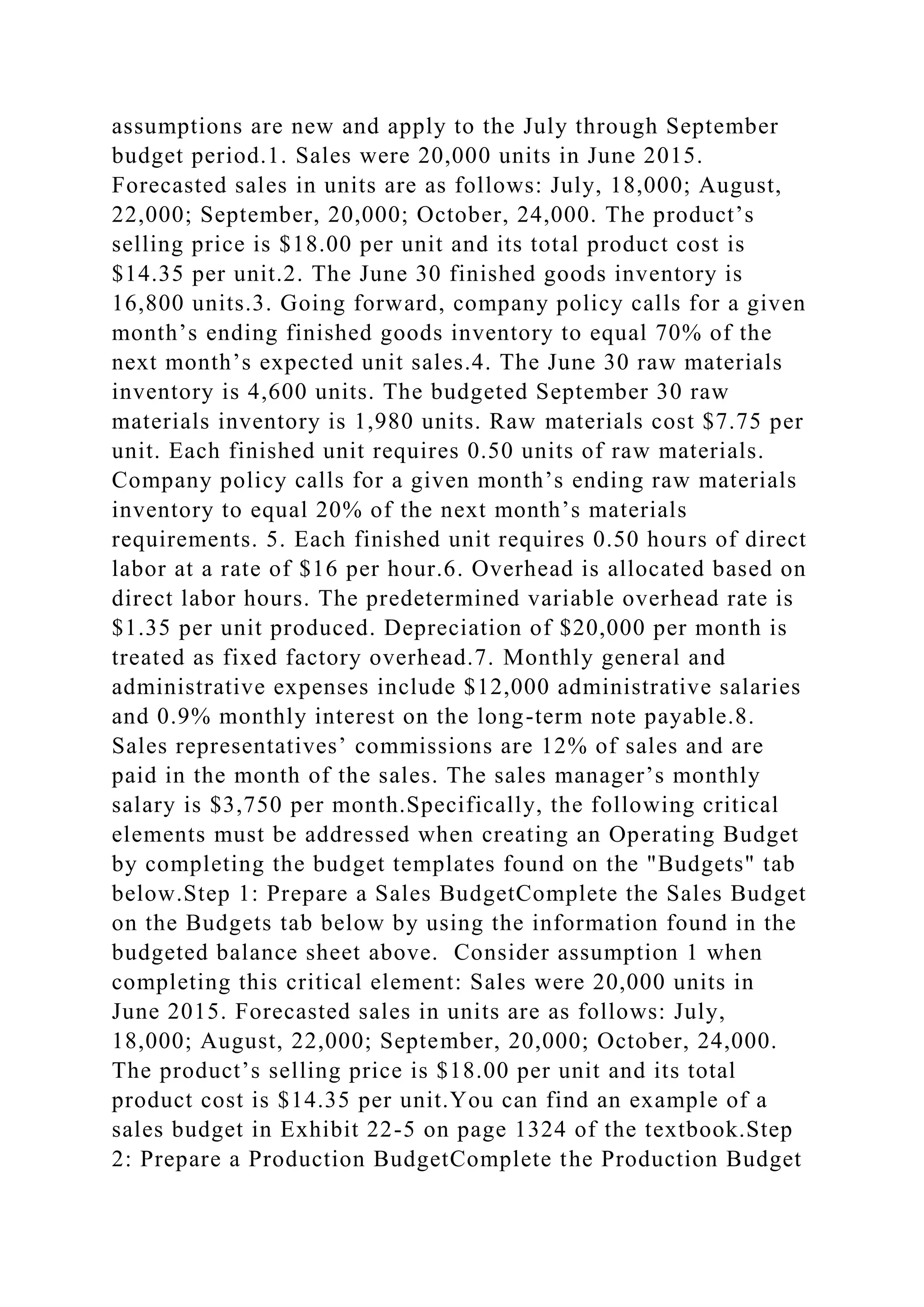

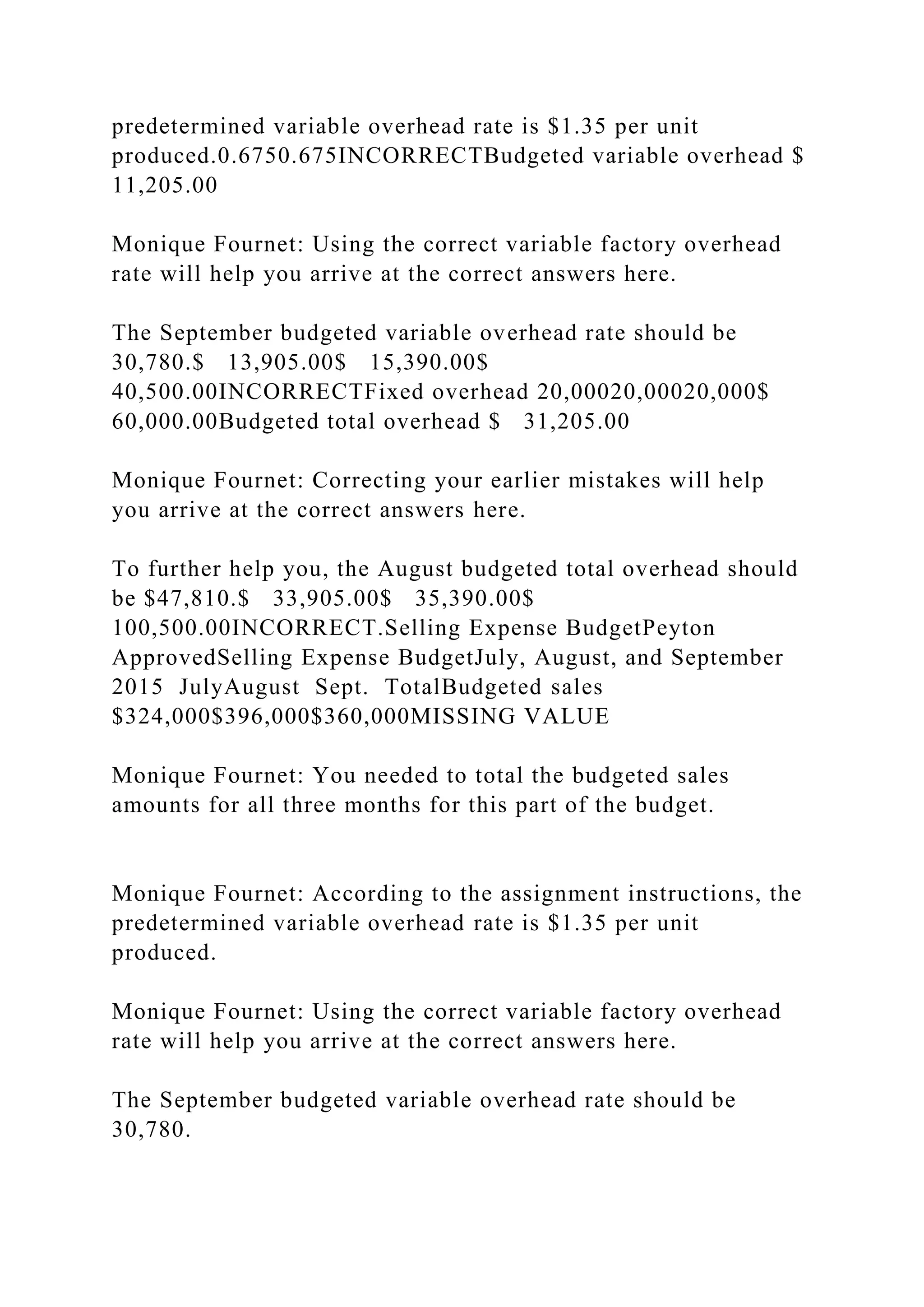

![Cost /price variance

4,95,000

5,28,000

33,000

Favorable

Efficiency variance

5,28,000

4,80,000

(48,000)

Unfavorable

Total direct labor variance

10,23,000

10,08,000

(15,000)

Unfavorable

[Please refer to my comments in your budget variance

worksheet to help you ensure that the figures in this table are

correct.]

The main reasons for the above variances are as under follows:

Material Variances:

· Cost/Price Variance: AThe variance is zero. This means there

has been no change in (the) per unit cost of material.

· Efficiency Variance: A favorable efficiency variance provides

for indicates better good management of the materials and usage

of high quality material (missing period)

Labor Variance:

· Cost/ Price Variance: The favorable variance was mainly

because of (a/the) fall in the labour rate.

· Efficiency Variance:Though Although the labor rate has

reduced was lower than what was budgeted, but the efficiency

of the labor is was reduced as (is) evident from (the)

unfavorable (efficiency) variance. One of the reason(s) for same](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-3-2048.jpg)

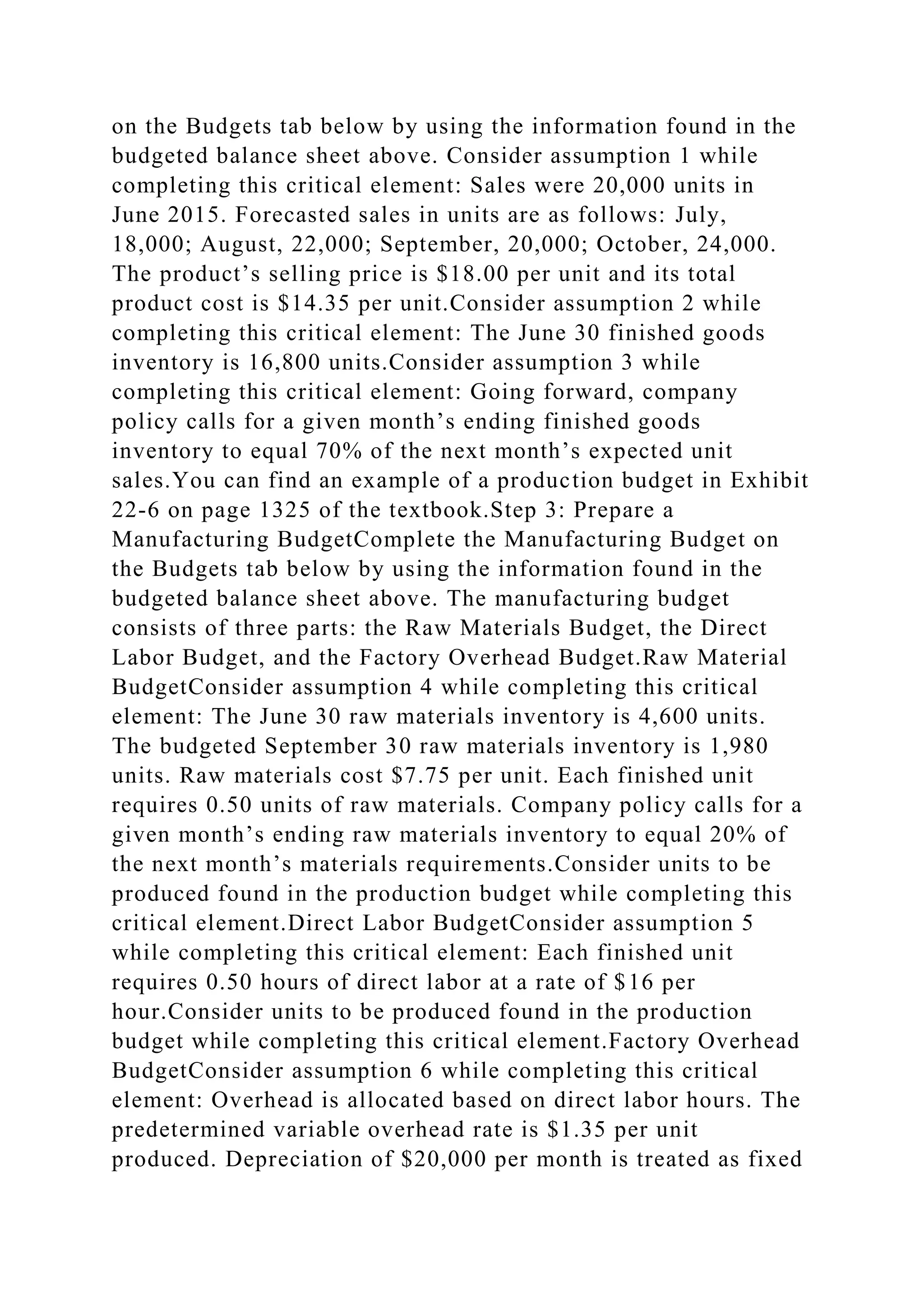

![this could be poor training to of employees.

Changes Required:

On the basis of above (missing comma) the company should try

to improve the labor efficiency by providing them employees

with proper training. Also, the company should find suppliers of

raw materials providing that provide quality material(s) at (a)

lower price (missing comma) or (they should) try to purchase

(materials) in bulk so as to avail take adavantage of discounts.

Conclusion.

Actually, budget operation (construction?) and variance analysis

is are one some of the best accounting techniques in that enable

the business to analyse its pending [This word choice is a little

awkward and confusing.] resources and make changes where

applicable.Peyton Approved should (make) adjust(ments) on to

(its) labor (training?) and suppliers of raw materials so as it (the

company?) works effectively.

This is a good start. However, for this assignment, you need to

use your words (in sentence/paragraph format) to describe the

variances you found. You need to do this in order to

demonstrate to me your understanding of the course concepts.

Thus, you should describe how you calculated the variances and

what the variances tell you about the company’s operations.

You also need to provide more detail on the potential causes for

the variances you found and what should be investigated by the

company in order to determine the specific causes of the

variances (i.e., what parts of the company’s operations should

management examine).

You need to provide more detail on why the potential causes

you identified could be responsible for the variances you

observed (i.e., why do you think that training is the reason for](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-4-2048.jpg)

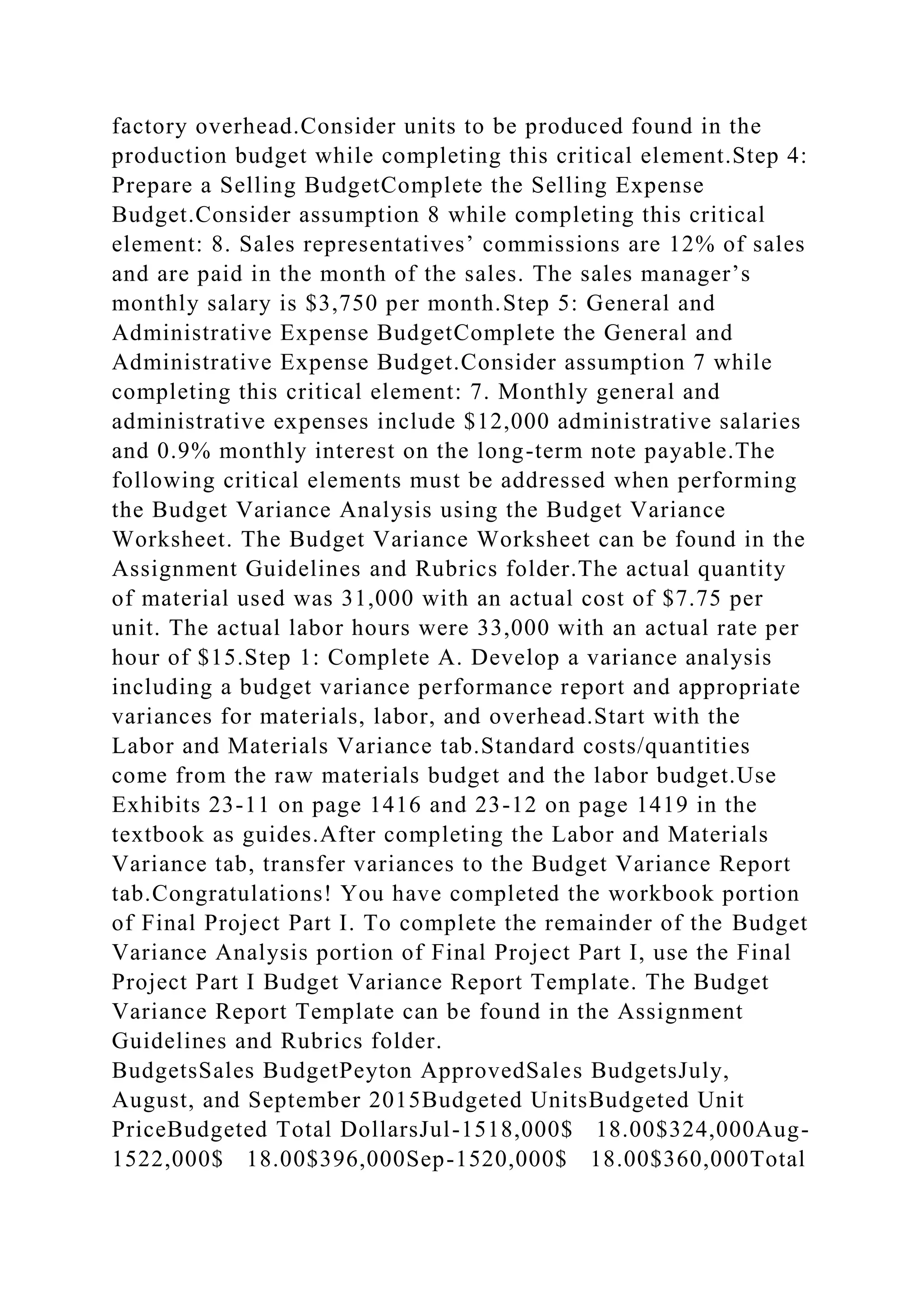

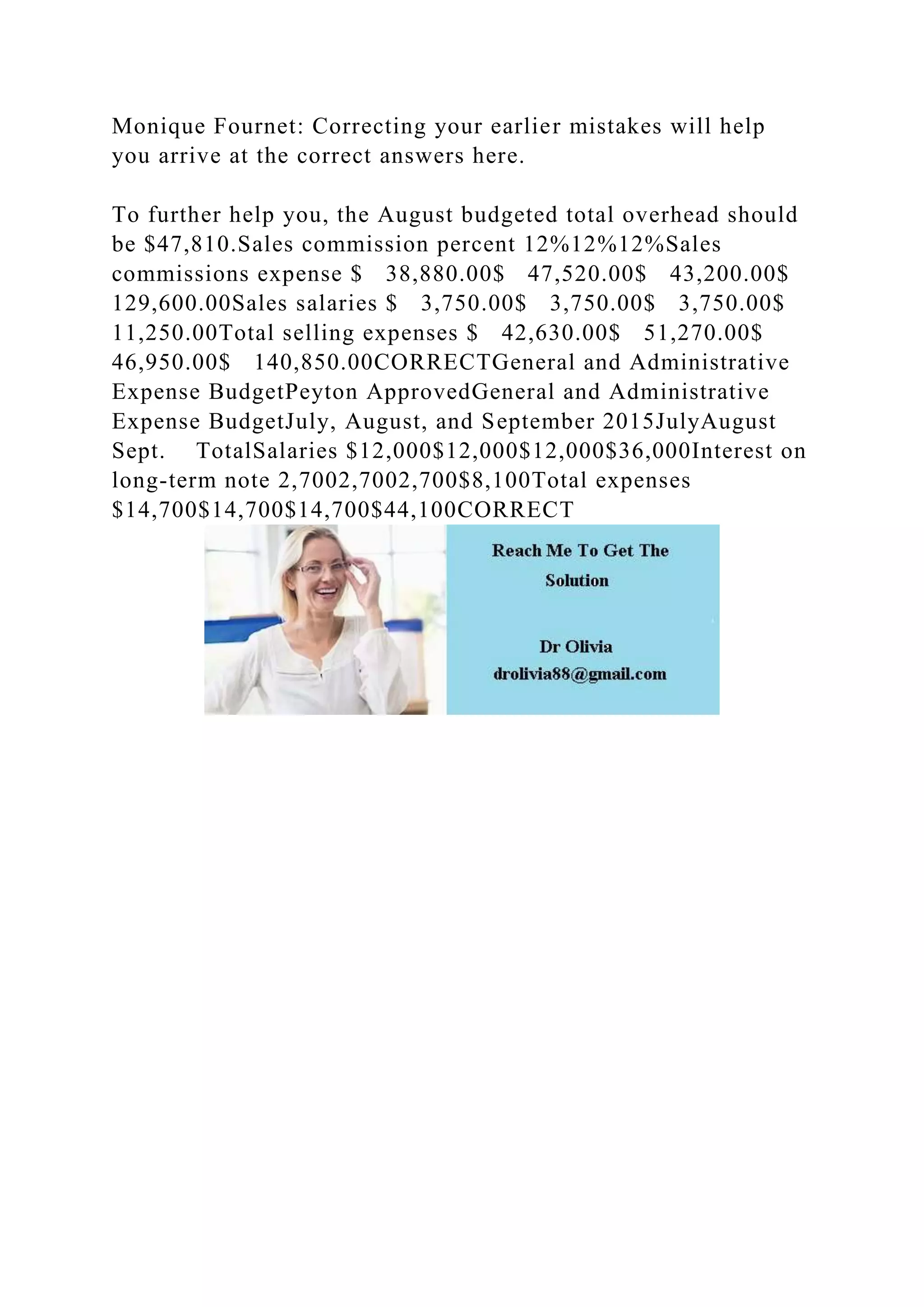

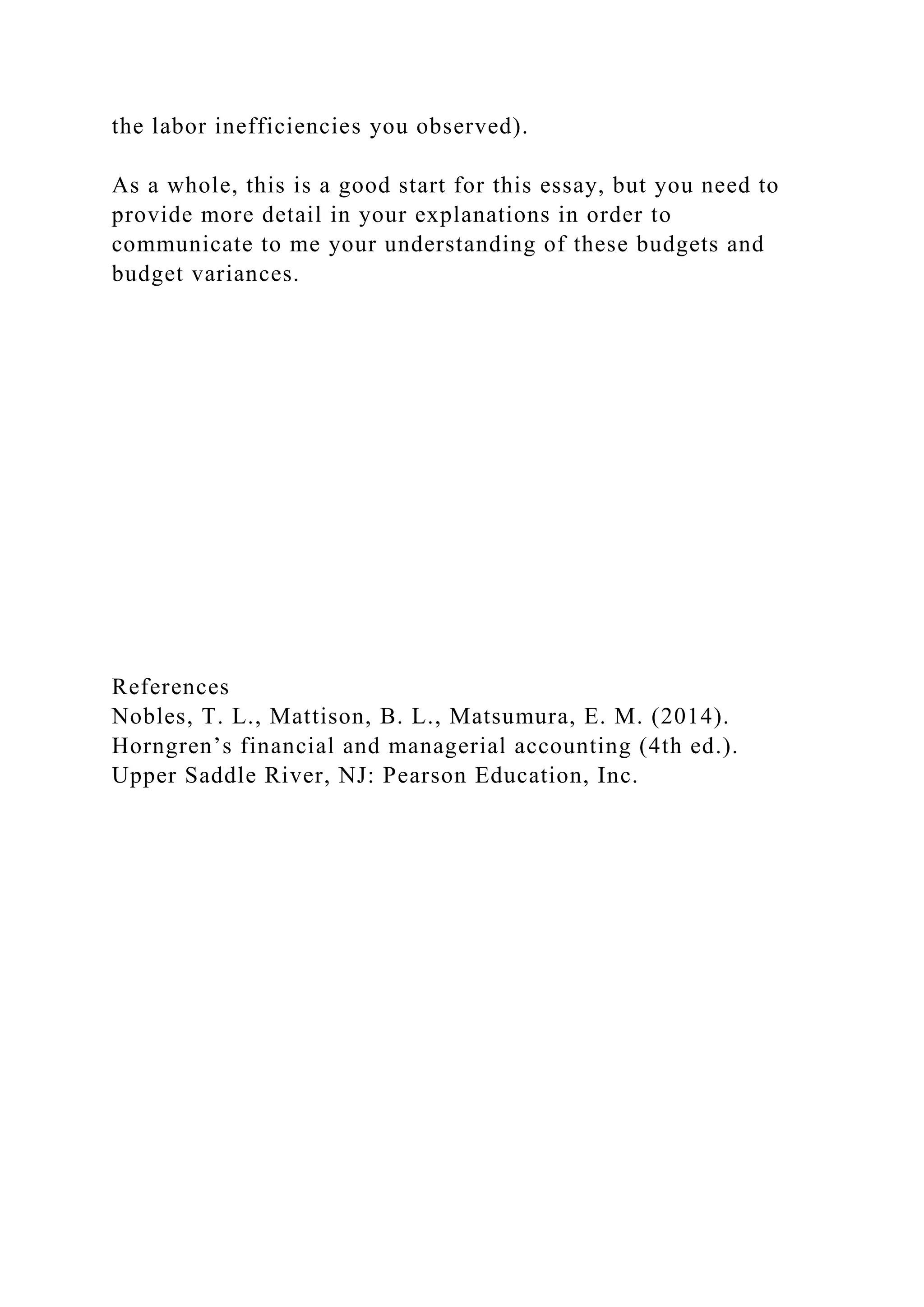

![Budget Variance ReportPeyton ApprovedBudget Variance

ReportFor the Year Ended …Actual ResultsStatic

BudgetVarianceFavorable/ UnfavorableDirect materials

variances Cost/price variance240,250240,250Missing Value

Monique Fournet: You should report your cost/price variance

[(AC x AQ) - (AQ x SC)] here. Missing Value

Monique Fournet: Here, you should indicate whether the

cost/price variance is favorable (0 and above) or unfavorable

(below 0).Incorrect Efficiency variance240,250281,480

Monique Fournet: These cells should be blank.41,230

Monique Fournet: Your efficiency variance [(AQ x SC) - (SC x

SQ)] belongs here.Favorable

Monique Fournet: Correcting your variances will help you

arrive at the correct answers here.Incorrect Total direct

materials variance480,500

Monique Fournet: This is where your 240,250 figure

belongs.521,730

Monique Fournet: Here is where you should report the total

direct materials variance for your static budget (SC x

SQ).41,230](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-6-2048.jpg)

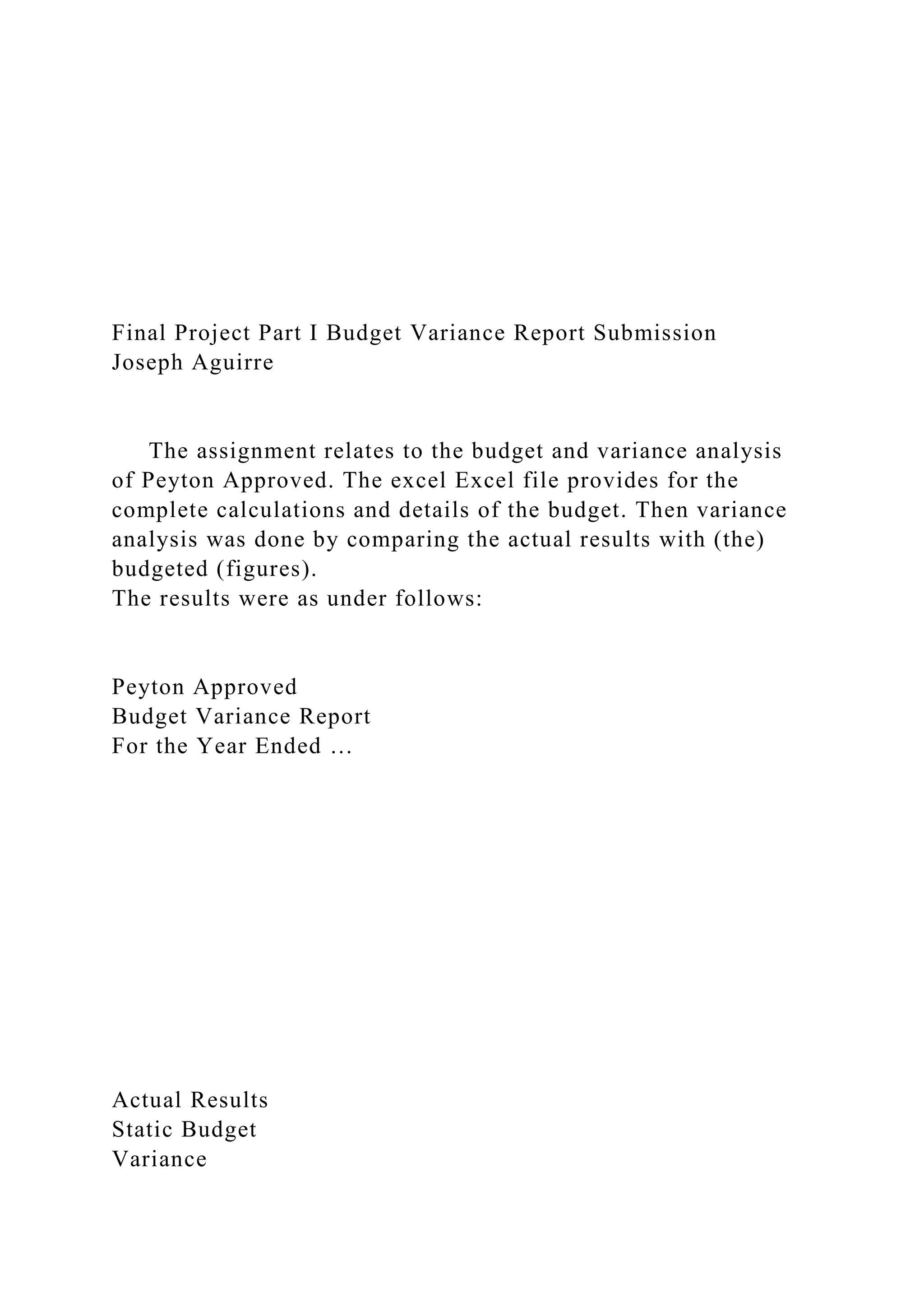

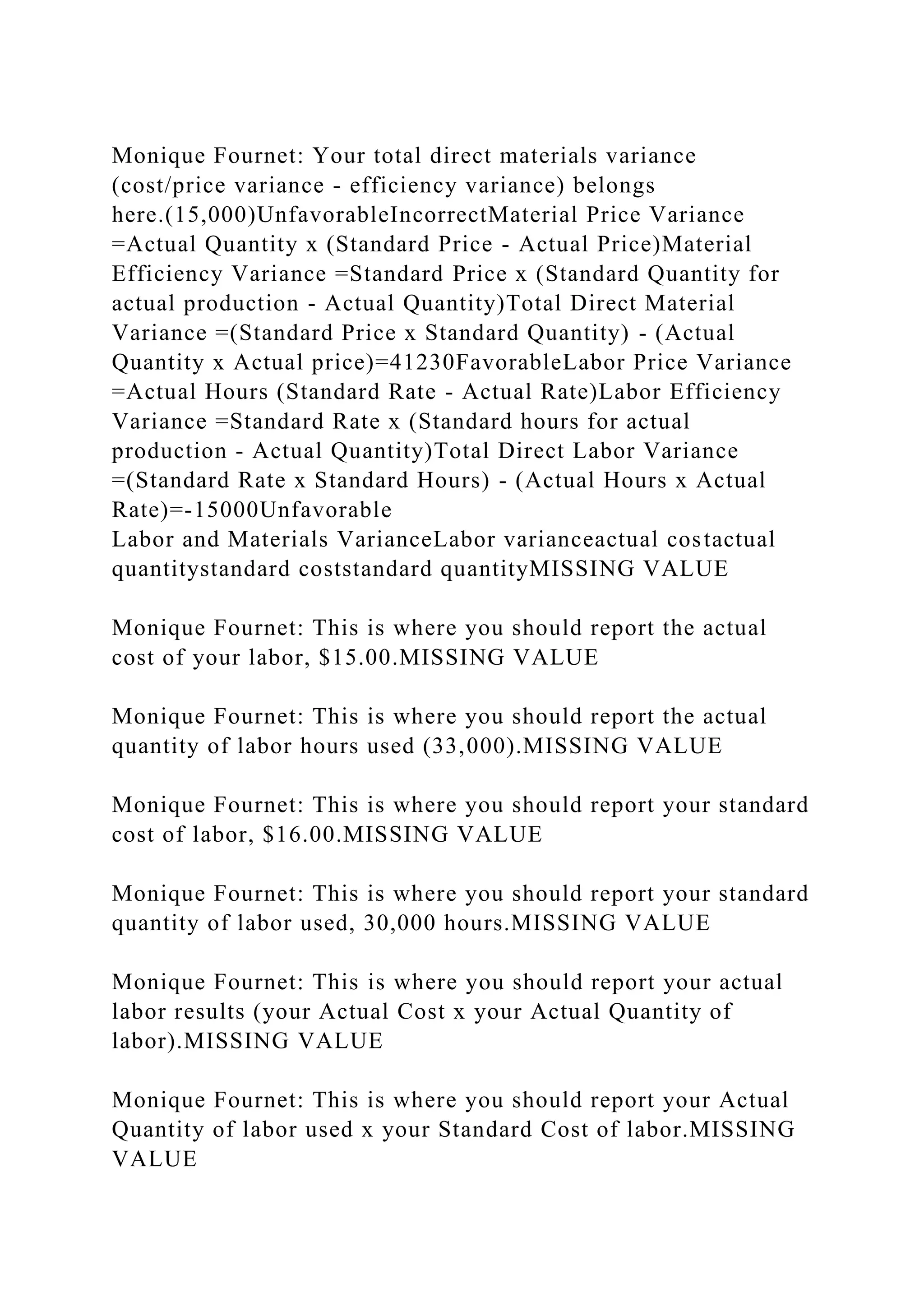

![Monique Fournet: Your total direct materials variance

(cost/price variance - efficiency variance) belongs

here.FavorableIncorrectDirect labor variances Cost /price

variance495,000528,00033,000FavorableIncorrect Efficiency

variance528,000480,000

Monique Fournet: These should be

blank.(48,000)UnfavorableIncorrect Total direct labor

variance1,023,000

Monique Fournet: You should report your 495,000 figure

here.1,008,000

Monique Fournet: This is where you should report your static

budget direct labor variance (SC x SQ).

Monique Fournet: You should report your cost/price variance

[(AC x AQ) - (AQ x SC)] here.

Monique Fournet: These cells should be blank.

Monique Fournet: This is where your 240,250 figure belongs.

Monique Fournet: Here, you should indicate whether the

cost/price variance is favorable (0 and above) or unfavorable

(below 0).

Monique Fournet: Your efficiency variance [(AQ x SC) - (SC x

SQ)] belongs here.

Monique Fournet: Here is where you should report the total

direct materials variance for your static budget (SC x SQ).

Monique Fournet: Correcting your variances will help you

arrive at the correct answers here.](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-7-2048.jpg)

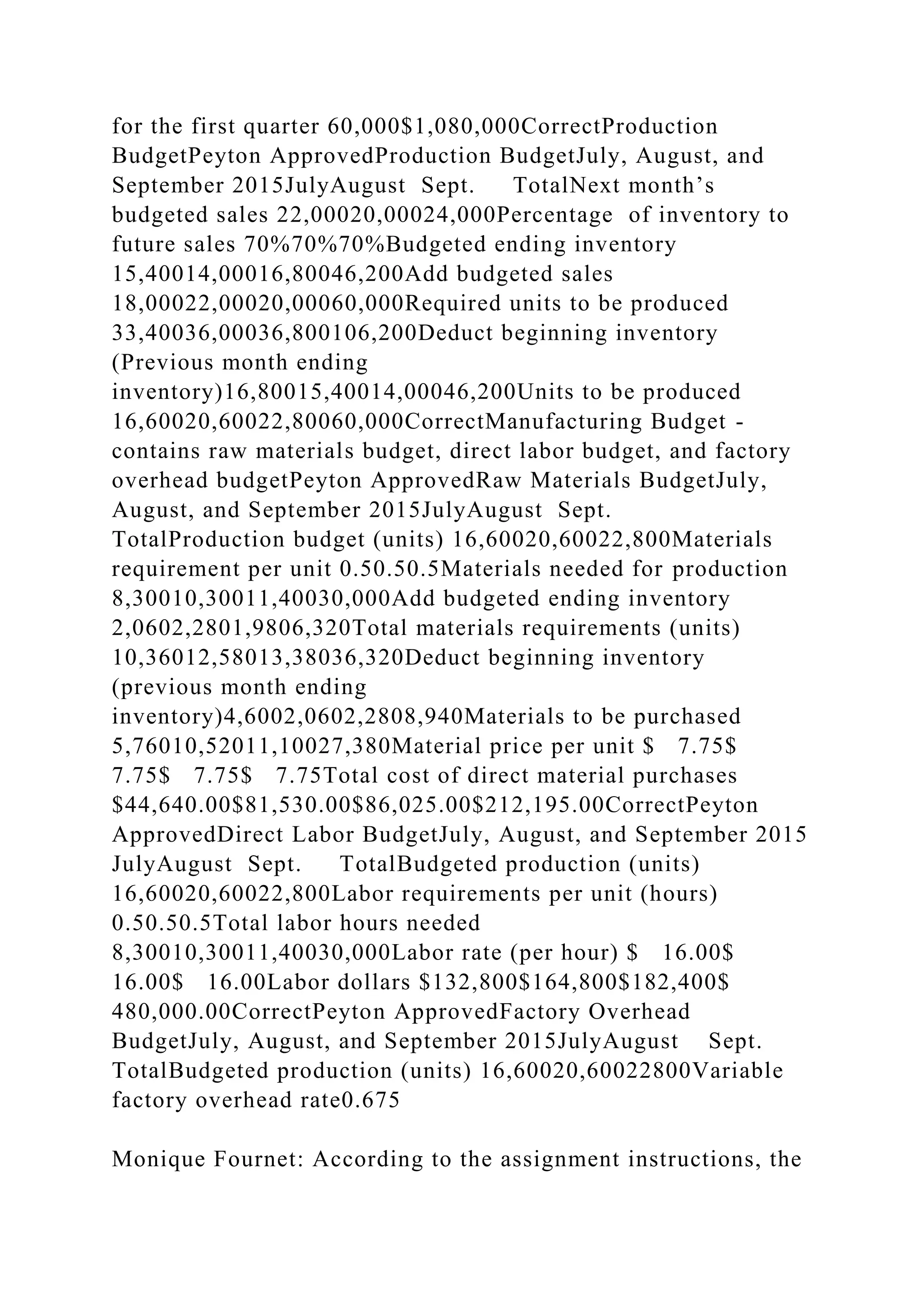

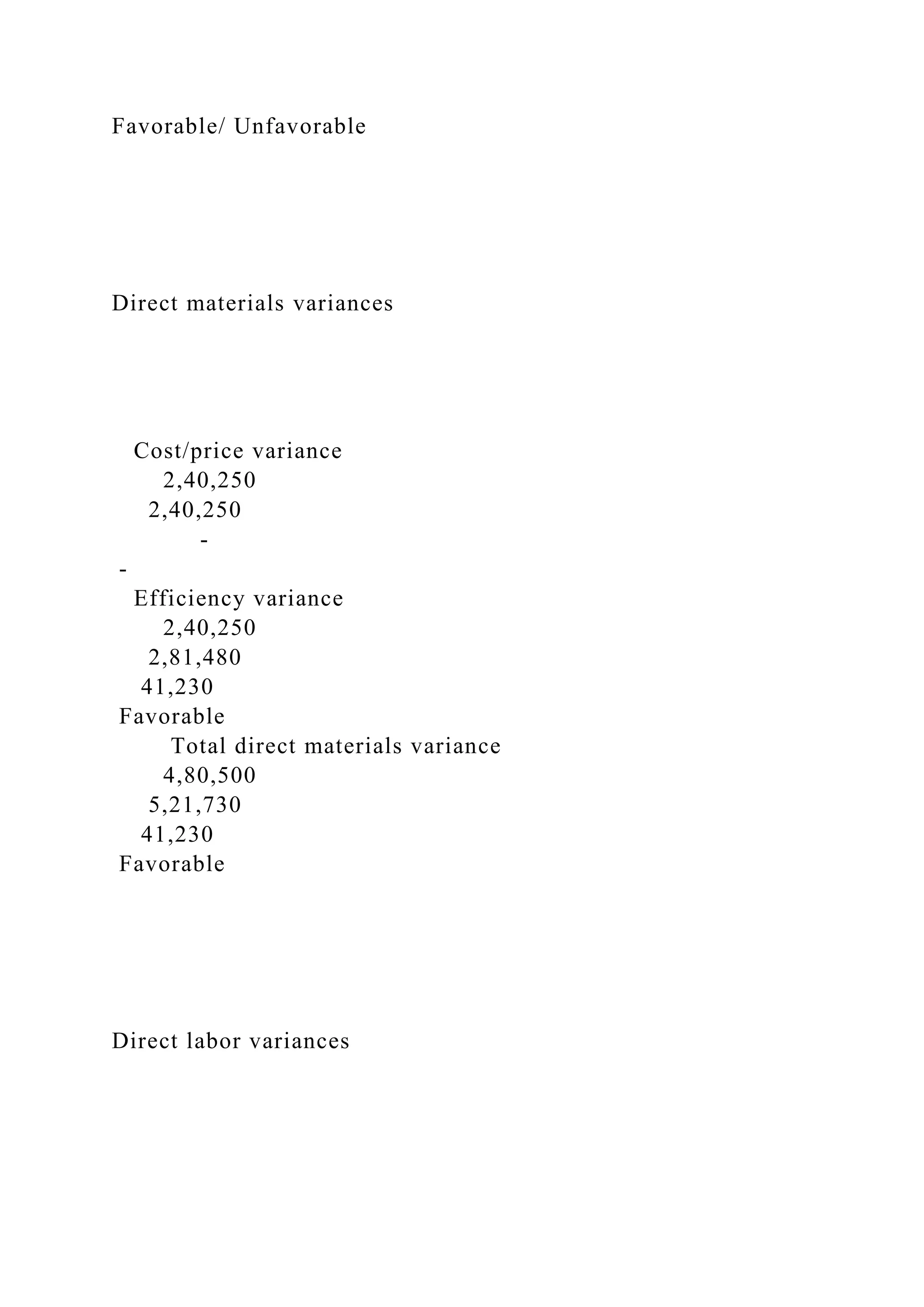

![Monique Fournet: This is where you should report your

budgeted (standard) labor cost x your budgeted (standard) labor

quantity.15

Monique Fournet: This belongs under "actual cost."

Monique Fournet: This is where you should report your standard

cost of labor, $16.00.

Monique Fournet: This is where you should report your Actual

Quantity of labor used x your Standard Cost of labor.33,00016

Monique Fournet: Here, you need to report the efficiency

variance for your direct labor. You calculate this by:

[(Standard Cost x Standard Quantity) - (Actual Quantity x

Standard Cost)]30,000

Monique Fournet: This figure belongs under "standard

quantity."MISSING VALUE

Monique Fournet: You need to indicate whether the variance

you found was favorable (0 and above) or unfavorable.

Monique Fournet: This is where you should report your standard

quantity of labor used, 30,000 hours.

Monique Fournet: This is where you should report your

budgeted (standard) labor cost x your budgeted (standard) labor

quantity.

Monique Fournet: Here, you need to report the efficiency

variance for your direct labor. You calculate this by:

[(Standard Cost x Standard Quantity) - (Actual Quantity x](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-9-2048.jpg)

![Standard Cost)]MISSING VALUE

Monique Fournet: Again, you need to indicate whether the

variance you found is favorable or unfavorable.

Monique Fournet: This figure belongs under "standard

quantity."MISSING VALUE

Monique Fournet: You need to report your total direct labor

variance here. Materials varianceactual costactual

quantitystandard coststandard quantityMISSING VALUE

Monique Fournet: You should report your actual cost for your

direct materials, $7.75, here. MISSING VALUE

Monique Fournet: Here, you should report your actual quantity

of materials used, 31,000. MISSING VALUE

Monique Fournet: You need to report the standard (budgeted)

cost of the direct materials, $7.75, here.7.75

Monique Fournet: This belongs under "actual cost."

Monique Fournet: Here, you should report your actual quantity

of materials used, 31,000. MISSING VALUE

Monique Fournet: Here, you should report your Actual Cost of

your materials x your Actual Quantity of materials used.31,000

Monique Fournet: This belongs under "actual quantity."

Monique Fournet: You need to report the standard (budgeted)

cost of the direct materials, $7.75, here. MISSING VALUE

Monique Fournet: Here, you need to report the Actual Quantity

of materials used x the Standard Cost of the materials.7.75](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-10-2048.jpg)

![Monique Fournet: This belongs under "standard cost."

MISSING VALUE

Monique Fournet: Here, you need to report the (Standard Cost x

Standard Quantity) figure.36,320

Monique Fournet: This should be under "standard quantity."

MISSING VALUE

Monique Fournet: Here, you should report your cost/price

variance, which is calculated by:

[(Actual Cost x Actual Quantity) - (Actual Quantity x Standard

Cost)]

Monique Fournet: This belongs under "standard cost."

MISSING VALUE

Monique Fournet: You should report your direct materials

efficiency variance here. This is calculated by:

[(Standard Cost x Standard Quantity) - [Actual Quantity x

Standard Cost] MISSING VALUE

Monique Fournet: You need to indicate whether the variance

you found is favorable (0 and above) or unfavorable.

Monique Fournet: Here is where you should report your

Standard Quantity for direct materials, 36,320.

Monique Fournet: Here, you need to report the (Standard Cost x

Standard Quantity) figure.

Monique Fournet: You should report your direct materials

efficiency variance here. This is calculated by:](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-11-2048.jpg)

![[(Standard Cost x Standard Quantity) - [Actual Quantity x

Standard Cost]

Monique Fournet: This should be under "standard quantity."

MISSING VALUE

Monique Fournet: You need to indicate whether the variance

you found is favorable or unfavorable. MISSING VALUE

Monique Fournet: You should report your total direct materials

variance here. This is calculated by:

[(Actual Cost x Actual Quantity) - (Standard Cost x Standard

Quantity)]

Sheet3

InstructionsYou are a manager for Peyton Approved, a pet

supplies manufacturer. This responsibility requires you to create

budgets, make pricing decisions, and analyze the results of

operations to determine if changes need to be made to make the

company more efficient.

You will be preparing a budget for the quarter July through

September 2015. You are provided the following information.

The budgeted balance sheet on June 30, 2015, is:Peyton

ApprovedBudgeted Balance Sheet30-Jun-15ASSETSCash

$42,000Accounts receivable259,900Raw materials

inventory35,650Finished goods inventory 241,080Total current

assets 578,630Equipment $720,000Less accumulated

depreciation 240,000480,000Total assets

$1,058,630LIABILITIES AND EQUITYAccounts

payable$63,400Short-term notes payable24,000Taxes payable

10,000Total current liabilities 97,400Long-term note payable

300,000 Total liabilities397,400Common stock

$600,000Retained earnings 61,230Total stockholders’

equity661,230Total liabilities and equity$1,058,630All](https://image.slidesharecdn.com/finalprojectpartibudgetvariancereportsubmission-221102052330-c4891118/75/Final-Project-Part-I-Budget-Variance-Report-Submission-docx-12-2048.jpg)