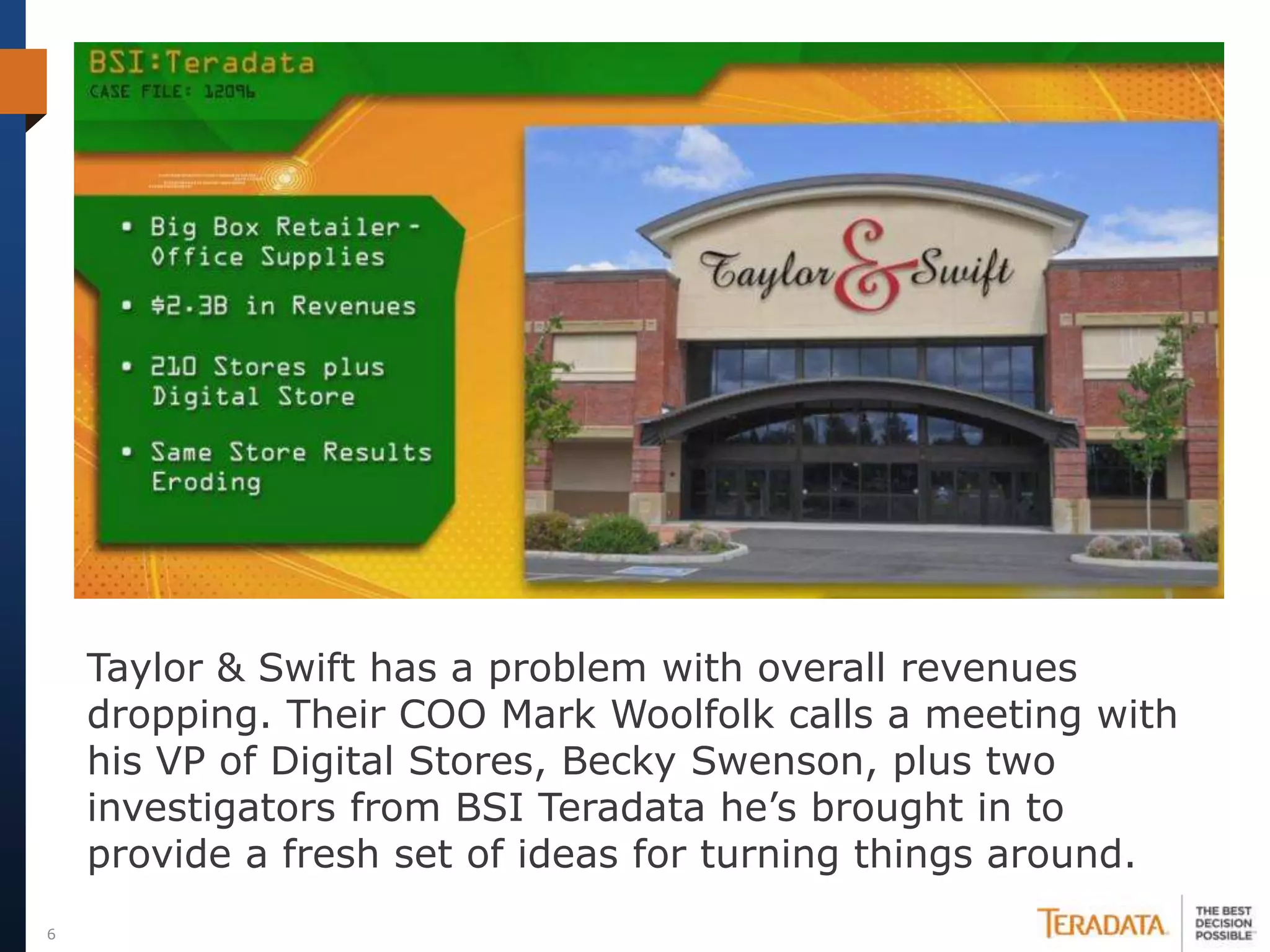

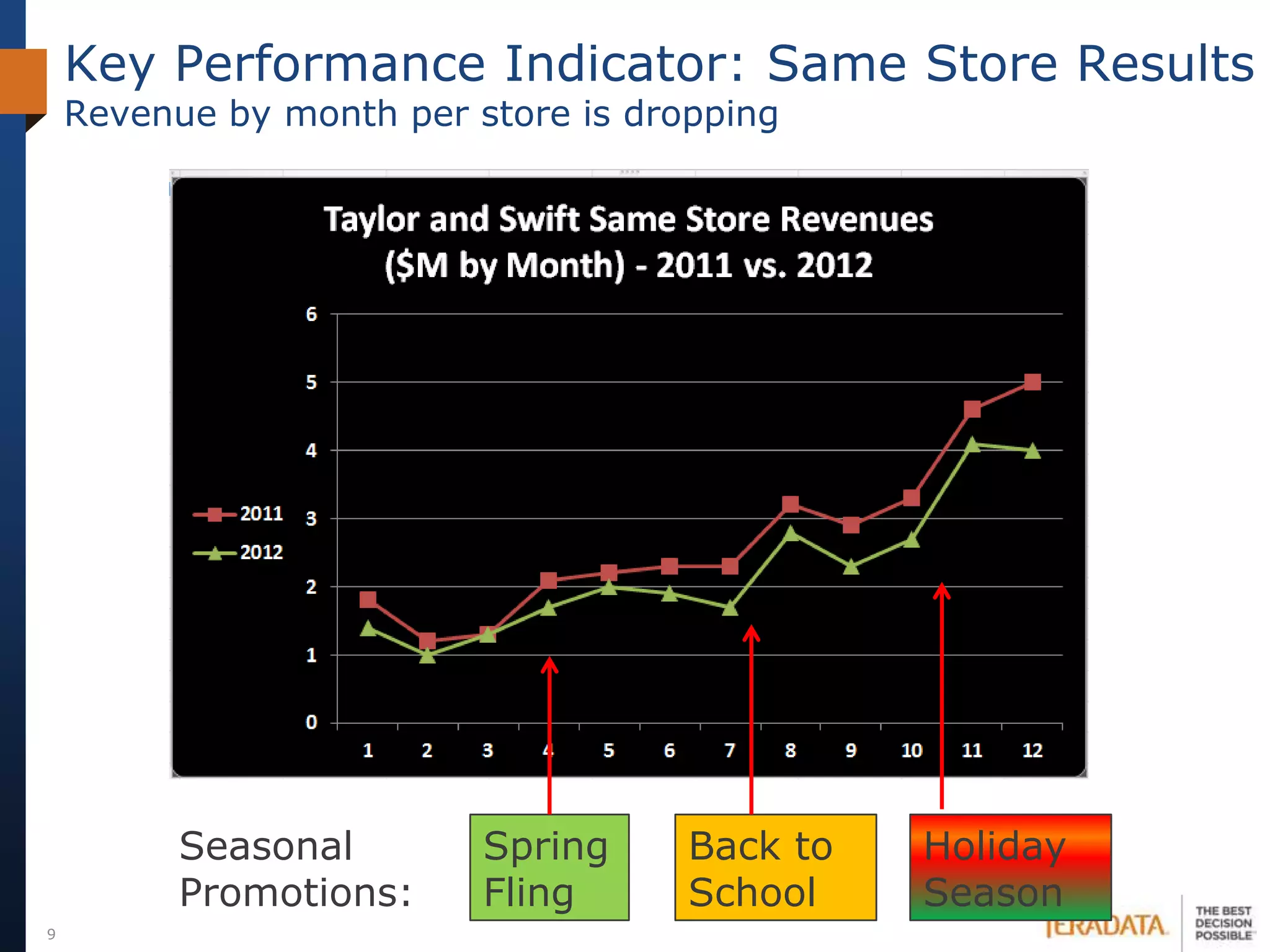

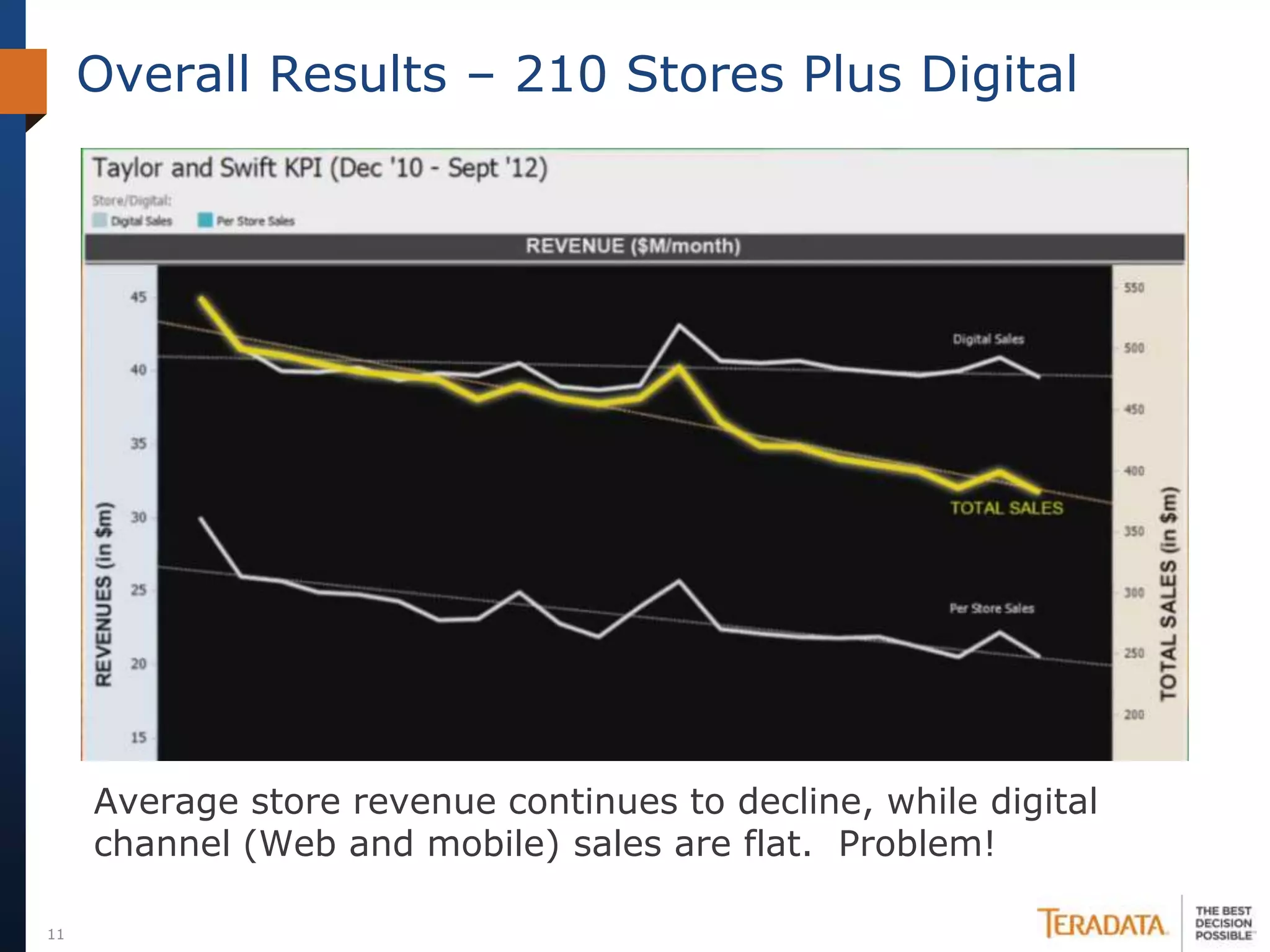

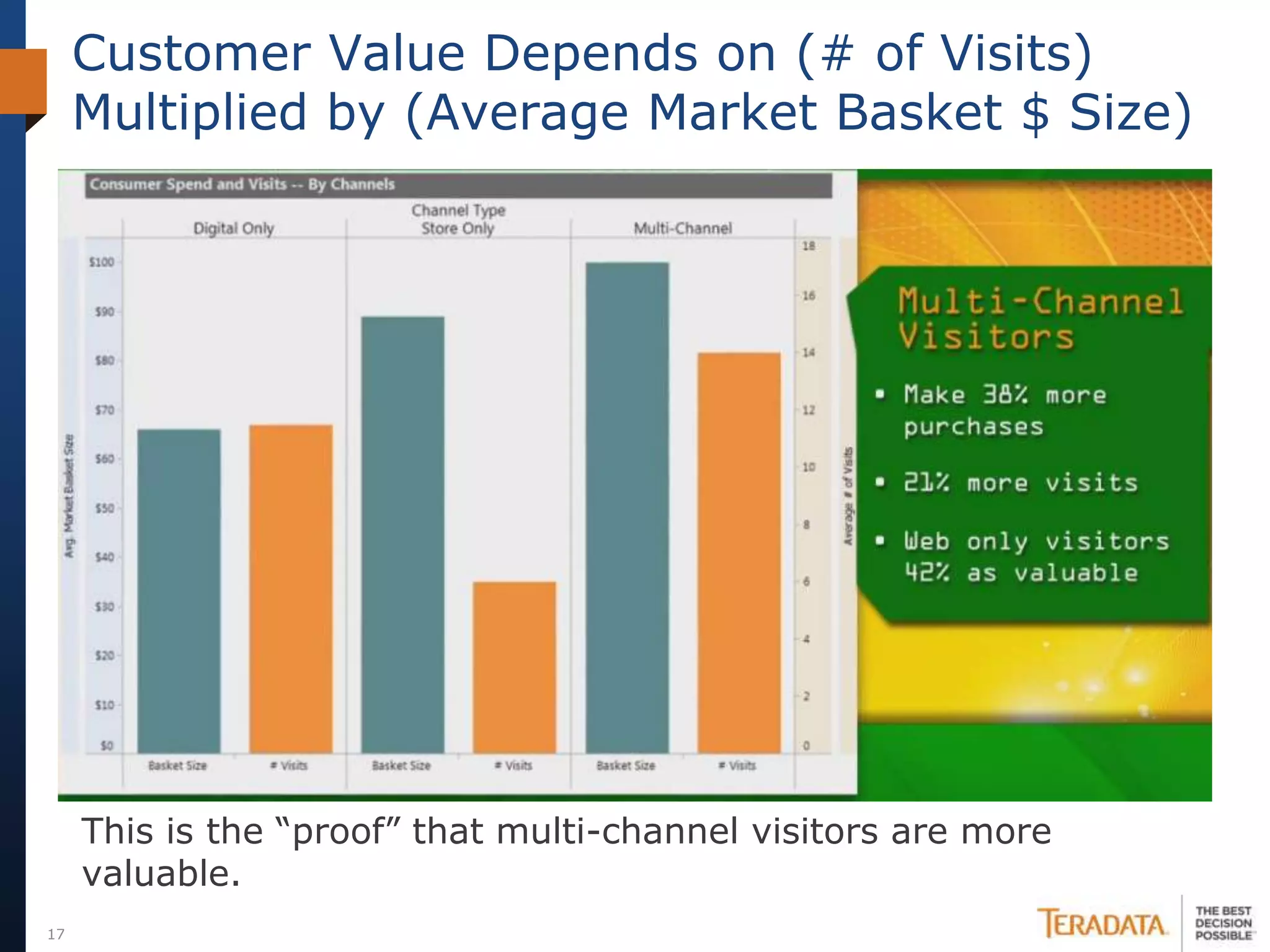

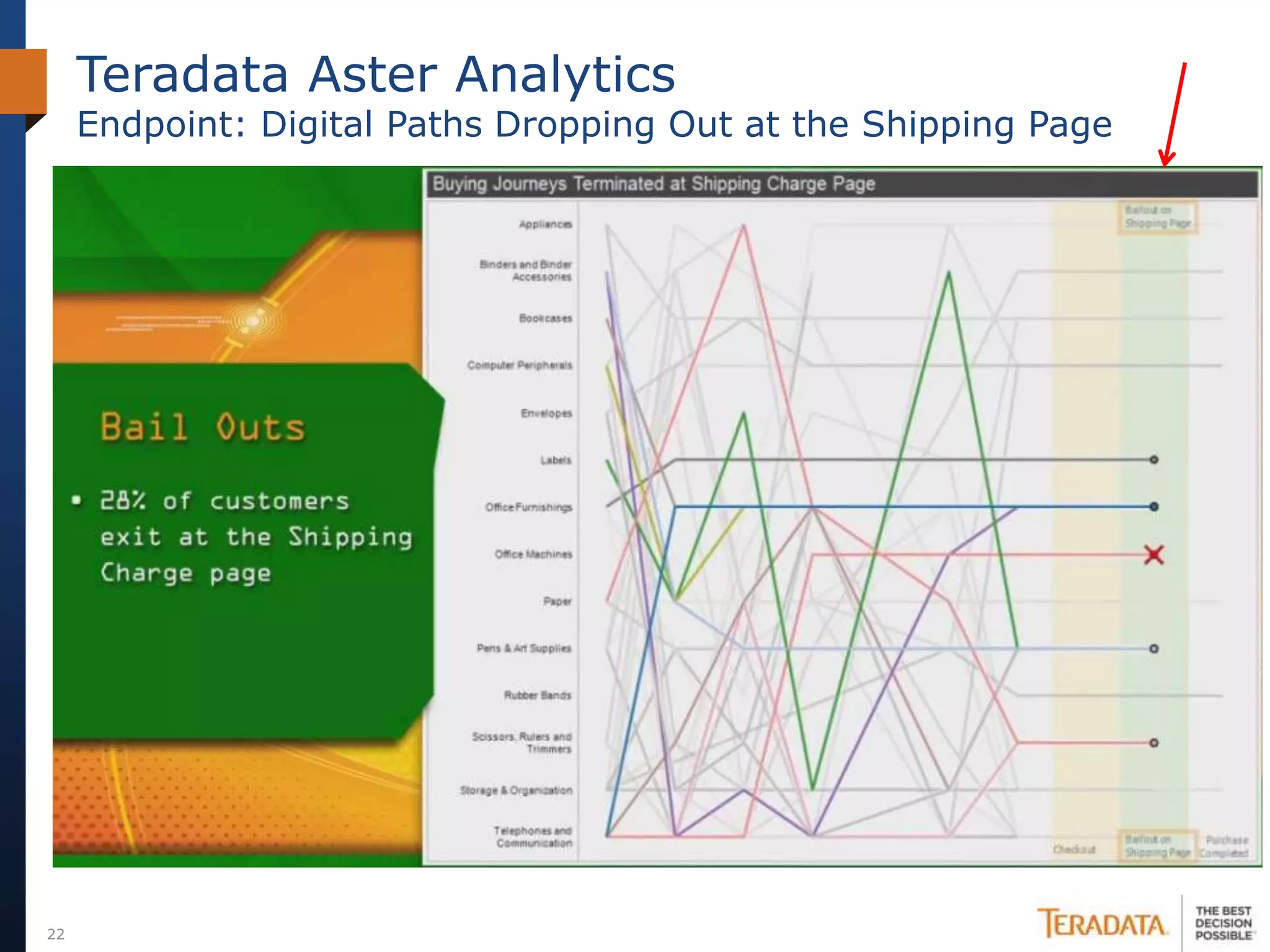

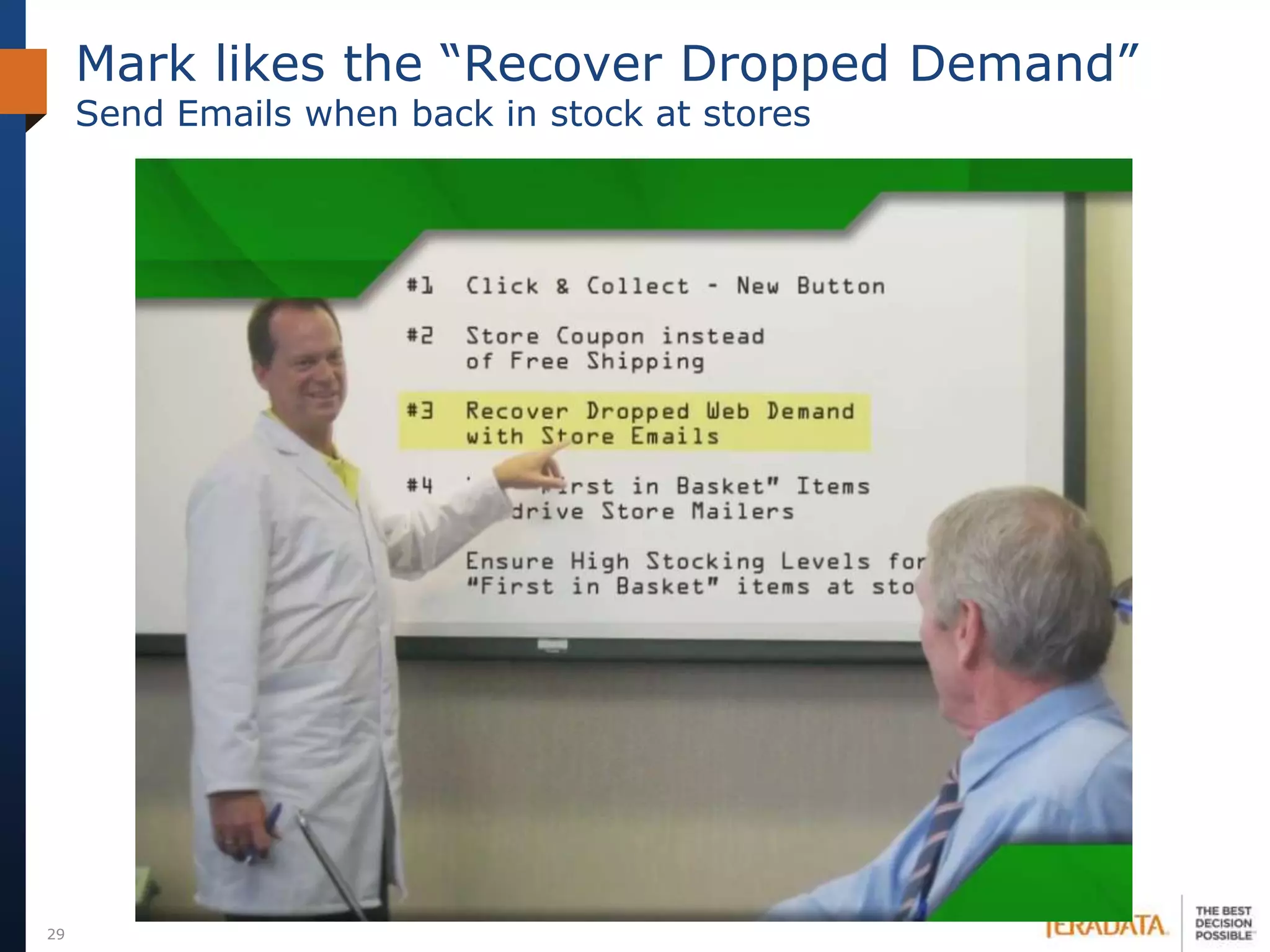

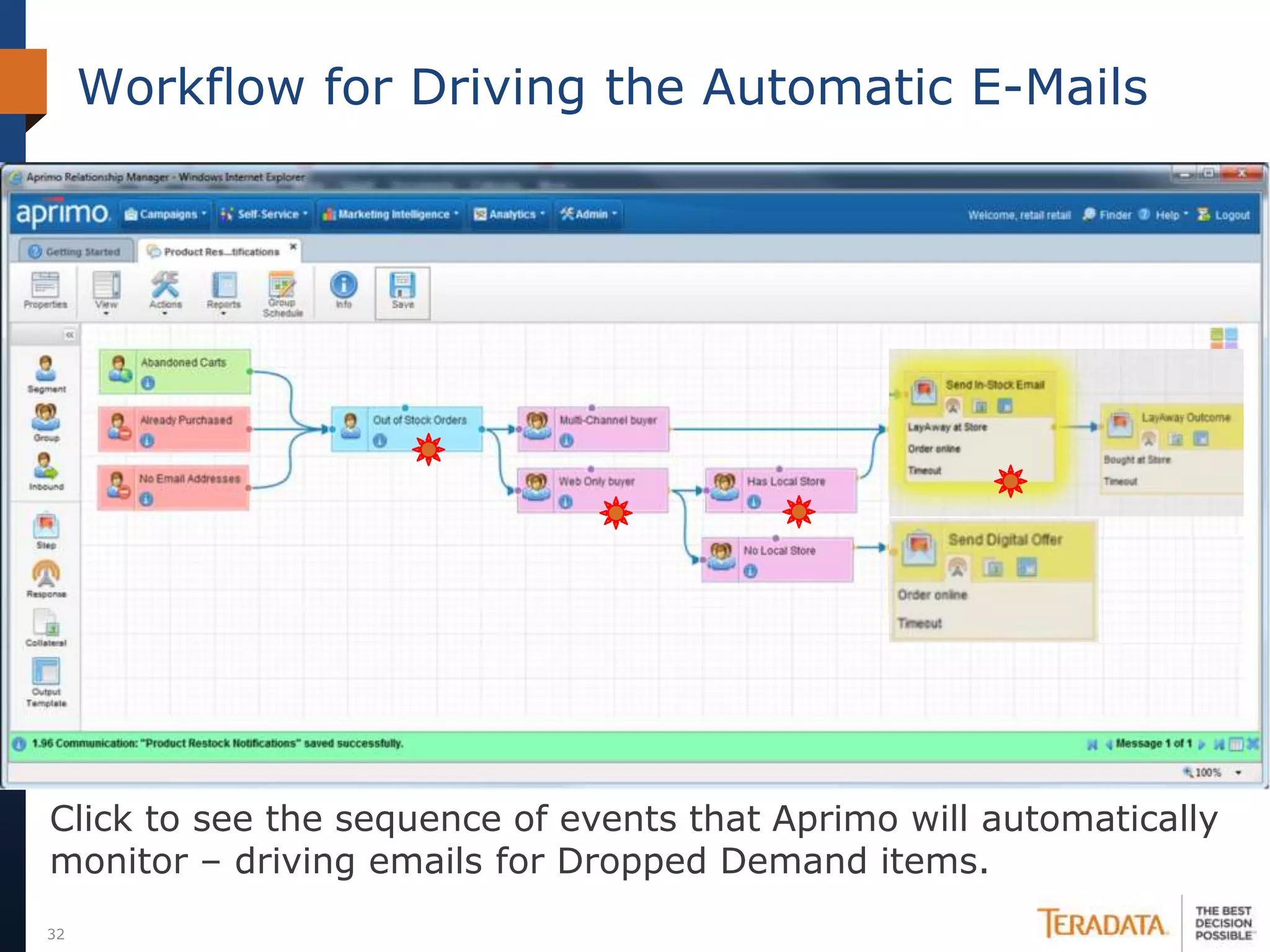

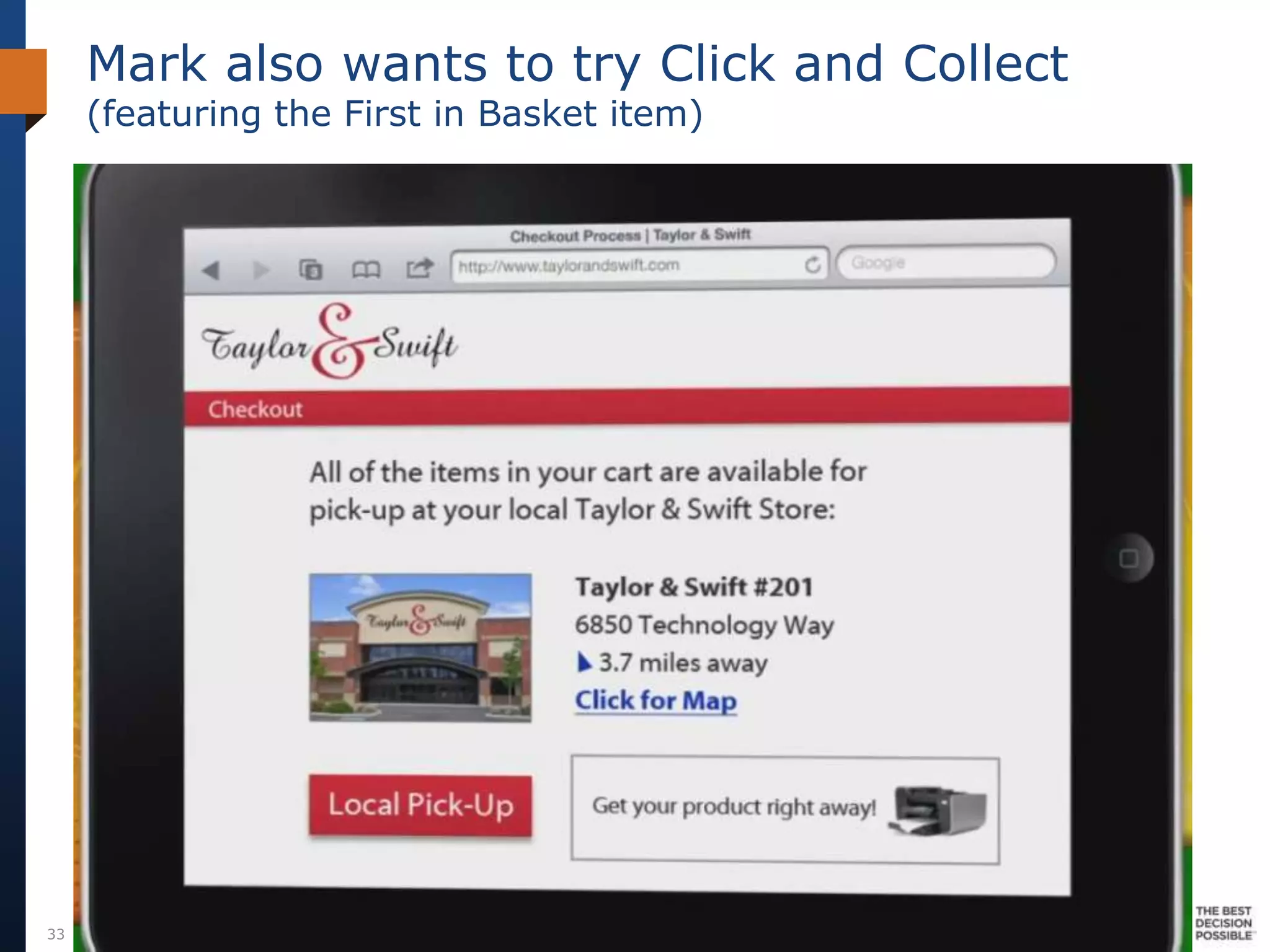

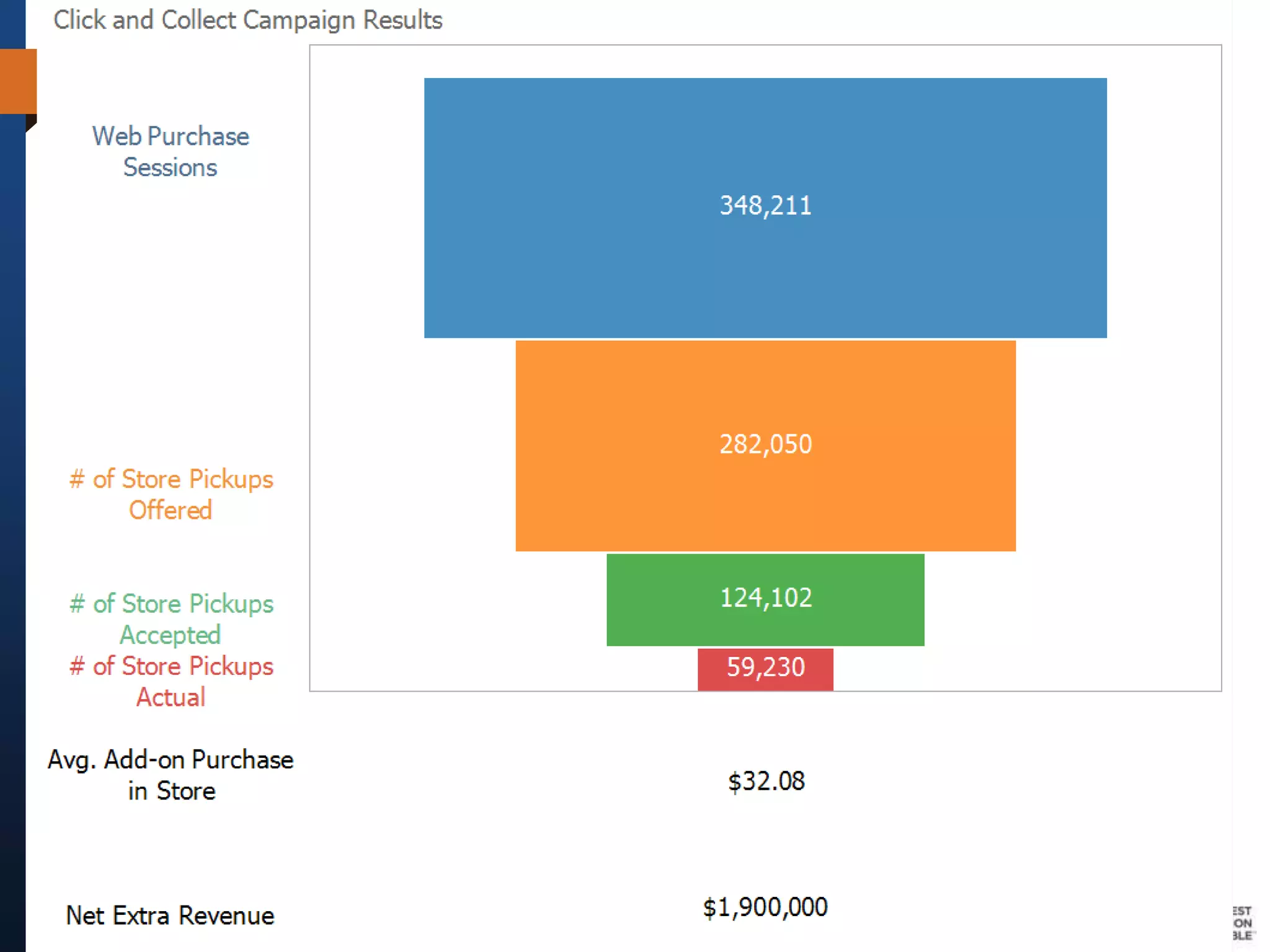

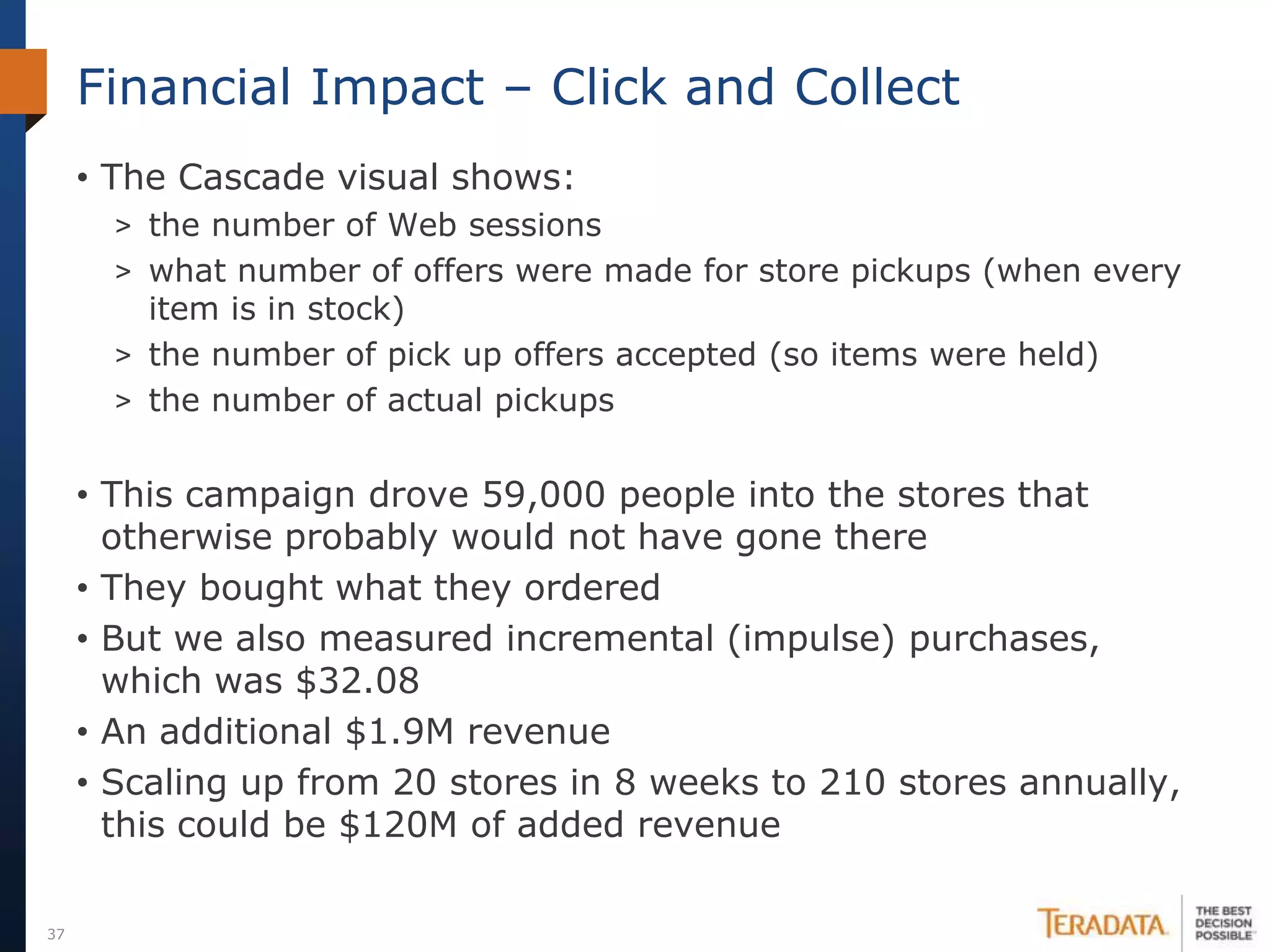

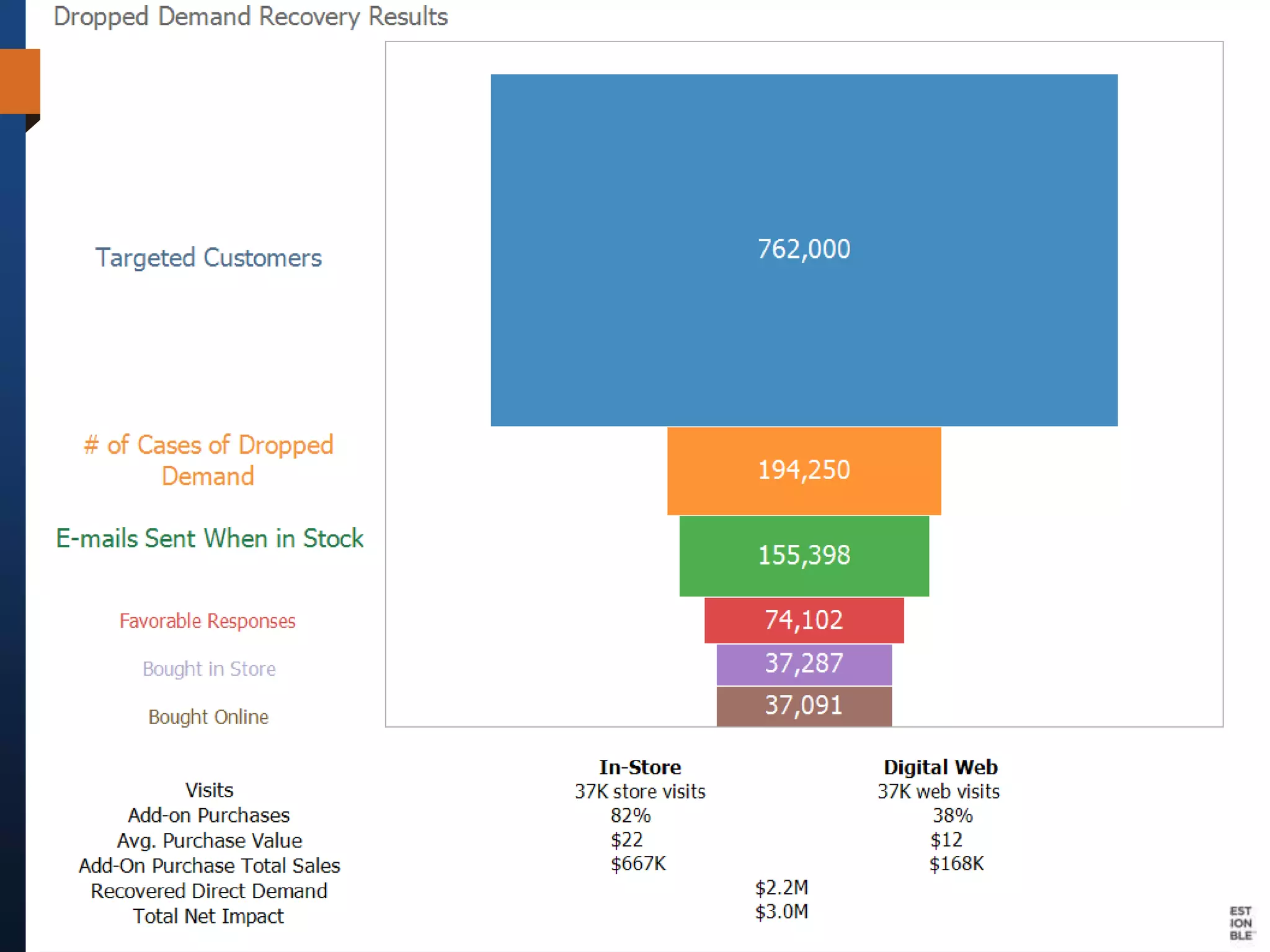

Chi Tylana and Frazier McDonald analyzed retail company Taylor & Swift's customer data using Teradata sandbox systems. They segmented customers by their browsing and buying behaviors across channels. They discovered that customers who shopped across multiple channels had higher purchase values. The investigators identified opportunities to increase store visits and sales by recovering abandoned online purchases and offering in-store pickup. They proposed and tested these ideas, finding significant revenue increases from driving more omni-channel shopping.