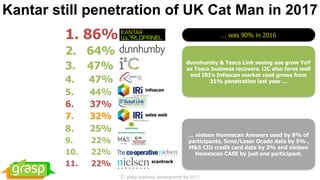

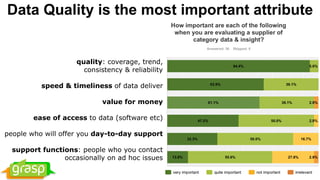

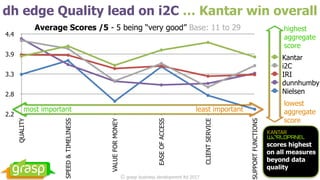

The Category Vantage Point 2017 report summarizes a survey of 36 UK fast-moving consumer goods professionals aimed at evaluating category data suppliers to enhance the value derived from category data investments. The findings indicate that Kantar remains the primary data currency in the market, but competitors like Dunnhumby and I2C are gaining traction, with data quality being the top priority for respondents. Recommendations suggest improving client relationships and understanding while addressing significant challenges in data integration and service delivery.

![Generic customer service issues …

“service levels and integrity of database”

“neither IRI nor Kantar are able to support

short customer driven requirements”

“Not enough pace when getting to the bottom of issues”

“Level of knowledge and insight outside

of the data about the category”

“some [people/agencies] stand out in this field as exceptional,

others are not bothered about you as clients.”](https://image.slidesharecdn.com/graspcategoryvantagepoint2017-170221174433/85/grasp-category-vantage-point-2017-13-320.jpg)