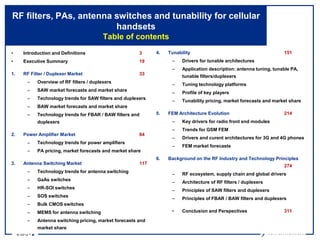

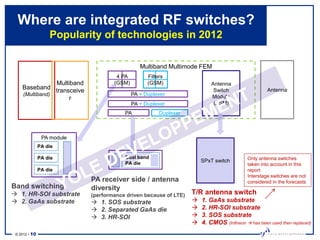

This document provides an overview of key components in the radio frequency (RF) front end of cellular handsets, including RF filters, power amplifiers (PAs), antenna switches, and tunability technologies. It discusses technology trends, market forecasts and shares, and profiles of major players for each component type through 2016. It also examines how changes at the component level and the rise of tunability are impacting RF front end module architectures and the competitive landscape. The RF component market for handsets is projected to reach $4.7 billion by 2016, up from $3.6 billion in 2011, driven primarily by increased adoption of LTE and demand for duplexers and tunable components.