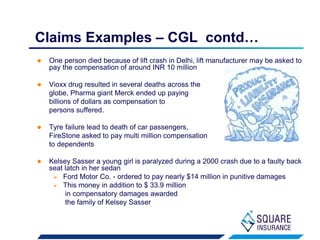

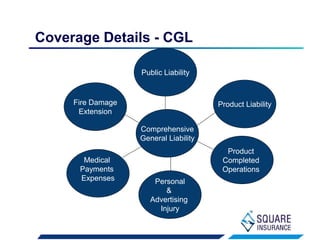

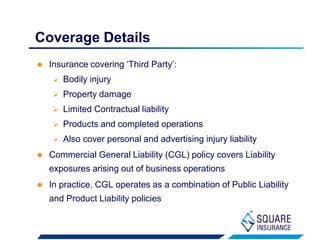

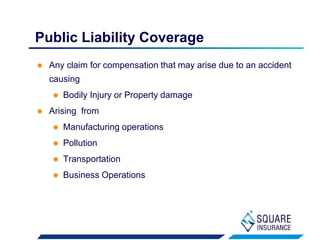

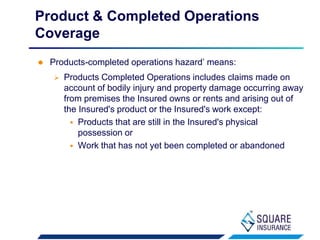

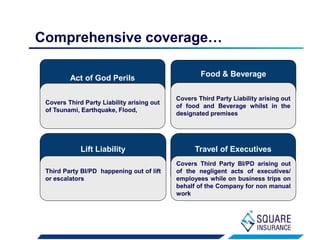

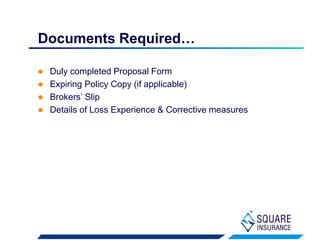

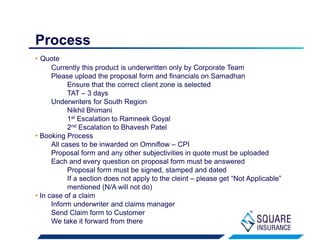

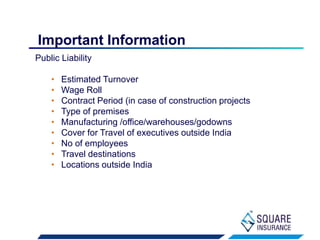

The document outlines the need for Comprehensive General Liability (CGL) insurance, emphasizing its coverage for third-party bodily injury and property damage arising from business operations. It highlights various claims examples, such as injuries from accidents and damages due to product defects, and details the specific coverage provided, including public liability and product liability. Additionally, it discusses the requirements, exclusions, and process for obtaining CGL insurance, along with key sectors that require such coverage.