This document summarizes the key details of a money insurance policy, including:

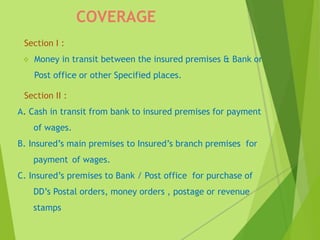

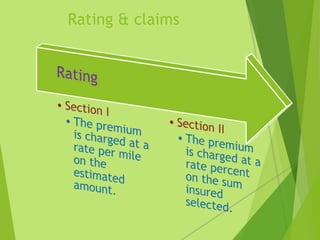

Section I covers money in transit between insured premises and banks or post offices. Section II covers cash in various transit scenarios, including between banks and insured premises.

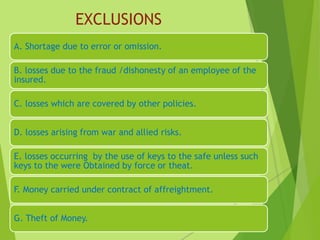

The document outlines exclusions like shortage due to error, losses from fraud/dishonesty of employees, and losses covered by other policies.

It also mentions extensions that can be included, such as infidelity of employees, riots/strikes/terrorism, disbursement risk, and money in safes.

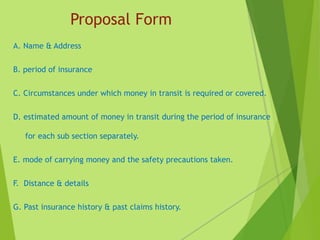

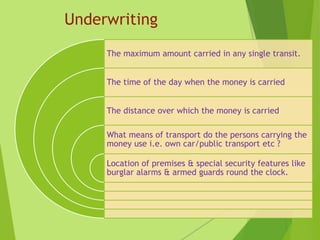

The underwriting process examines factors like the maximum amount carried in single transits, the time of day money is carried, and security measures at insured