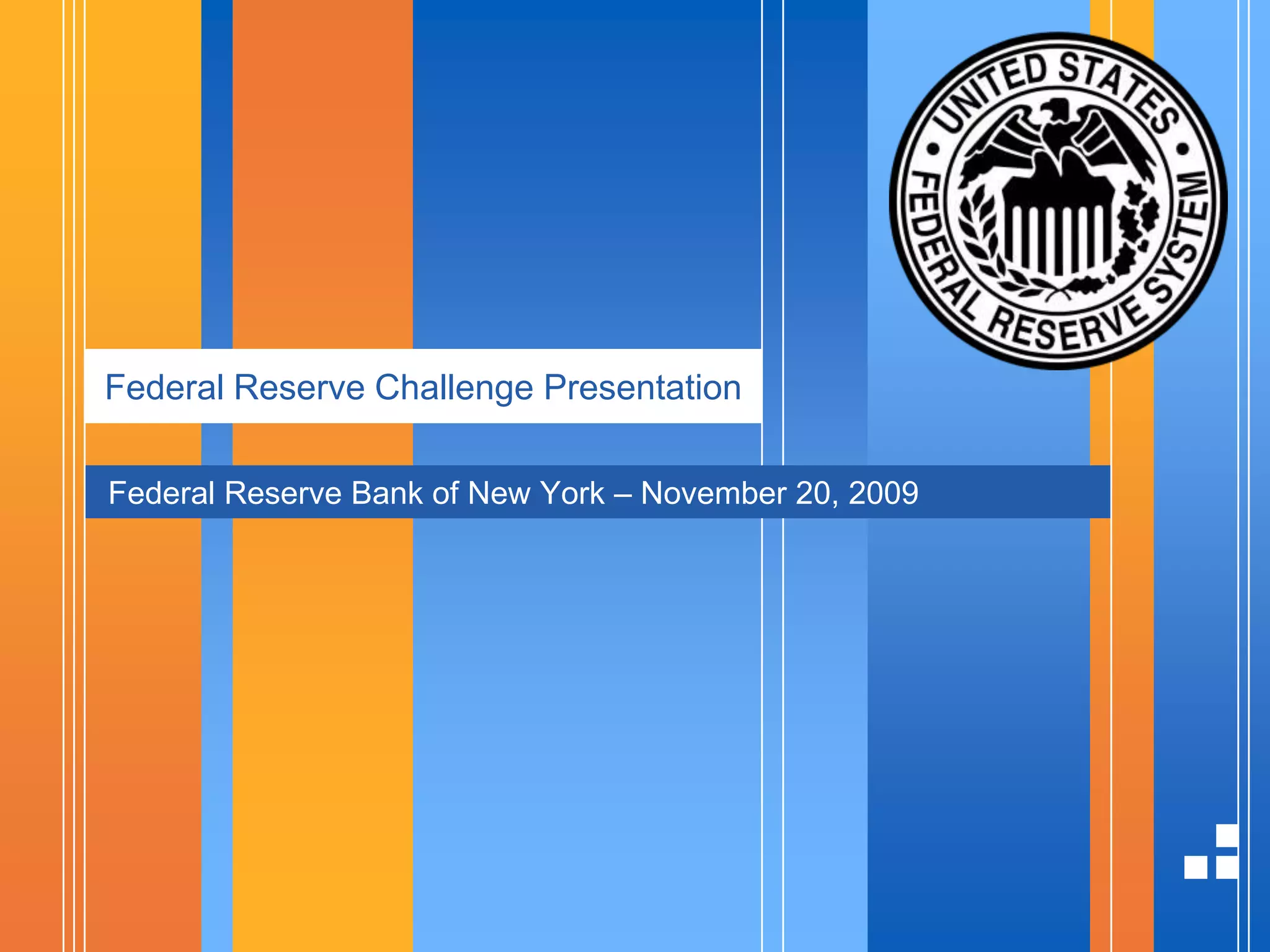

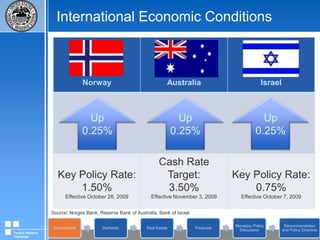

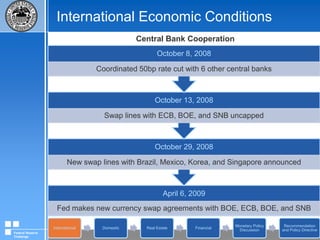

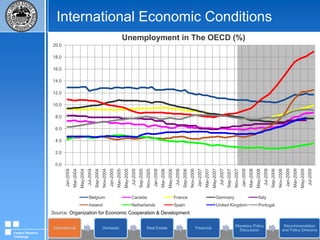

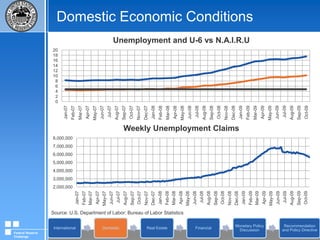

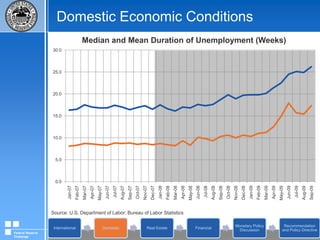

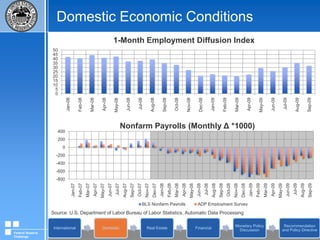

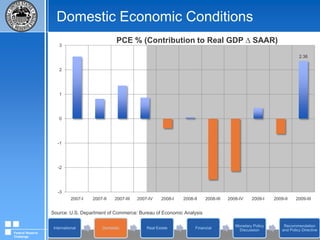

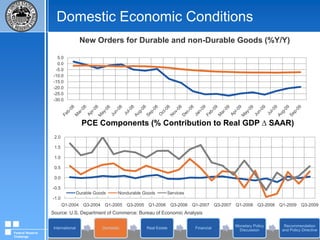

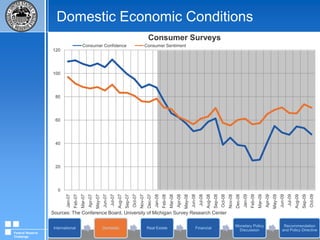

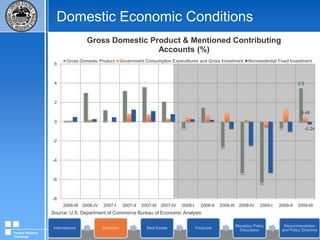

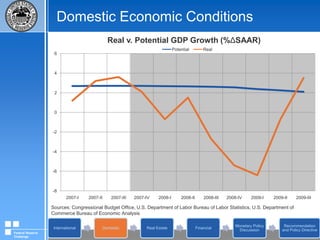

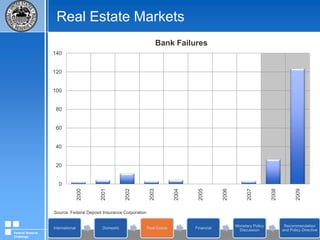

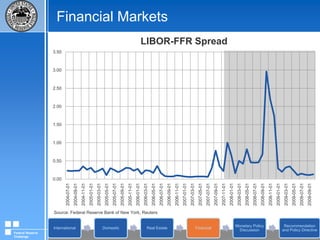

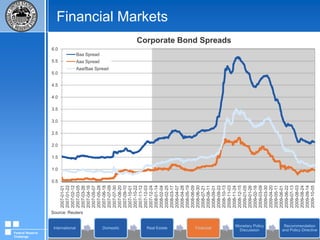

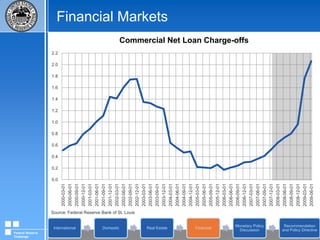

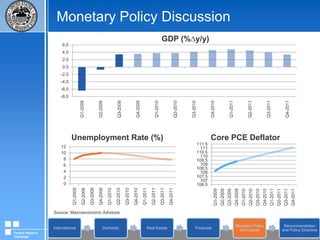

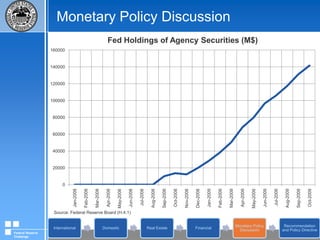

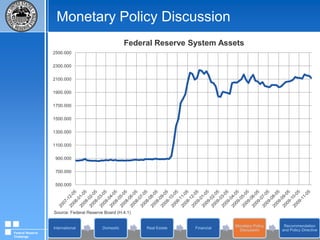

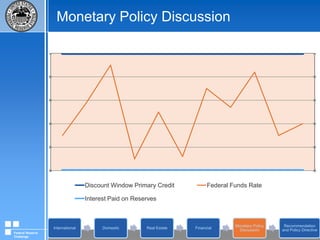

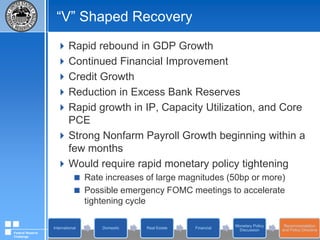

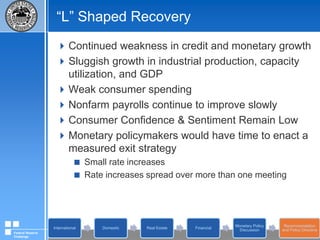

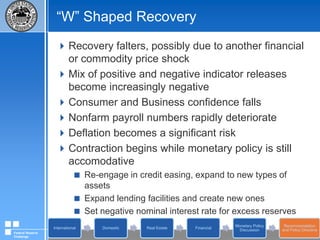

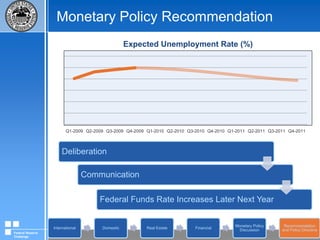

The document summarizes a presentation given at the Federal Reserve Bank of New York on November 20, 2009. The presentation covered global and domestic economic conditions, the real estate crisis, financial markets, monetary policy challenges, a monetary policy recommendation, and a draft FOMC policy directive. The presentation considered three potential economic recovery scenarios - a rapid "V-shaped" recovery, a slow "L-shaped" recovery, or a double-dip "W-shaped" recovery. The recommendation was to maintain the target federal funds rate at 0-0.25% at the next FOMC meeting.