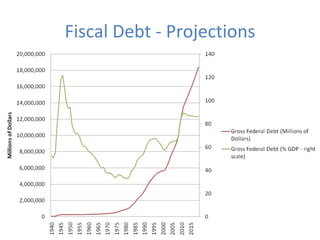

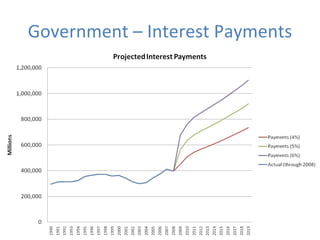

The document discusses the state of the US economy following the recession and outlines several challenges. It notes that unemployment remains high, especially long-term unemployment, and that jobs lost in manufacturing and construction will be difficult to replace. It also expresses concerns about large government deficits, dependence on foreign investment in US debt, potential inflation risks from monetary policy, uncertainty in Europe and China, and the possibility of rising long-term interest rates. The document argues that structural economic issues must be addressed through retraining workers and reducing deficits, and that both monetary and fiscal policy face challenges in the coming years.