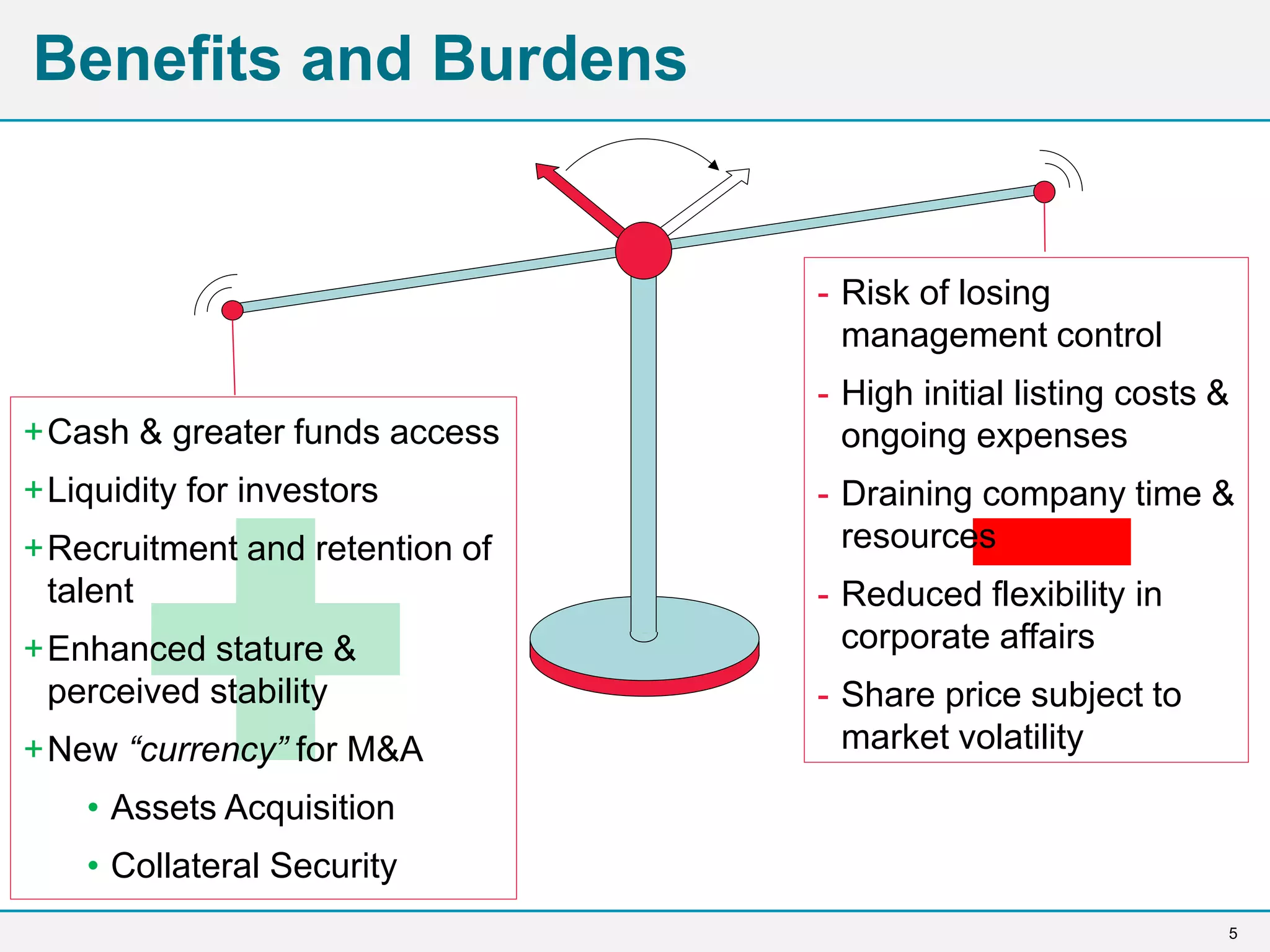

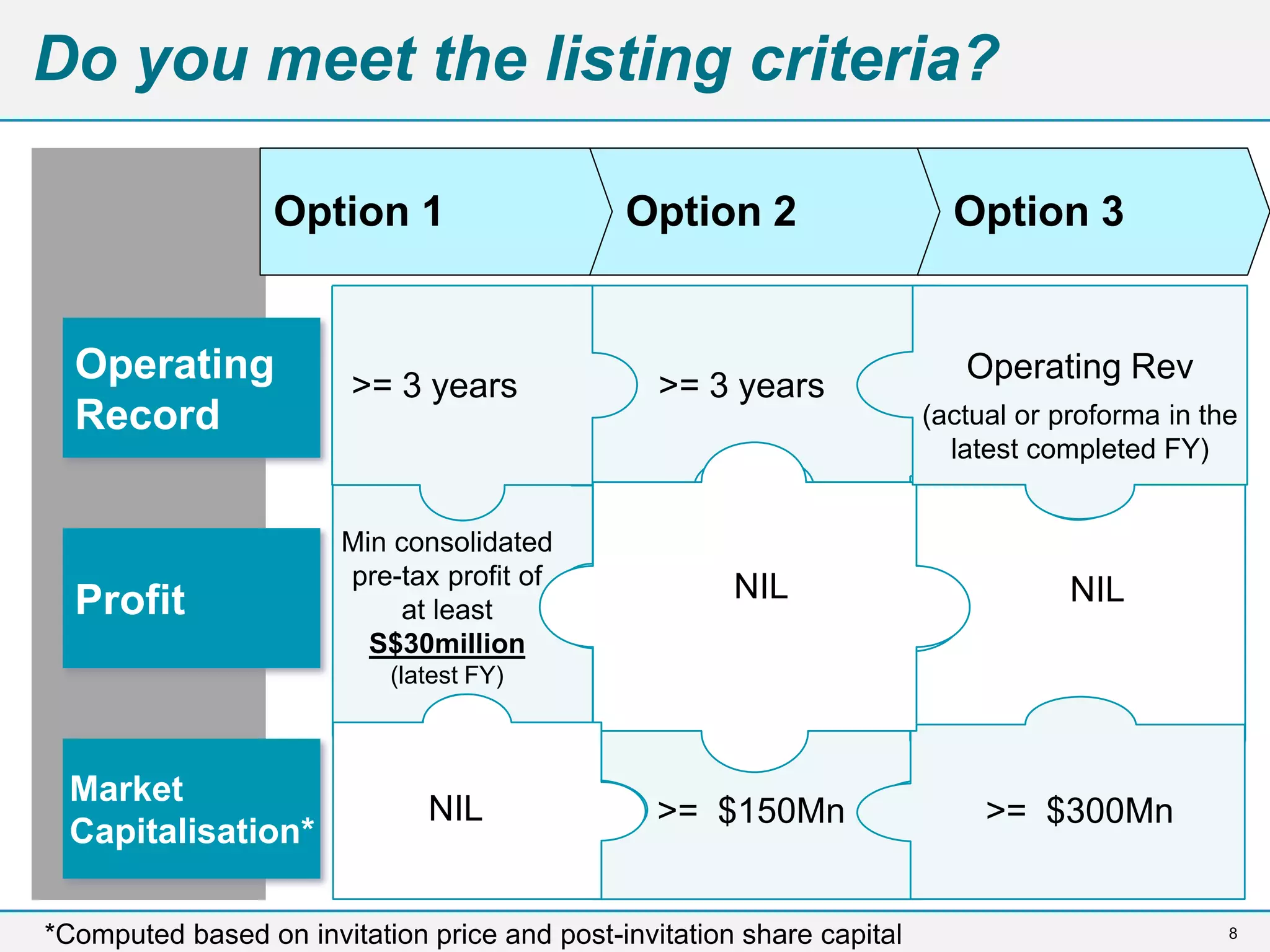

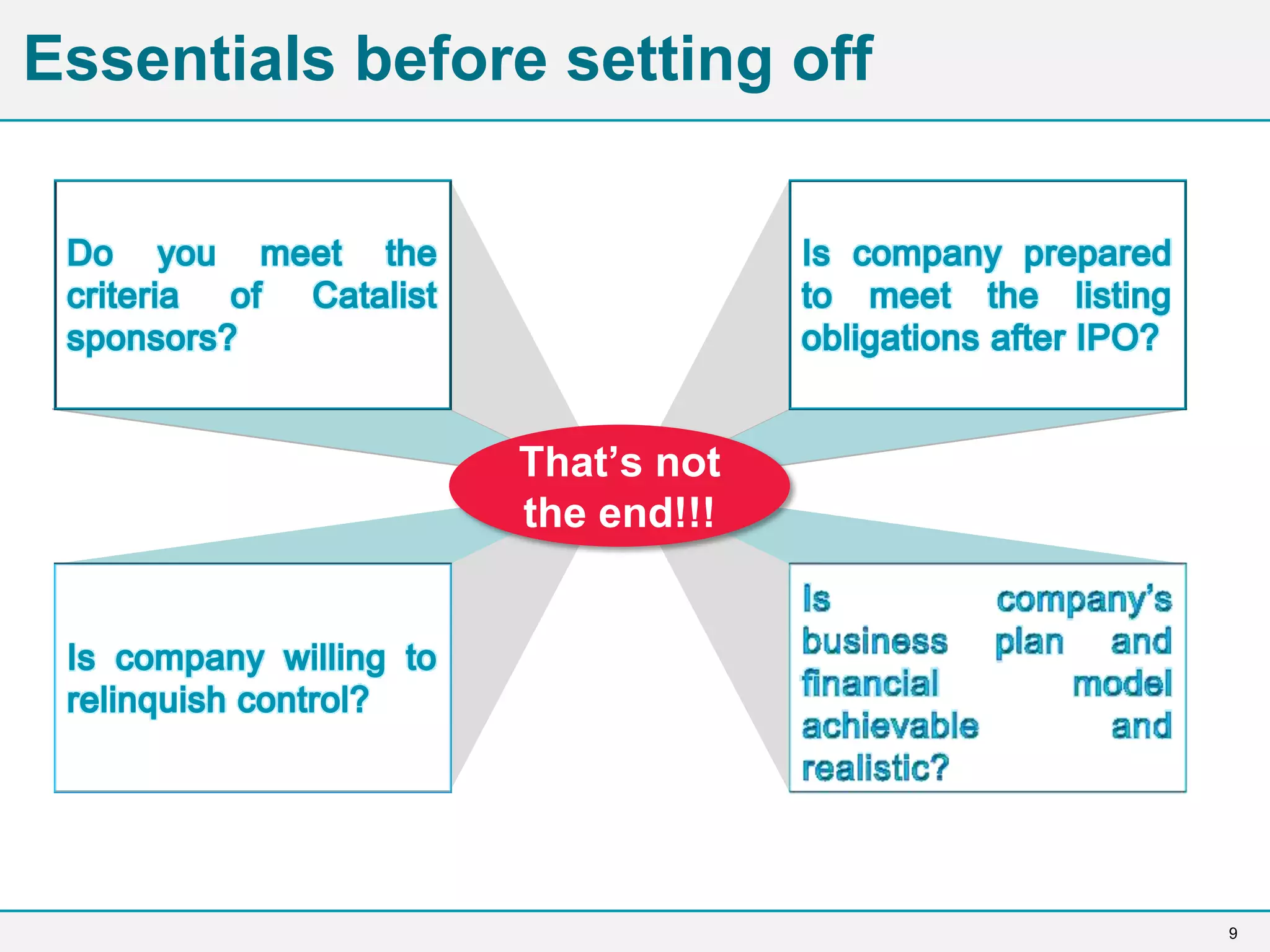

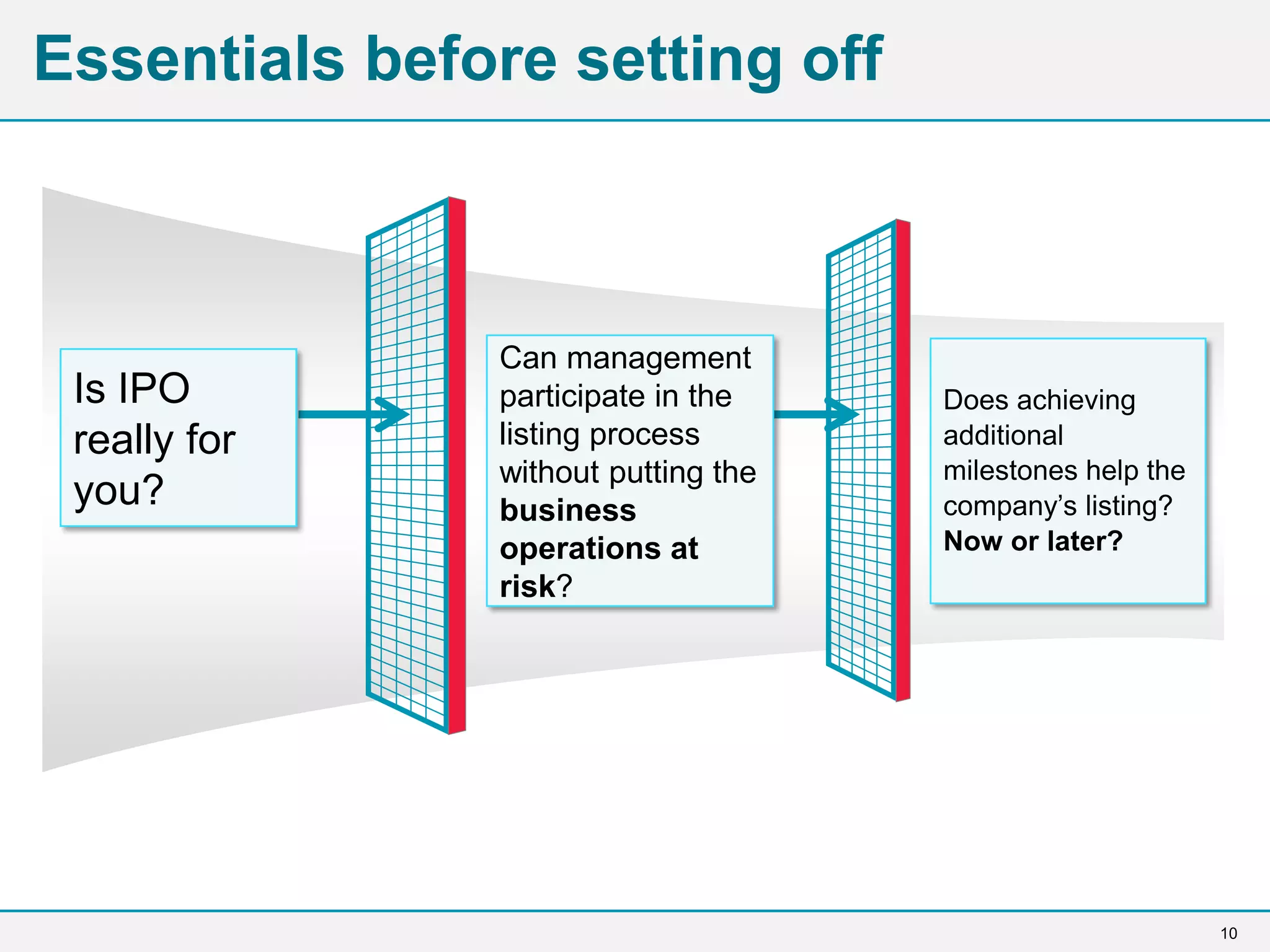

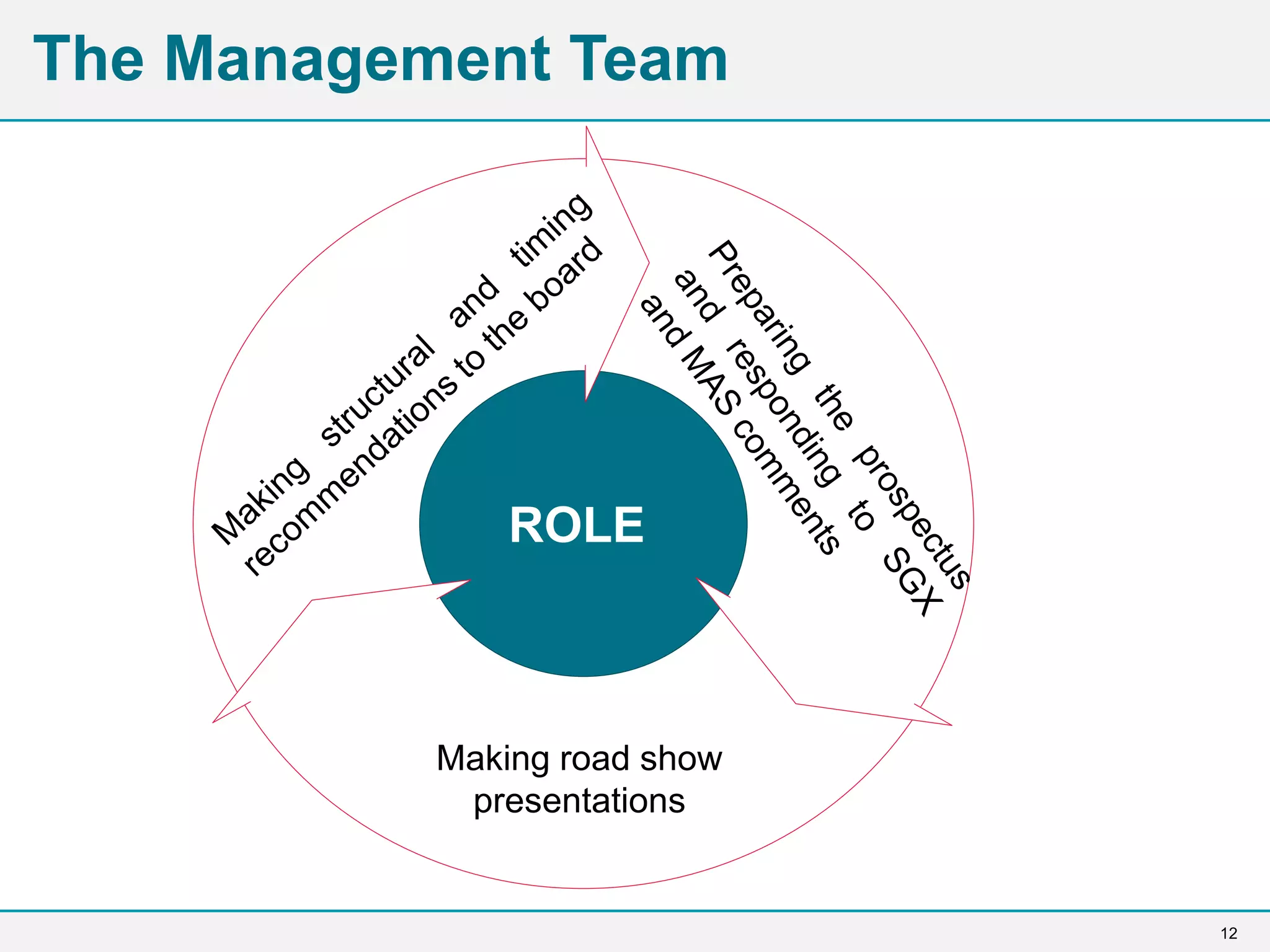

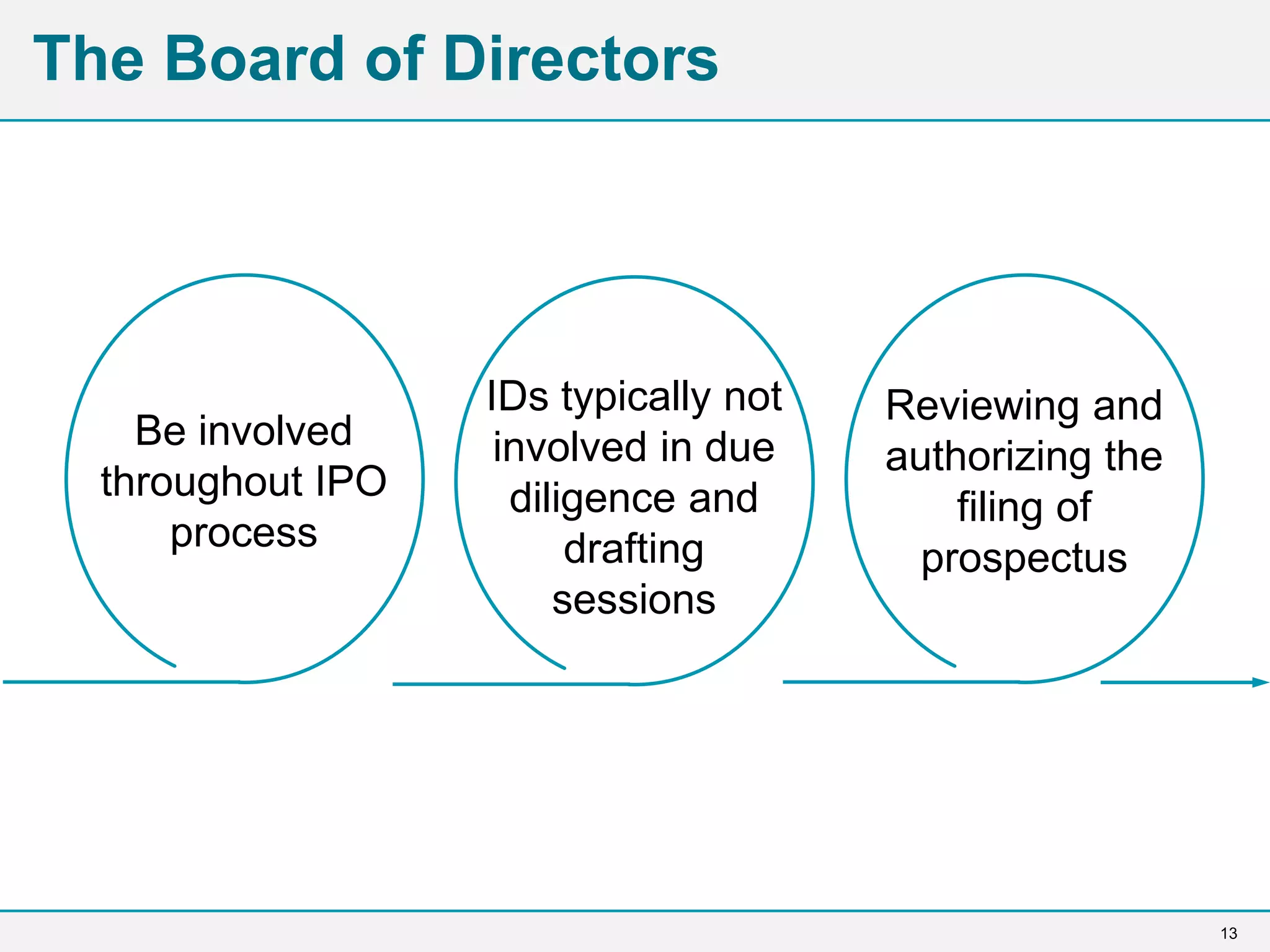

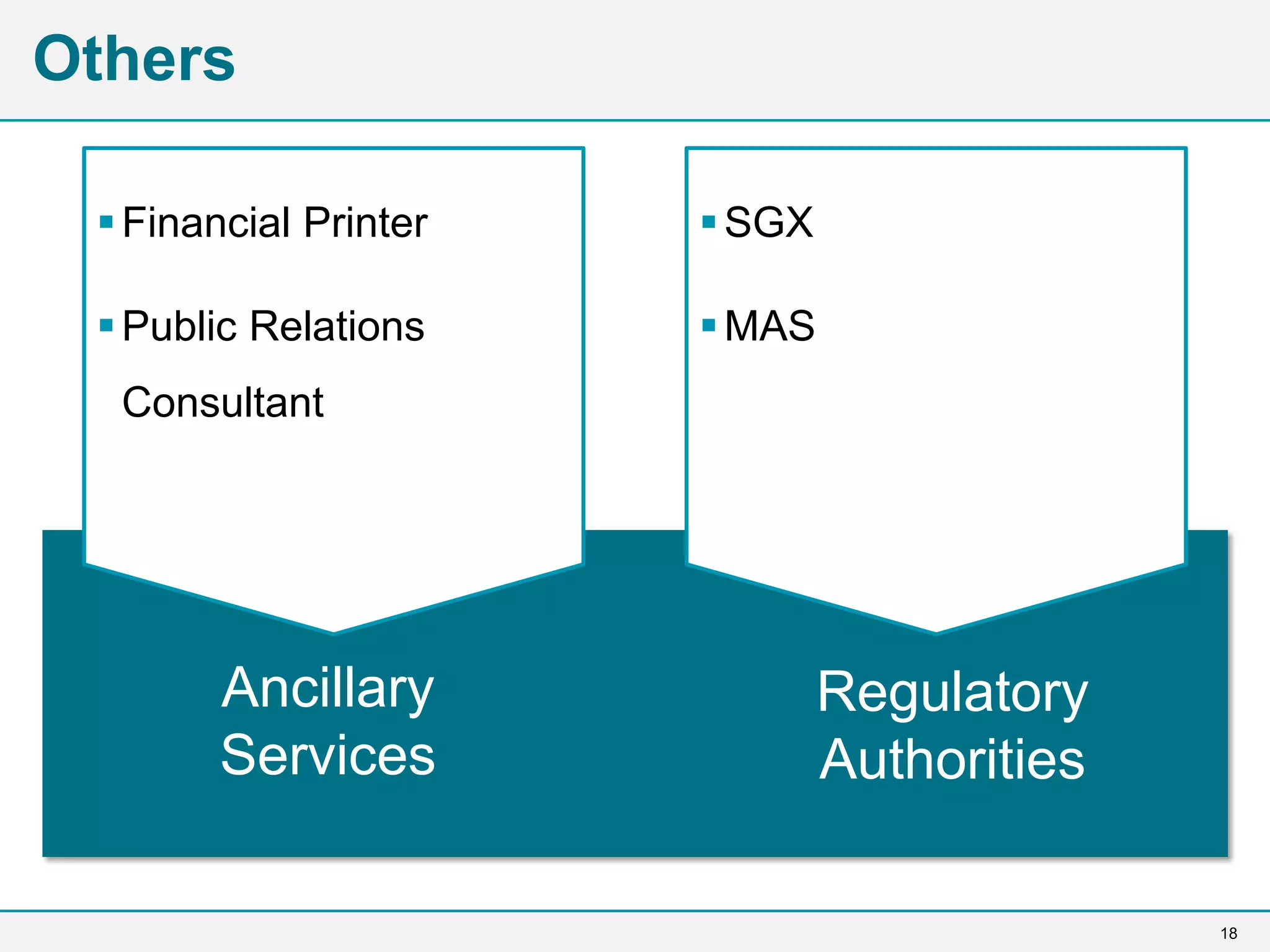

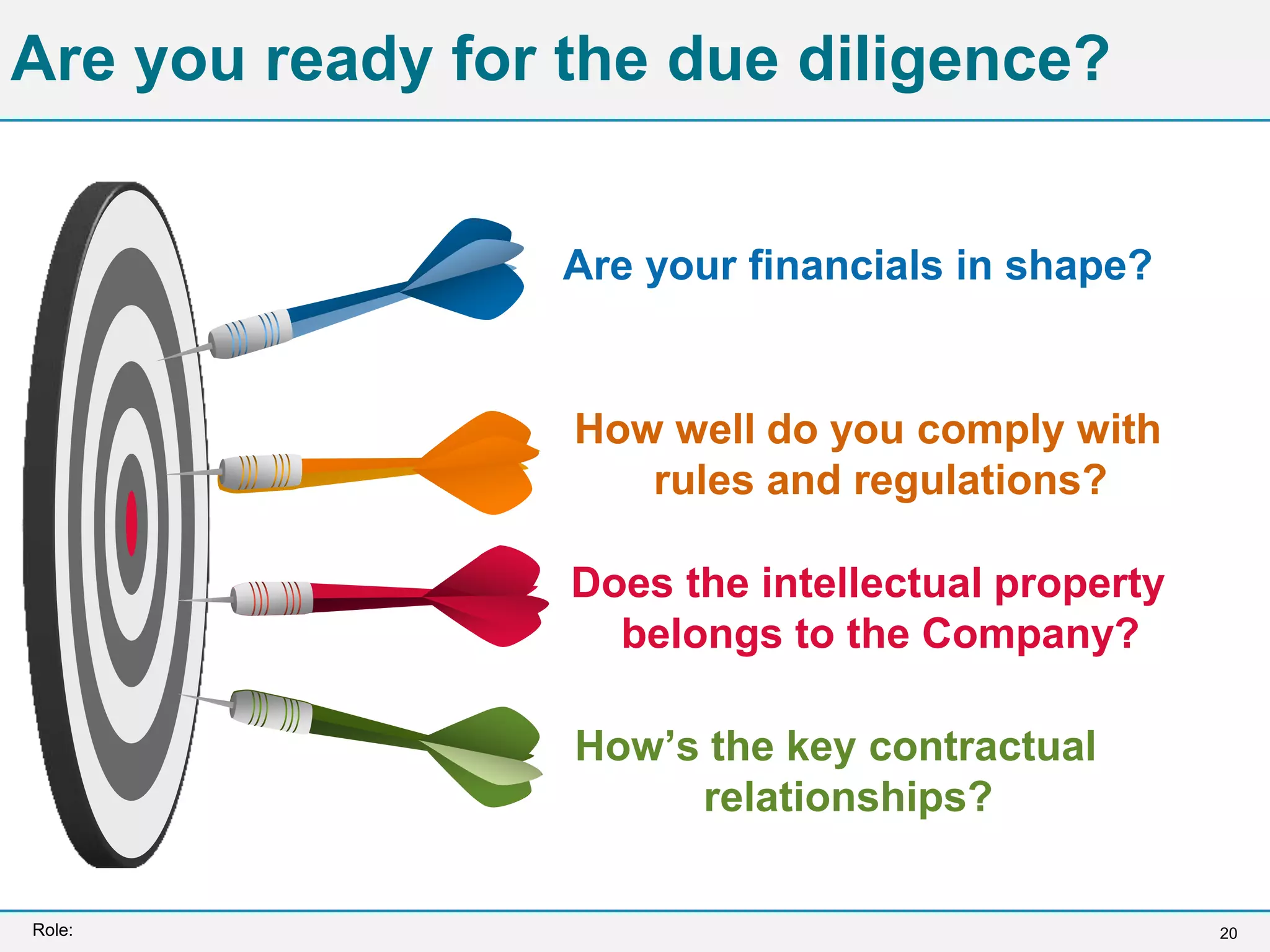

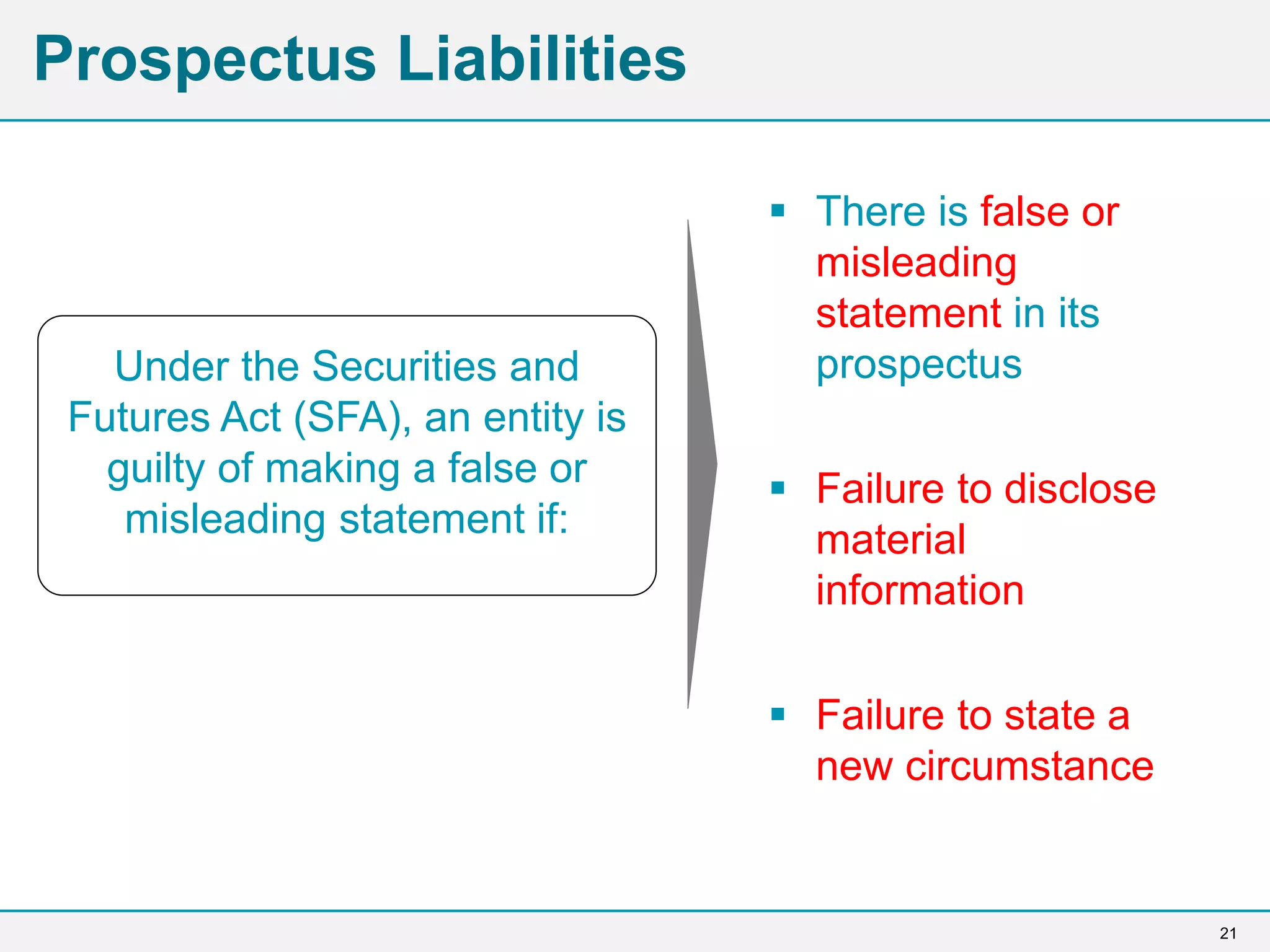

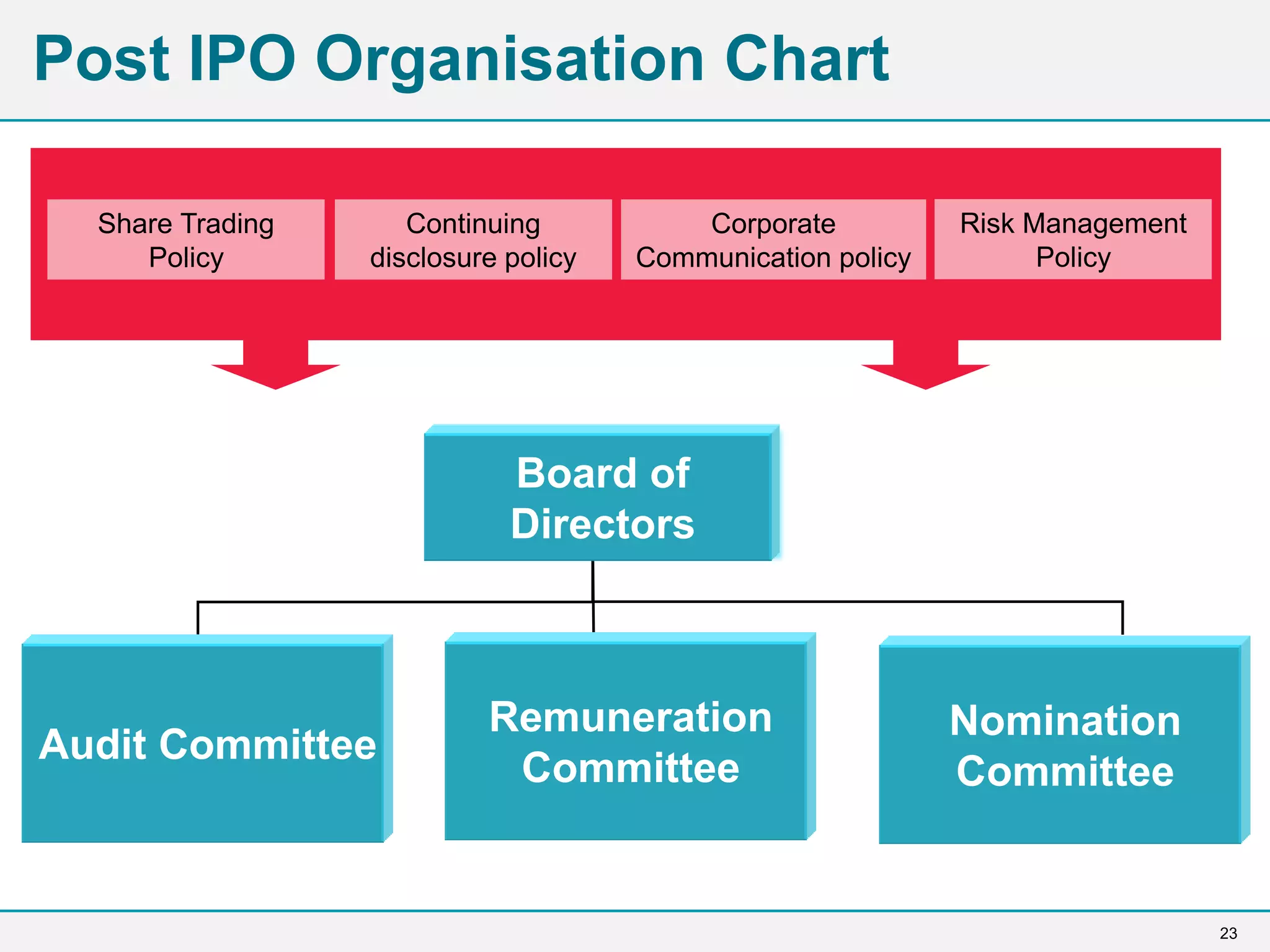

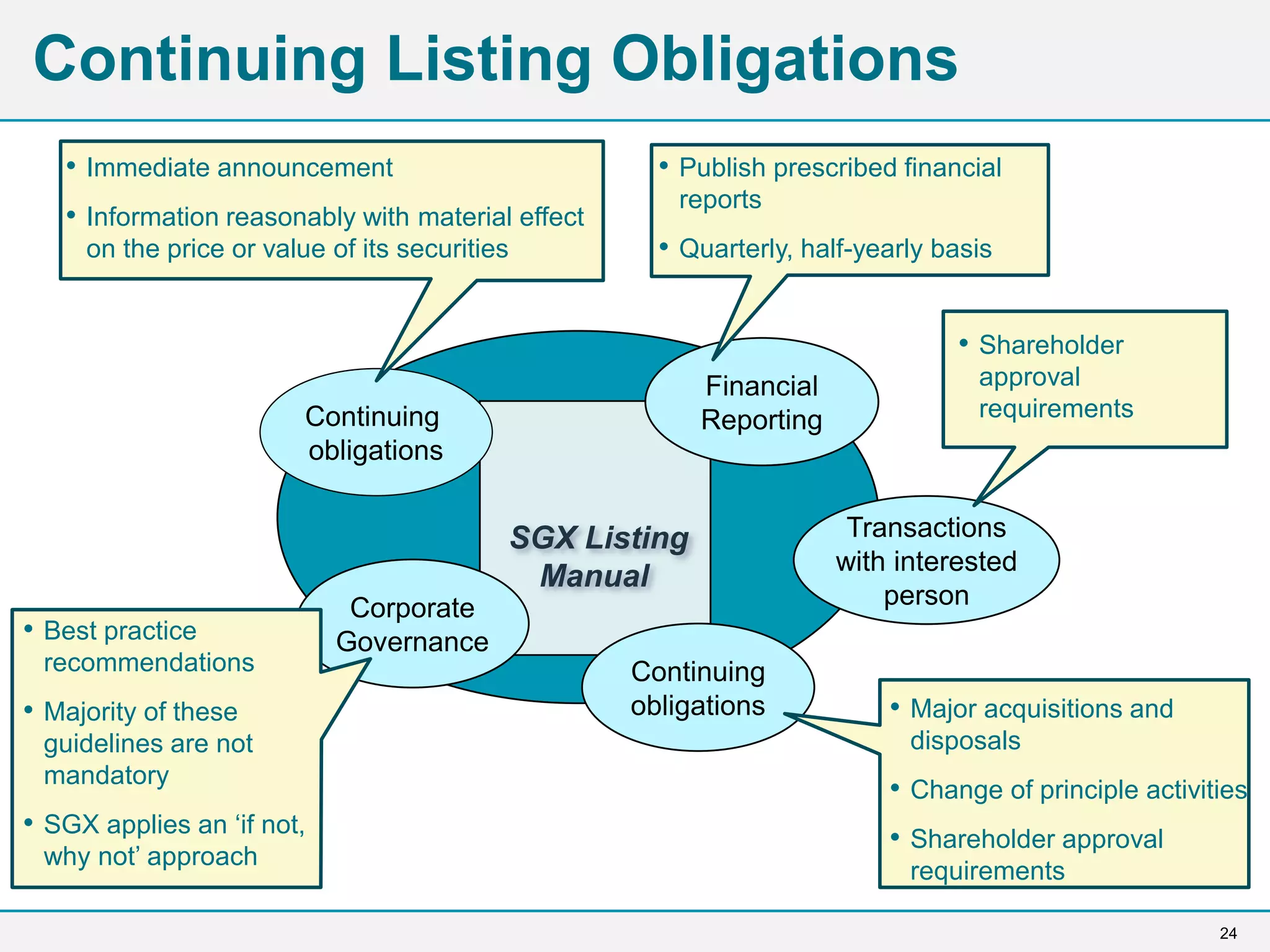

The document outlines the process of building an IPO project management team, highlighting the benefits and challenges associated with going public. It discusses essential preparations, team formation, pre-IPO tasks, and life post-listing, emphasizing the importance of compliance and strategic planning. The conclusion stresses the need for a well-prepared team and realistic expectations to achieve successful IPO outcomes.