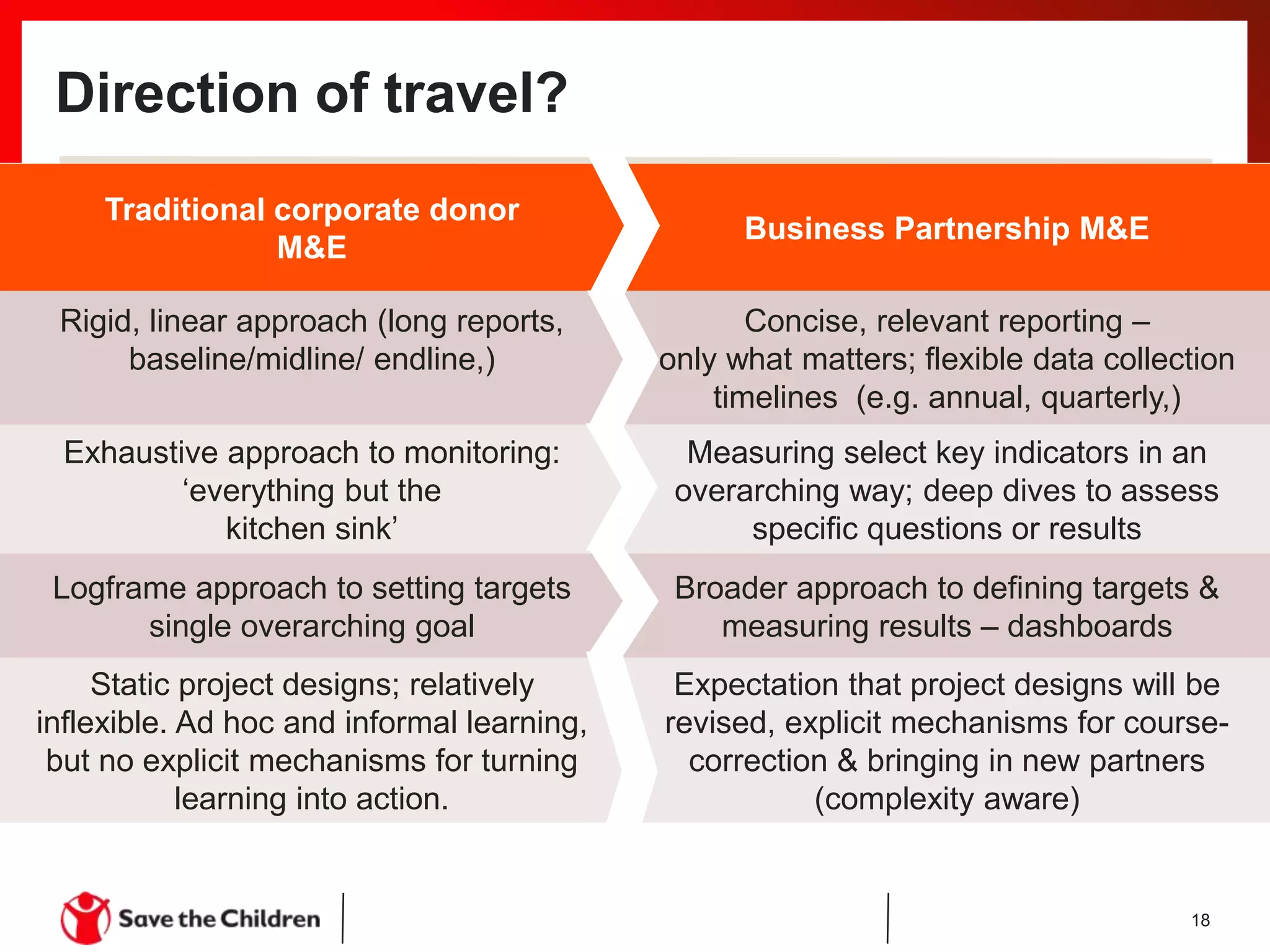

This document discusses Save the Children's experience with evaluating two of its global business partnerships - one with GSK and one with RB. It notes that businesses have different expectations around monitoring, evaluation and data compared to traditional donors. They want reliable results early and often so data can be used for course correction if needed. While this presents opportunities to work more flexibly, it also poses challenges around balancing methodological rigor with flexibility, reporting requirements, adaptive programming vs target setting, and resource needs. The document reflects on questions around finding the right approaches and balances to meet the needs of business partners while respecting implementation realities.

![Key Reflections

14

Businesses have different data

expectations compared to traditional

donors (& are less constrained in

terms of internal processes and

requirements)

1

They want [reliable]

results early and

often…..

2

3

.. so that data can be used

for course correction &

[radical] adaptation if

needed](https://image.slidesharecdn.com/cdiseminar04may2017-170504150908/75/Evaluating-impact-of-business-partnerships-14-2048.jpg)