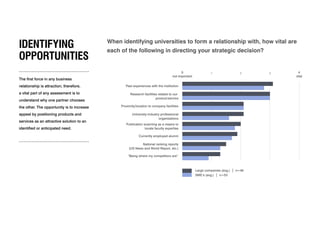

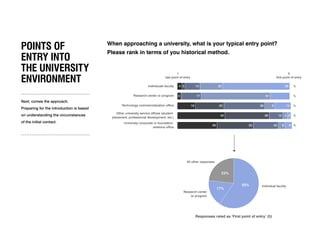

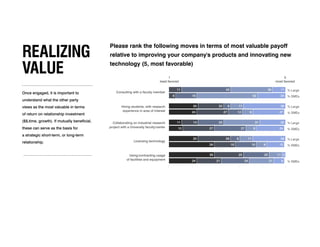

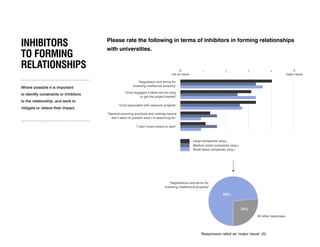

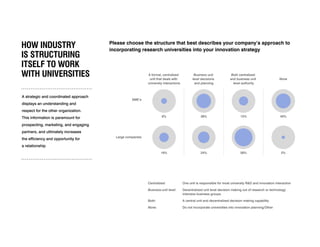

The document discusses the dynamics of university-industry innovation relationships, highlighting key factors for optimizing partnerships and the perspectives of industry leaders. It presents insights from a survey of high-tech company leaders on entry points into university environments, value perception, and inhibitors to forming these relationships. The report emphasizes the importance of a strategic approach and identifying mutually beneficial outcomes for successful collaborations.