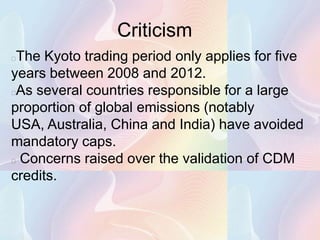

The document discusses greenhouse gases like carbon dioxide and their impact on global warming. It explains that carbon credits were created through agreements like the Kyoto Protocol to limit greenhouse gas emissions from countries and allow for carbon trading. Under the Kyoto Protocol, countries agreed to emission caps and could buy carbon credits from other countries or companies that had excess allowances to emit greenhouse gases. The flexibility mechanisms in Kyoto, like the clean development mechanism, aimed to reduce emissions on an international scale through carbon trading.